Market analysts predict moderate growth to freight volumes and for-hire rates in 2025, giving fleets hope after a difficult 2024.

The optimistic forecasts come from annual outlooks by the American Trucking Associations, ACT Research, FTR Transportation Intelligence, and DAT Freight & Analytics.

“As we close the books on 2024, the coming year promises a dynamic freight environment—one driven by change but full of opportunity,” Jeff Clementz, DAT president and CEO, said in the firm's annual outlook.

The firms' predictions see freight volumes growing 1% to 1.6% and for-hire rates beginning their upturn later this year—as early as Q2.

See also: CARB withdraws Advanced Clean Fleets bid

ATA predicts 1.6% growth in truck volumes

In its latest annual freight forecast in collaboration with S&P Global Market Intelligence, ATA Freight Transportation Forecast 2024 to 2035, the association expects truck volumes to grow 1.6% in 2025.

“In this edition of Forecast, the trucking industry continues to dominate the freight transportation industry in terms of both tonnage and revenue, comprising 72.7% of tonnage and 76.9% of revenue in 2024,” said Bob Costello, ATA’s chief economist. “We project that market share to hold over the next decade as the country continues to rely on trucking to move the vast majority of freight.”

As research firms predict the overall U.S. economy to grow by about 2.1% in 2025, ATA predicts U.S. industrial output will grow by about 0.6% and manufacturing output will grow by about 0.9% next year. Meanwhile, the report forecasts total imports would grow by 3.6% and exports would grow by 3.9%.

With trucks poised to continue handling a substantial majority of freight movement, increasing economic activity would boost freight volumes.

For the report’s long-term projections, ATA expects truck volumes to rise from 2024’s 11.27 billion tons to nearly 14 billion tons by 2035. The report also predicts general trucking industry revenue to grow over that same period, from roughly $906 billion last year to $1.46 trillion in 2035.

ACT Research’s free industry forecast blog post makes similar predictions to ATA's. The research firm projects freight demand to grow about 1.8% year-over-year—close to ATA’s 1.6% prediction.

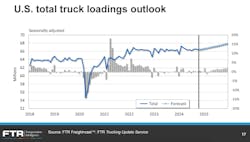

In their 2025 Transportation Outlook, analysts at FTR Transportation Intelligence were a little more cautious in predicting 2025 volumes. The firm predicts around 1% growth.

“We’re expecting the overall truck freight volume up around a percentage point year over year,” Avery Vise, VP of trucking at FTR, said during the webinar. “It doesn’t sound like much, but 2024 was only up two-tenths of a percent, so it’s a lot better. It varies significantly by equipment type.”

Vise sees refrigerated and flatbed loadings growing significantly more in 2025 than short haul or heavy haul loads, for example.

DAT sees rate upturn as soon as Q2

The annual outlook from DAT Freight & Analytics projects an upturn in for-hire rates this year.

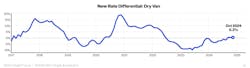

DAT observed that new contract rates are growing as carriers continue to exit the marketplace. The firm expects the trend of rising rates to continue, with rates increasing akin to pre-pandemic levels. By Q2 at the earliest, the market could flip in carriers’ favor.

Headwinds still threaten fleet prosperity, the report notes. Strife over tariffs, geopolitical chaos, and labor struggles from mass deportation spell uncertainty for the future of freight.

Echoing DAT, ACT Research also predicted spot rates would increase gradually throughout the year—though excess capacity may continue to burden for-hire trucking.