Diesel emissions - especially from trucks - appear to be the next environmental frontier. Battle lines have been drawn and a few skirmishes already have occurred as interested parties are staking their positions and bringing forth their experts in a war that will continue well into the next century. The end result could affect one of the basic financial underpinnings of every truck fleet: the price and availability of diesel fuel.

While the issue has been simmering for years, three major events have recently thrust it into the nation's consciousness. In July, Congress held hearings on the Kyoto Protocol, which was signed by the U.S. and others last December in Japan. The Senate still must ratify it. The ultimate goal of the treaty is to lower airborne pollutants that are thought to contribute to global warming. The agreement would mandate that the U.S. cut emissions of major greenhouse gases to 7% below 1990 levels. The treaty would exempt most developing countries, which could account for almost 70% of all emissions by 2025.

For trucking companies in the developed world, especially in North America, the treaty could have profound financial consequences. Tim Lynch, president and CEO of the Motor Freight Carriers Assn., testified before the House's Natural Resources and Regulatory Affairs Subcommittee that it has been customary to discourage driving by raising fuel taxes. For the U.S. to achieve its emissions-cutting goal, the price of diesel fuel would have to increase 50 cents to $1 a gallon, but he warned that this tack might not work. "Trucking companies don't create the freight," he said, and higher fuel costs would simply be passed on to consumers without a decrease in miles driven.

Edward Arnold, chairman and CEO of Arnold Industries, Lebanon, Pa., offered Congress a more dire prediction. "The Kyoto Protocol treaty will have a devastating effect on the American economy and the trucking industry.

"Realistically, the only way to meet [the protocol's] aggressive targets for reducing carbon monoxide emissions is to reduce fuel consumption. This can only be accomplished through taxation or rationing through the sale or trading of emissions permits. Neither alternative is acceptable," Arnold said. He cited statistics showing that diesel prices would have to rise almost 70 cents per gallon by 2010 to meet the Protocol. "With the kinds of increases in fuel prices necessary to achieve the goals of the treaty, many in our industry will be forced into bankruptcy."

The Administration argues that these and other gloomy predictions are not bolstered by accurate data. Unfortunately, the President's Council of Economic Advisors (CEA), which claims to have the 'true' data, has kept mum on its numbers and has not shared them with Congress.

Amid the backdrop of the Kyoto Protocol, the Environmental Protection Agency (EPA) is locked in a battle with diesel engine makers over emissions from their engines. EPA officials claim that the heavy-duty diesels were designed to emit lower emissions during EPA testing than during on-the-road use. Most of the discussions are taking place behind closed doors, but in one case EPA has threatened legal action against Mack Trucks for noncompliance. Mack responded by suing EPA. In late June, both sides agreed not to actively pursue their lawsuits amid new discussions. The outcome of those discussions could radically change the way engines are designed, manufactured, and tested.

"Clearly, this incident, which went further than it should have, shows the high level of emotions on both sides," said one official close to the action. "It's also clear to me that this didn't happen by coincidence. It's all related to increased interest in diesel emissions a la Kyoto and what's happening in California."

In late July, lawmakers in Sacramento held hearings on whether or not diesel exhaust should be listed as a toxic air pollutant. The California Trucking Assn. supports a bill requiring the California Air Resource Board to conduct a new study on the possible hazards of diesel exhaust using human data. The group claims that current studies cited by legislators are overstated, because they use estimated statistics and not real-life data. Hearings were expected to begin again in late August. Some fleet officials testified that putting diesel exhaust on the list of toxic substances would be tantamount to outlawing its use altogether.

All three events form a neat troika of global, national, and local policy issues concerning diesel emissions, and the trucking industry's stake in their outcomes will no doubt determine its financial future.

Targeting mine safety The Dept. of Labor's Mine Safety and Health Administration is considering regulations to reduce the number of accidents in the mining industry. The agency said 30% of fatal mining accidents involve surface haulage equipment. Specific factors likely to be addressed include occupant restraint systems, blind spots, and inadequate lighting.

Railroad crossing In keeping with the Hazardous Materials Transportation Authorization Act of 1994, FHWA has announced its intent to prohibit truckers from driving onto railroad grade crossings unless there is sufficient distance to drive completely through before being required to stop.

No-go for OMC The House killed a section in its transportation appropriations bill that would have moved the Office of Motor Carriers from the FHWA to the National Highway Traffic Safety Administration. Rep. Frank Wolf (R-Va.) had offered the measure.

Good form In response to numerous requests from medical examiners, FHWA is asking for comments to update and simplify the medical examination form that is currently in use. This proposed action is intended to reduce the incidence of errors on such forms and to provide more uniform medical examinations of commercial truck drivers. Comments are due November 3.

Haz-mat changes RSPA is looking to amend its Hazardous Materials Regulations so they mirror international standards. If adopted, the changes would include proper shipping names, hazard classes, packing groups, special provisions, packaging authorizations, air transport quantity limitations, and vessel stowage requirements. Comments are due October 2.

Trucking industry leaders listen to what drivers are saying

Congested highways and aggressive car drivers are taking all the fun out of driving. That's the message that emerged last month from 400 of the nation's top drivers gathered in Long Beach to compete in the National Truck Driving Championships.

Leaders from the American Trucking Assns. (ATA), the group that represents their employers, said after the listening session that they agree with the drivers and will look for ways to support them.

"We've turned to our highest-achieving truck drivers for insight into the nation's deteriorating highway environment and for suggestions on what the motor carrier industry can do to bring about change," said Walter B. McCormick Jr., president and CEO of ATA. "Our industry is facing the greatest boom in its history. As the economy expands, there is more freight that has to be moved. If we don't do something to make driving a more satisfying and less stressful profession for our employees, fewer products are going to make it to market - and into America's homes."

Driver turnover, which exceeds 100% per year at some trucking companies, has emerged as the motor carrier industry's most serious and persistent problem, particularly at a time when low unemployment makes it almost impossible to find a replacement when a driver leaves. McCormick attributed much of the driver-retention challenge to the current economic boom.

But booming auto sales and highway travel have filled the nation's highways with a glut of traffic that slows down truck deliveries and sets off dangerous episodes of "road rage" among frustrated motorists.

In oral interviews, and printed survey forms collected from more than a hundred drivers, "congestion," "aggressive driving," and "road rage" repeatedly registered as the problems generating the greatest concern among professional truck drivers.

The truck drivers' concerns are backed up by statistics. National Highway Traffic Safety Administration figures show that in 71% of fatal car-truck accidents, the driver of the car was cited.

"The trucking industry has aggressively policed itself," McCormick said. "In the last ten years the number of fatal truck accidents has dropped 35% while miles driven has increased 40%. Thus, if we are going to make further progress, we will have to take a holistic approach to highway safety and improve the driving skills of all drivers."

The truckers did not confine their complaints to car drivers and congestion, however. Almost all of them blamed some bad actors in the trucking industry itself, as well as some shippers, for issuing unrealistically demanding schedules. They also complained about shippers and receivers who expect them to spend as long as two hours unloading or loading while they should be resting up for the next trip.

Companies that believe the Internal Revenue Service has wrongly classified some of their workers as employees can now take their case to Tax Court. Congress added this option as part of the Taxpayer Relief Act of 1997. Now the IRS has spelled out, in Notice 98-43, exactly what steps companies must follow before, and while, going to Tax Court.

Tax Court can be a faster and cheaper alternative than the traditional venues - U.S. District Court and the Court of Federal Claims - particularly for taxpayers eligible for the Tax Court's simplified procedures. See an experienced employment tax litigator before deciding.

Daimler president unveils first steps to expand Asian presence

On hand for the official opening of the Sterling Truck plant in London, Ont., Canada, in late July, Daimler-Benz A.G. chairman Juergen Schrempp said that the company was talking to Nissan Diesel Motor Co. about joint projects that would help fill "the missing piece" in its worldwide commercial vehicle operations.

Daimler is the world's largest manufacturer of commercial vehicles, with dominant market shares in Latin America, Europe, and in North America through its subsidiary Freightliner Corp. Asia remains the one major truck market where Daimler has yet to sell many vehicles.

Sterling, operating as a subsidiary of Freightliner, is Daimler's newest entry in the truck market and is based on heavy-truck operations purchased from Ford Motor Co. last year. The first Sterling models are Class 6 through 8 conventionals aimed at regional distribution and vocational markets. A Class 7-8 cabover based on the Ford Cargo will also be built with both the Sterling and Freightliner badges. Sterling currently has 165 dealer locations in the U.S. and 57 in Canada.

Also speaking at the plant's opening ceremonies, Freightliner chairman, president, and CEO James Hebe said that expansion plans for Mexico would make the new truck brand a true NAFTA product "in the near future."

One week after the Sterling event, Daimler officially announced that it will jointly develop and build a light truck with Nissan Diesel and its parent, Nissan Motor Co.

The new Daimler/Nissan truck will draw on components from all three partners and will be distributed in Japan and Southeast Asia, as well as Latin America. Production is set to begin in 2002, with annual sales projected at 100,000 to 150,000 units by 2005.

New president shares market strategies

William R. Anderson Jr. has a passion for trucks. The new president of Bering Truck Corp. loves to climb behind the wheel of one of his rigs and drive it home or to a local restaurant. In his spare time, he restores old trucks. His latest project is a 1937 Mack Jr., so it wasn't too much of a stretch to take that energy to the new-truck side of the business. Thus was born Bering, the first new truck manufacturing venture in a generation.

Bering will manufacture a new line of Class 3-8 commercial trucks for the North American market. Retail sales launch date is November for Class 5 and January 6, 1999, for Class 3 and 4; Class 8 is targeted for early-to-mid 1999.

The Bering brand combines Hyundai chassis and cabovers with American-made engines, transmissions, clutches, and axles. In the beginning, the vehicles will be built at Hyundai's Chunju plant to Bering's U.S. specifications and imported to the U.S. In 1999, Bering will manufacture Class 7-8 units at a new facility in Front Royal, Va., and import the rest.

One of the initial hurdles Bering must clear is the perception that it is a foreign truck manufacturer. "We are not," Anderson told FLEET OWNER in an exclusive interview. "This venture was created in America. We approached Hyundai because they offered fabulous technology. We have 55% U.S. content. The common thread between Bering and Hyundai is the cab technology. But even there, differences exist. We have a line distinctively created for the U.S. market."

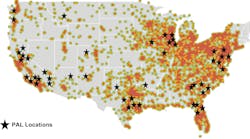

Anderson said Bering will be a "niche market" player, focusing initially east of the Mississippi and vocational markets such as regional pickup and delivery, refuse, recovery and construction.

The trucks will carry the Bering identification, which draws its name from the Bering Straight, where Asia and North America meet.

"We don't want to be all things to all people," Anderson said. "We offer significant value-added - but as a niche player. We are not a longhaul solution."

Market dynamics make Bering's timing "exceptional," he says. First, the midrange and medium-duty vocational products have not received the attention they merit or the investment in research and development they deserve from existing truck manufacturers.

At the same time, the tremendous shortage of quality truck drivers - a problem that historically has been associated with the over-the-road market - is starting to leave its imprint in vocational markets.

That has opened the door for the bear. "The premise of the company is centered on giving drivers the best possible truck to operate," explains Anderson. "We want to be perceived as the driver's truck. Professional truck drivers spend more time behind the steering wheel than anywhere else. Bering has addressed the issue of driver comfort."

Bering will venture into the market with 13 models in three broad product categories, each of which features a cab-forward design to enhance driver visibility and maneuverability. Drivers are isolated from vibrations and noise through the use of a two-stage air cleaner and full-floating air suspension. Plus, driver comfort features include power assist brakes and synchronized transmissions. An ergonomic wraparound cockpit provides drivers with easy access to cab controls, including a high-efficiency climate control system. In Classes 3-5, Bering will offer the VT55 and the VT67, featuring both 5-speed manual and 4-speed automatic transmissions, four wheelbase options, and a Detroit Diesel D642 160-hp. engine.

In the medium-duty market, Bering offers the HD-120, with a 25,950 lb. GVWR. The model, which has four wheelbase offerings, is powered by the Cummins ISB 215-hp. engine; a 6-speed manual transmission is standard.

The HD-160 cargo is Bering's entry in the Class 7 market. Available in three wheelbases, power is supplied by the Cummins ISC 285-hp. powerplant; a 10-speed transmission is standard.

On the heavy-duty Class 8 end of the business, Bering will offer the HD-160 cab chassis, the HD-390 single-axle tractor, the HD-540 tandem-axle tractor, the HD-270 concrete mixer and dump version, and the HD-370 dump chassis.

The common thread uniting these diverse applications is that "the truck is critical to the success of the business," Anderson said.

As proof of his customer focus, Anderson held out an innovative pop-off box for dry van applications. Through the use of a quick-release mechanism and weathertight connectors, fleets will be able to remove the van body for more drops and hooks in medium-duty applications.

Bering will sell on the value of the product, which Anderson defines in terms of content, warranty, and trade-in value. "We will be competitive at a given value," he said. "But we are not going to create any price wars."

Anderson recognizes that Bering must look beyond the hardware alone. That's why he is putting in place a captive leasing program and three parts-distribution centers that will guarantee prompt delivery.

Distribution through the market will be through a dealer network estimated at 45 by year-end.