Half of Class 8 regional-haul tractors are electrifiable now, study finds

The second new study in a week to focus on all-electric Class 8 trucks has found that 50% of the heaviest diesel-burning tractors in the U.S. that operate in trucking’s regional-haul segment can be replaced with battery-electric equivalents that have zero tailpipe emissions.

The report, “Electric Trucks Have Arrived: The Use Case For Heavy-Duty Regional Haul Tractors,” is the third of four market segment reports from the North American Council for Freight Efficiency (NACFE) based on findings from the council’s Run on Less – Electric freight-efficiency demonstration last year.

The latest NACFE report, released May 5, says that about 468,000 of the 930,000 Class 8 tractors in the U.S. that function along regional routes could go electric, opening the option for many fleet managers to consider adopting heavy EVs. About 2 million Class 8s serve all U.S. freight transportation segments.

See also: ATRI study offers warnings on electric Class 8s

An earlier NACFE report, released April 12, also based on the 2021 demonstration, sees vans and step vans, which often are used for urban deliveries, as 100% electrifiable. The market for smaller electric delivery vehicles and vocational trucks has exploded, as Work Truck Week 2022 in March demonstrated. The Class 8 use cases are much farther behind.

“Heavy-duty Class 8 tractors are the most challenging of all the truck segments considered for electrification,” Rick Mihelic, the new NACFE report’s lead author and the freight efficiency council’s director of emerging technologies, said in a release summarizing the May 5 report.

“Battery-electric vehicles cannot replace all diesels,” he added, “but they can replace a significant share of regional-haul ones, where the driver and truck return to base each day, where loads are usually cubed out, or in the case of beverage deliveries, the daily distances are not very long.”

“These trucks are capable. We believe this market’s bigger than we think,” Mike Roeth, NACFE’s executive director, added during a video press conference a few hours after the report was released.

The rap against electric Class 8s, largely among long-haul stakeholders, is their current range capability (150 to 250 miles, depending on the weight of the load and weather and temperature conditions). But NACFE’s report identifies regional-haul vehicles, mostly day cabs, that travel 200 miles or less as prime candidates to go all-electric—or routes where the driver can travel to a delivery location, unload his cargo, and return home within one hours-of-service day, or about 11 hours.

See also: NACFE demonstrates use case for electric vans and step vans

The range concern was voiced earlier this week by Daniel Murray, senior VP and second in command at the American Transportation Research Institute (ATRI), which on May 3 released a study of its own that favors other sustainability options in freight transportation such as hydrogen fuel-cell heavy tractors and other cleaner fuel options such as renewable diesel but contained warnings about all-electric heavy trucks.

“They’re not going to be a panacea for the industry,” Murray said of electric Class 8s that day.

The ATRI study also points out the higher prices to purchase the heaviest EVs ($400,000 to $600,000, depending on configuration, compared to about $150,000 for a conventional diesel truck) and the environmental costs to manufacture all-electric Class 8s, generate and deliver their power, and produce and recycle their lithium-ion batteries.

For NACFE’s Run on Less demonstration last year, four fleet-OEM teams operated electric heavy-duty tractors in regional hauls: Anheuser-Busch with a BYD 8TT all-electric day cab; Biagi Bros. with a Peterbilt Model 579EV; NFI with a Volvo VNR Electric; and Penske with a Freightliner eCascadia. All the teams ran their regional routes in California, which is the leading test bed for electric Class 8s.

NACFE scales back its projection

The freight efficiency council’s outlook for regionally routed heavy EVs was even rosier in September, when the Run on Less – Electric demonstration ended, predicting at the time that 70% of the segment is electrifiable.

But given more detailed analysis, interviews with industry experts, and further research for the May 5 report, “we now consider this market segment to be 50% electrifiable with lower average daily miles, which results in the avoidance of nearly 29.4 million metric tonnes of CO2e annually. NACFE estimates the entire CO2e to be eliminated by this segment at an average of 250 miles per day to be 97.8 million metric tonnes,” the council said in its summary.

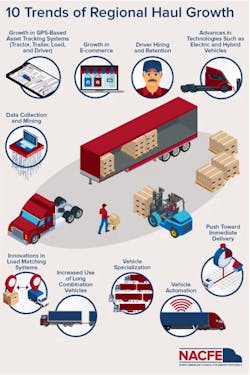

Its report includes basic information about heavy-duty regional haul tractors and the size and scope of the market. It also looks at duty cycle and charging considerations and presents the benefits and challenges of battery-electric vehicles.

NACFE’s new report also includes information on the manufacturers and fleets that had heavy-duty regional haul tractors in Run on Less and provides details on what metrics were measured.

Also, just as ATRI’s study released this week did, the NACFE report includes discussion about the total cost of operation (TCO) of battery electrics and their return on investment. However, the NACFE report does not deal with environmental considerations as ATRI's new report does.

The wave of reports on electric and other "green" alternatives to diesel commercial vehicles arrives as the Advanced Clean Transportation (ACT) Expo, a conference of stakeholders in "clean" transportation, gets ready to convene May 9-12 in Long Beach, California. ACT Expo features a schedule of sessions and workshops as well as an expo hall filled with clean transportation technology.

Look for coverage of ACT Expo all next week from FleetOwner.