The word to describe diesel fuel prices (and gasoline, for that matter) the last year might be “volatile.” Not so the last two weeks. The U.S. average price for trucking’s main fuel did rise 3.9 cents the week of July 10 to $3.806 per gallon, but it stayed precisely there for the week of July 17, according to the latest government data from the U.S. Energy Information Administration (EIA).

Flat, exactly flat. Zero increase, no decline, according to EIA, which does have diesel $1.626 cheaper per gallon than during the wild times of fuel prices a year ago. Motor club AAA’s own diesel average did rise—but barely—this week. The AAA average ticked up 1.3 cents from last week to $3.856 by July 18.

Gasoline, meanwhile, used widely by consumers but also some commercial fleets and work-truck operators, rose but, again, slightly, according to EIA, which had its U.S. gasoline average at $3.559, or 1.3 cents more per gallon than the week of July 10. Gas is 93.1 cents less expensive than a year ago, EIA's data shows.

See also: Roeth: Don't be a slave to fuel prices

Diesel rises in three regions, four subregions

Diesel that EIA measures in its five regions of the country and its five subregions is either ahead of increases that might be coming in the following weeks or more of an indicator of the true state of the fuel now across the U.S. Trucking’s main fuel is higher for the week of July 17 in all but one of the subregions (the West Coast not including California) and up in three of the five main EIA regions, the coasts (East Coast, Gulf Coast, and West Coast). All the increases are slight, but four subregions and one region (the West Coast) sit above $4 per gallon for trucking's main fuel.

See also: Weak freight market doesn’t slow ‘incredibly active’ 2023 mergers

On the East Coast, diesel is up the most, 2.1 cents to $3.879 per gallon. The fuel also is higher in every subregion in the East: 2.5 cents to $3.779 in the heavily-trafficked-by-trucking Lower Atlantic, 1.4 cents to $4.092 per gallon in the Central Atlantic, also a major trucking epicenter, and seven-tenths of a penny to $4.081 in New England. Diesel also is higher in the pricey subregion of California, 2.7 cents to $4.848 per gallon, the most expensive place in the nation to buy the fuel.

Diesel also is higher, but less than a penny, on the Gulf Coast (to $3.506, the cheapest in the U.S.) and the West Coast (to $4.465, the most expensive main EIA region). The fuel is lower this week in two other regions, the Midwest (down 1.6 cents to $3.726 per gallon) and the Rocky Mountains (1.2 cents lower to $3.927).

Crude prices on the rise, too

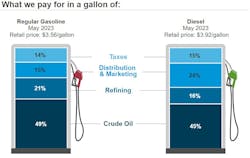

Bumps in gas and distillate prices might be tied to the per-barrel price of oil, which has risen slightly, after months of decline, the last three weeks thanks to increasing demand and OPEC+ supply cuts. Oil rose near or above $80 briefly this week, though both West Texas Intermediate and Brent floated below that level the morning of July 18. WTI sat just below $75, while Brent was slightly above $78. Experts predicted this might lead to slightly higher diesel and gas prices in the coming weeks, though the busy summer travel season is coming to an end, so demand (at least for gas) might slow.

See also: Focus on used trucks: Class 8 sales trend up, costs to run them keep rising

“While the [gas] price increases could continue into this week, I would expect them to be fairly mild, with the national average likely staying in the $3.50-$3.60 range that we’ve been stuck in since April for the coming week and likely into next week as well,” said Patrick De Haan, head of petroleum analysis, for GasBuddy’s weekly blog on the fuel markets. “Economic data has been playing a larger than typical role in putting pressure on gas prices, with OPEC production cuts also a major factor.”