Newest NACFE report finds all medium-duty box trucks electrifiable

More findings this week from the North American Council for Freight Efficiency (NACFE) cap a series of reports from the group that collectively show just about every class of U.S. commercial vehicle—from cargo, step and delivery vans, to certain medium-duty trucks, to heavy-duty tractors used regionally—are at least partially if not totally suitable for all-electric adoption.

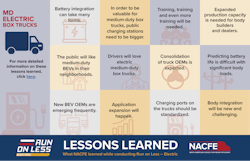

The reports all are based on NACFE’s three-week September 2021 Run on Less – Electric (RoL–E) demonstration that tested different vehicle classes for electric suitability. Their latest report, released on June 28, deals with the EV possibilities of Classes 6-7 medium-duty box trucks—and NACFE judges them 100% electrifiable based on tests of three different companies’ EVs last fall. NACFE also released a fact sheet on the medium-duty portion of the demonstration.

See also: Shippers want to decarbonize, trucking can help

The companies and their Class 6 trucks tested last year were a Day & Ross Lion Electric Co. all-electric model Lion6, a Frito-Lay Peterbilt-Cummins 220 EV, and a Roush Fenway Racing Roush CleanTech Ford F-650. Tests of other classes focused on terminal tractors (seen by NACFE as 100% electrifiable), delivery vans and step vans (also judged as 100% electrifiable), and heavy-duty Class 8 regional-haul tractors (seen as 50% electrifiable).

The key to suitability during all the RoL–E demonstrations was whether the vehicles ran shorter or regional routes (around 250 miles maximum) and could return to their home depots every night for full charges, according to the five NACFE reports, which have been released as a series since this spring. In the freight-hauling industry, range has been a significant concern with all commercial electric vehicles along with their cost to fleets as they contemplate switching in the future and the availability of charging infrastructure.

Countless electrified medium-duty and other classes of commercial vehicles were on display at Work Truck Week 2022 in Indianapolis in March. FleetOwner had extensive coverage from the event, which was one of many industry shows this year, such as the Advanced Clean Transportation (ACT) Expo, to showcase the explosion of the electric-vehicle marketplace.

See also: Battery-electric trucks are a 'fantasy,' futurist says

“Medium-duty box trucks are a great application for electric trucks, given their short distances and return-to-base operations,” according to one of the June 28 NACFE report’s five key findings.

“They are an ideal portion of the overall medium-duty truck market for electrification. Other medium-duty applications that do not require much battery power to operate aspects of the body also can be good candidates for electrification.”

That’s a key distinction in the newest report and to NACFE’s executive director, Mike Roeth. During an interview with FleetOwner following the report's release, he stressed that box trucks are an easier all-electric “use case” than more complicated MD applications like vocational Classes 6-7 utility bucket trucks, fire trucks with pumpers, concrete mixers, and snowplows. These work trucks will require specialized upfits that will draw more electricity from their batteries other than what is used for propulsion back and forth to job sites, Roeth added.

See also: EV interest is growing and not about to stop

“Electrification will be really quick for simple box trucks, but the market will determine how fast vocational vehicles” will become practical for widespread adoption, he stressed. “When you start to look at what we all call vocational trucks, nearly all the battery power is going to move the truck. When you start to add certain things … you have more power demands out of the body, and that’s going to be more difficult to electrify. The engineers are salivating over the challenges here.”

Other MD findings from NACFE’s latest report were:

- Medium-duty trucks almost always have a second manufacturer that adds body devices requiring engineering design and validation as well as manufacturing planning for electrification. Body builders and upfitters will add a variety of bodies to medium-duty chassis. While a van body doesn’t require a lot of additional engineering or validation, many other applications will be much more challenging in terms of installation, operations, safeguards, and more.

- More complex Classes 6-7 trucks such as snowplows, refuse trucks, and fire trucks will require significant efforts that will delay electrification timing. For example, trucks that see continuous operations for a day or more such as a snowplows or utility trucks are “obvious” challenges for battery-electric powertrains.

- Application expansion into more complex medium-duty trucks will occur as knowledge is gained. Tackling relatively simple and straightforward applications such as box trucks provides the trucking industry with a launching point to design, build, validate, and refine medium-duty BEVs. The industry also will learn things such as how much of the battery is consumed by various cab air conditioning and heating demands and how lift gates and other peripheral devices tax power consumption.

NACFE believes that 100% of the medium-duty box truck market will embrace electrification, although some applications within the duty cycle will be easier to electrify than others that have more complex bodies. When the simpler box truck portion of this market segment—about 380,000 trucks in the U.S. and Canada—electrifies, it will result in the avoidance of 7.68 million metric tons of CO2e annually, according the June 28 freight efficiency council report.

“The more complex trucks in this category will also electrify as the medium-duty marketplace expands the electric coverage over the next decade,” it says. “These trucks cover both freight and work truck use cases.”