The U.S. average price of diesel fuel has fallen below the $5 mark for the first time since early March—before the Russian invasion of Ukraine sent shocks through the oil and distillate markets and prices went on a monthslong ascent to never-before-seen highs.

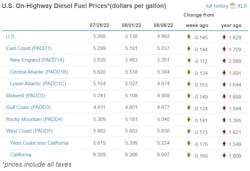

Trucking’s main fuel fell 14.5 cents to $4.993 for the week of Aug. 8, according to the U.S. Energy Information Administration (EIA)—the seventh week in a row that the U.S. average has dropped. Motor club AAA has diesel still above $5 in its daily average, $5.143, but 13.6 cents below the mark of the week before and more than a penny lower than just the day before.

See also: Diesel declines for sixth straight week

AAA last recorded its record high for diesel on June 19. EIA’s last record for the distillate was set the week of June 20—$5.81 per gallon. Diesel has dropped in price every week since through a combination of factors such as declines in demand and dropping oil prices, according to EIA.

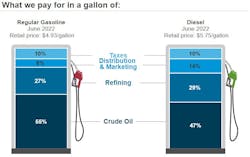

Diesel still is $1.629 above the level of a year ago, but gasoline is down almost $1—86.6 cents—over the year-ago level. According to EIA, Gasoline is nearing the $4-per-gallon mark. It fell 15.4 cents last week to $4.038 per gallon. AAA had the U.S. average at $4.033 on Aug. 9, down 2.6 cents from the day prior. AAA tracks distillate price trends daily as well as weekly and monthly.

Some regions hover above $5

Diesel was down in every region of the country, according to EIA. Three regions remained above $5 per gallon, but even prices in those places have come down precipitously.

On the East Coast, trucking’s main fuel was at $5.037 per gallon on Aug. 8, down 14.4 cents from the week before, according to EIA. In the Rocky Mountain region, diesel sat at $5.040, down 14.1 cents. The distillate was the highest in the country on the West Coast—as it always is—at $5.630, but still down 17.3 cents, EIA’s Aug. 8 data shows, including California, where it was $6.097.

Diesel was cheapest in the U.S. on the Gulf Coast, where it was $4.677 per gallon on Aug. 8, down 12.4 cents. The distillate was $4.959 in the Midwest, down 14.9 cents, according to EIA.

See also: As demand grows, fleets don’t have to run on empty

The decline in prices for all distillates is tracking consistently with the drop in oil prices. West Texas Intermediate and Brent crude were well below $100 on Aug. 9, when they had been tracking well above the century mark in the months when diesel and gasoline reached record levels. Crude inventories also remain elevated, according to Oil & Gas Journal, FleetOwner's sister publication, as oil companies report record profits.

Demand remains an influencer in the market as well. U.S. drivers are using less gasoline, Bloomberg reports, solely because high prices have choked off demand this summer. Meanwhile, some outlets are reporting that diesel supplies may become more constrained and cause prices to actually go up in the months to come.