NACFE releases report on the viability of fleets fueled by natural gas

The North American Council for Freight Efficiency released a report on natural gas and its potential role in decarbonizing the trucking industry. The report shared key factors that fleets should consider when exploring the viability of alternative fuel in their fleet. While the fuel is largely available to fleets now, implementation of natural gas won’t come without its challenges—much like any other alternative fuel.

Natural gas has been used as a trucking fuel source for about 100 years, with many sources identifying its use as early as World War I to combat the gasoline shortage brought on by the war. As FleetOwner reported in 2012, natural gas has been used in the trucking industry since the 1980s, although the high cost of adoption has largely kept fleets from implementing the fuel source. The report states that it might take 10 years for some fleets to see a return on their investment after implementing natural gas into their fleet.

Taking this into consideration, which fleets would find the most benefit in considering natural gas over another alternative fuel source? NACFE challenges fleets to consider the switch by looking at three main factors: regulations and emissions mandates, alternative fuel comparisons, and economic considerations.

Regulations and emissions

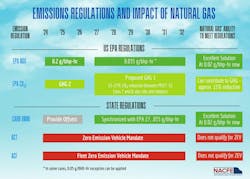

The NACFE report references EPA’s new emissions standard for vehicles beginning in model year 2027, which states that NOx emissions must be reduced from 0.2 g/bhp-hr to 0.035 g/bhp-hr. That’s a reduction of more than 85%. The report also references the proposed reductions in Phase 3 of EPA’s Clean Trucks Plan. The goal of the proposed rule is to reduce emissions from medium-duty trucks by 50% and reduce emissions of Class 7 and 8 vehicles by 27% for 2032 model year vehicles.

While these regulations are taking place on the federal level, individual states are also passing their own emission-reducing regulations. California is leading the pack with the Advanced Clean Trucks rule, which requires that 5% to 9% of all manufacturers’ vehicle sales be zero-emission vehicles starting this year. An additional 16 states and the District of Columbia have also signed a Memorandum of Understanding supporting the deployment of ZEVs across the country.

See also: EPA poised to grant California more rigid emissions rule than rest of nation: report

Regulations, emissions, and natural gas engines

Despite being a cleaner fuel than diesel, these regulations will also have an impact on natural gas. The NACFE report states that the EPA emissions standard for 2027 model-year vehicles will have no direct impact on natural gas vehicles; however, the rule’s impact on the cost of diesel engines—due to more complex requirements—will reduce the cost difference between the two engine types. This will help put natural gas on a more level playing field with diesel.

Further, natural gas engines can help OEMs meet EPA’s proposed Phase 3 requirements because “the net CO2 benefit of natural gas is on the order of 13% to 18% lower than diesel from a well-to-wheels standpoint,” according to the report.

Where natural gas falls short with upcoming regulations is with the California ACT rule, as they will not comply with the ZEV mandate, the report states. However, if a natural gas engine is paired with a hybrid, “it can qualify as a near-zero emission vehicle,” and “fleets will be able to purchase 50% of their ZEV required vehicles with a hybrid/natural gas product,” according to the report.

Alternative fuel comparisons

Natural gas engines might appear to be a viable emissions-reduction solution from an emissions and regulations standpoint, but fleets should compare natural gas to other alternative fuels and electric vehicles to get a better understanding of their potential ROI and TCO.

NACFE dedicates nearly 13 pages of its report to the summarization of different fuel types and their advantages and disadvantages. Key takeaways from the summarization include:

- While engine manufacturers have approved the use of biodiesel blends of up to 20%, running higher concentrations of biodiesel could cause problems such as compromised cold performance and increased NOx emissions.

- Diesel fuel provides the lowest cost, best range, best packaging, and widest available fueling in commercial vehicles today. Today’s diesel engines are lower emitters than older models and capable of achieving much higher fuel efficiency.

- Renewable diesel can be used directly or blended with fossil diesel fuel with no consequences; however, it is more expensive to create than biodiesel.

- Propane is a popular fuel for medium-duty vehicles, such as school buses, utility vehicles, and local delivery trucks, but has not been widely used in heavy-duty applications. Propane also requires additional safety measures due to its odorless and colorless characteristics.

Fleet owners looking to decrease their emissions output should compare alternative fuels with hybrid, hydrogen fuel cell, and battery-electric vehicle technology to determine which option is best for their fleet operations. Key takeaways from the report relating to these technologies include:

- Hybrids provide few benefits to vehicles traveling distances longer than 200 miles per day because of cruise conditions that inhibit regenerative braking and weight availability for a battery large enough to benefit long-haul applications.

- Battery-electric vehicles are operating in heavy-duty fleets today, but three big challenges have kept some fleets from implementing the technology into their fleets. These challenges include infrastructure and charging, range, and cost.

- A hydrogen fuel-cell powertrain has potential, especially in long-haul applications. However, the report outlines its primary challenges as technology maturity, availability, costs, and infrastructure. It also requires significant space for fuel storage.

Economic factors of a natural gas fleet

The report also covers the economics of integrating natural gas into a fleet, and NACFE stated that some fleets have saved money after integrating natural gas into their fleet. But that isn’t the case for every fleet.

According to interviews taken by the NACFE study team, CNG vehicles can cost between $50,000 and $100,000 more than diesel vehicles. This could be because CNG tanks require carbon fiber, linings, and robustness for safety purposes. NACFE did note that due to the EPA’s upcoming regulations, the cost of natural gas trucks should decrease, while the cost of diesel trucks is expected to rise by up to $35,000.

Once those trucks are purchased, a fleet must fuel them. Some fleets will find public stations near their operations, but others will have to build their own infrastructure. This can cost a fleet from $2 million to $5 million, NACFE reported.

“The $2 million estimate is for a station that can support 100 trucks. Given these high costs for infrastructure and initial vehicle purchase price, pursuing natural gas vehicles is a long-term solution. This can become a 10-plus year investment decision in order to amortize these upfront costs,” the report states.

Fleets that have built CNG fueling infrastructure will see a bit of relief at the pump, however, considering the cost of CNG is typically 30% to 50% lower than diesel.

Fleets can also find ways to increase their ROI and TCO through tax incentives and credits—both federally and locally. Tax incentives, such as the Alternative Fuels Tax Credit, are designed to benefit those who build fueling infrastructure and give a credit of 50 cents per gallon through December 31, 2024.

California offers tax credits to fuel companies that sell renewable natural gas to replace conventional fuel. Fleets can use this knowledge to help negotiate a fuel price agreement.

Additionally, fleets must consider maintenance costs. According to fleets that use CNG-powered vehicles in their fleet, these trucks can incur maintenance costs that are 20% higher than diesel-powered vehicles.

“Maintenance intervals for spark plug changes and oil changes typically are once every 20,000 to 30,000 miles, according to interviews with fleets. These numbers are based on the Cummins 12-liter engine, and Cummins is projecting much better intervals with the X15N,” the report states.

Finally, when considering alternative fuels, fleets must consider the possibility of a second life and the vehicle’s resale value. Because CNG isn’t a widely used fuel, the value of these vehicles in the market can be low, NACFE stated.

See also: Clark: The future of trucking looks like both BEVs and diesel

NACFE’s report identified pros and cons to the adoption of natural gas into fleet operations, yet the reality of those pros and cons will look different according to each individual fleet. It is ultimately up to the fleets to decide if the alternative fuel makes sense for them.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.