Diesel prices surge for third straight week

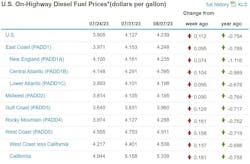

The U.S. average for diesel fuel surged by double digits for the second week in a row, according to the U.S. Energy Information Administration (EIA), and the 11.2-cent increase for the week of Aug. 7 brings the three-week bump for the average to more than 43 cents.

The string of increases might as well be three weeks—EIA’s U.S. average rose almost a dime, 9.9 cents, the week of July 24 before last week’s average bulged 22.2 cents, marking the largest one-week increase in 16 months.

At well above $4 per gallon this week—$4.239—the national average is the highest it’s been since March 20. And the gap between the Aug. 7 average and one year ago shrunk as well, as the fuel now is 75.4 cents cheaper than it was at this time in historically pricey 2022, according to the latest data from EIA.

Meanwhile, Motor club AAA’s own diesel average rose on Aug. 8 by double digits as well, to $4.203 per gallon, or 13 cents more than a week ago.

Higher crude, shrunken supply, eased recession fears, summer heat all conspiring

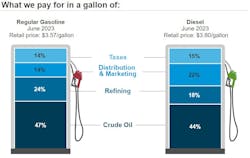

A few market forces are at play to increase fuel prices for consumers and for truckers. Oil prices are elevated compared to their levels of earlier this summer. West Texas Intermediate crude is sitting close to $83 per barrel, while Brent has almost reached $86. Per-barrel crude was set to post a sixth straight week of gains because of tighter supplies and recession fears that are easing, twin variables that usually mean higher pump prices, various analysts said.

See also: Lest we forget decarbonizing with diesel

Plus, as GasBuddy’s head of petroleum analysis Patrick De Haan pointed out in a blog post last week, crude inventories saw a monster drop, further constraining supplies. And, De Haan said, recent outages at major U.S. refineries because of the summer heat still are playing their part. At least four fuel-producing plants in Texas and Louisiana—the states that are home to half of the nation’s refining capacity—have suffered outages at least in part due to the heat in recent weeks.

Fuel could again threaten to elevate fleet costs significantly

When diesel and gasoline prices were headed in the “right” direction this year after rising to records in 2022, trucking fleets began to worry less about the slice fuel was eating out of their bottom lines, even though surcharges and better efficiency help carriers as buffers for their balance sheets.

If prices continue to surge, as they have in recent weeks, carriers might face the scenario they encountered in 2022. Overall fleet costs jumped 21.3% with fuel accounting for 54% of the jump over 2021, by far the largest expense for carriers, according to results of an annual American Transportation Research Institute survey published in June.

See also: Improve operational efficiency to offset cost increases

Fleets already exited trucking at historic levels in the first quarter of this year, a trend largely attributable to the squeeze truckers felt at the pump plus freight rates on the spot market that continue to underwhelm and sit about 19% below 2022 and nearly 7% behind their five-year average. Fleet failures also are still occurring to such a degree that they're having a logical consequence in fueling a surge in the used-truck market, analysts told FleetOwner late last month.

A lot of trucking's troubles in 2022 could be tied to sky-high fuel. Will that be the case in 2023? EIA and other outlets will tell the industry in the coming weeks.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.