While the economy may officially be in recovery mode—at least according to many politicians, pollsters, and various economic indicators—fleet owners and executives still have plenty of issues to keep them awake at night, based upon the results of a recent reader survey conducted by Fleet Owner.

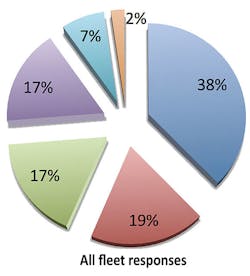

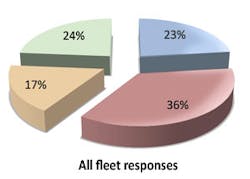

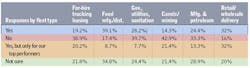

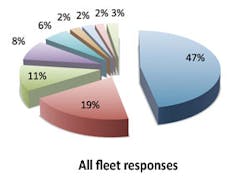

The state of the economy topped the list of reader concerns for all types of fleets, but the retail/wholesale delivery segment was more worried than most, followed by construction and mining fleets. Fifty-two percent of retail/wholesale delivery fleets responding to the survey put the economy at the top of their worry list as compared to 37.8% of all respondents. Interestingly, although for-hire carriers also listed the economy as their number-one concern, it was by a smaller percentage than other fleets.

This concern about the economy was based on recent experiences, according to the survey. An overwhelming majority of all respondents said that the economy had the greatest impact on their business over the past three years, beating fuel prices, emissions regulations, and even CSA by a wide margin.

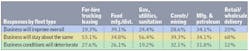

Not surprisingly, optimism about the future of the economy was tepid across the board, with most fleets agreeing that they expect business conditions to “stay about the same.” Hope triumphed over gloom in most fleet type categories, though, with notable exceptions. More respondents in the for-hire trucking and leasing category felt that business conditions would deteriorate than felt things would improve (27.6% vs. 19.3%). Construction and mining companies agreed.

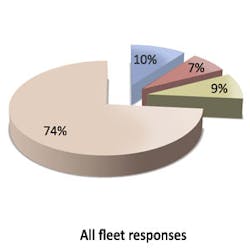

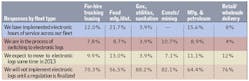

When it comes to using electronic onboard recorders (EOBRs) for hours-of-service records, hold-outs far outnumbered companies that have already moved to electronic logging. A hefty 73.5% of all respondents said, “No. We will not implement electronic logs until a regulation is finalized.”This response to electronic logs reflects the general dissatisfaction and even anger survey respondents shared concerning regulations and the role of government in general. “Put a stop to any new regulations until the economy actually recovers,” one person wrote. Another said, “Leave us alone and let us run our companies. We care more than [Congress] does about doing the right thing.”

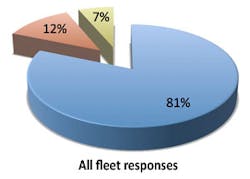

Fleets signaled their commitment to “doing the right thing” in responses to another question—this one about restricting cell phone usage. More than 81% of all respondents reported already having cell phone policies and procedures in place.

Management metrics got a warm reception when it comes to driver performance monitoring. Of all respondents, 49.9% are already using some type of driver monitoring system, with for-hire carriers, leasing companies, and fleets in manufacturing/processing and the petroleum industry leading the charge.

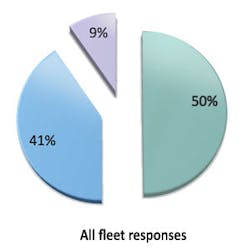

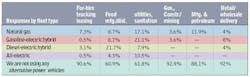

All this performance monitoring will not necessarily result in increases in driver pay and benefits, though, even for top drivers. Just 23.2% of all respondents reported plans to increase driver pay and benefits this year, while another 17.1% said they would do so, but only for their best performers. Fleets in the food manufacturing and distribution business are the most apt to offer drivers a raise.

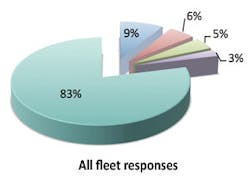

In spite of all the attention alternative power is garnering, actual adoption rates are still low, according to the survey. More than 83% of all respondents reported no use of alternative fuel vehicles of any kind.

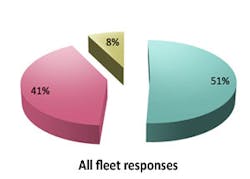

The survey also revealed a possible silver lining inside the economic cloud: The turmoil and trouble of the past few years may have helped to bring fleets and their equipment suppliers closer together. More fleets (51%) reported that they are working “more closely than ever with one preferred OEM, while 41.4% said relationships had weaked.

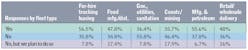

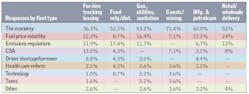

The following pages provide detailed results for each of the survey’s nine questions. Pie charts show percentages for the total fleet responses, and the data tables break those responses down by six fleet categories. Colors for the individual responses in each table provide the color-code for the accompanying pie chart. Percentages total over 100% in some cases due to multiple answers or rounding.

Worries about 2013 & 2013 Expectations

What worries you most in 2013?

By contrast, construction/mining fleets run relatively few miles and are far more focused on vehicle productivity than fuel consumption. Those fleets place fuel prices at the bottom of their worry list and see lack of political clarity as much more significant.

One other issue often cited as threatening the industry—the driver shortage— is ranked at the bottom of the list by all, even by the for-hire carriers. Among write-in replies to “other,” “all of the above” was cited multiple times, while “lack of qualified technicians,” “worker productivity/competence,” and “new engine performance and reliability” also warranted written replies.

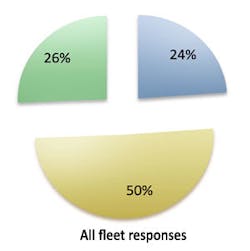

Compared to 2012, what business conditions do you expect in 2013?

Depending on how you felt about 2012, the survey result on business expectations is either good or bad news. The response here was fairly clear: Half the fleets believe 2013 business activity will be a continuation of 2012, with the other half neatly divided between optimism and pessimism.

Among the different fleet categories, those involved in areas most impacted by consumer consumption—retail/wholesale delivery and for-hire—are most optimistic that things will be as good or better this year. And fleets serving the food industry are the most bullish on a continuing economic recovery boosting business in 2013. The municipal & utility fleets also seem to anticipate a steady or improving economy, perhaps buoyed by recovering home prices and construction activity promising higher real estate tax revenues and services consumption.

The most bearish on business in 2013—construction/mining and manufacturing/ petroleum fleets—serve industries somewhat removed from the consumer economy, although the large majority in both those categories anticipate 2013 being equal to or better than last year.

Driver logs and monitoring systems

Does your fleet use electronic driver logs?

Benefits & Alternative Power

Do you expect to increase driver pay and benefits in 2013?

Cell phone use, business impact & equipment suppliers

Do you restrict cell phone use by drivers?