Report: How is clean vehicle technology adoption doing among fleets?

LAS VEGAS—Telematics, predictive maintenance, route optimization, and other fleet technologies have rapidly advanced within the past five years. So has the technology that powers the fleets. Alternative fuels, electric powertrains, and even cleaner-burning diesel technology have improved with time. With all this advancement and innovation, one thing is clear: Clean technology is here to stay—at least according to TRC’s fifth annual State of Sustainable Fleets report.

Want more trucking industry news? Subscribe to FleetOwner's newsletters here!

The report surveys fleets across the nation to get a handle on how the industry is reacting to new regulations, new vehicles entering the market, and, overall, new options for fleet operations. Key findings of this report include:

- Confusion with new emissions and zero-emission vehicle regulations

- A rise in diesel vehicle sales

- Renewable natural gas leads growth in compressed natural gas sector

- Medium-duty battery electric vehicle deployments double

- Hydrogen economy pushes forward

“If I had to really sum up the report for this year, there's one word that comes to mind: growth,” Eric Neandross, president of GNA, said during a keynote speech at the Advanced Clean Transportation Expo here in Las Vegas. “We cover all the major trends in the report, and these are the trends that we see in the headlines every single week.”

Key findings from the 2024 State of Sustainable Fleets report

Regulatory confusion

While 2023 was a year of ZEV adoption among fleets, it was also a year of confusion, according to the report, as emissions regulations shook the fleet world—some federally and some locally. With California leading the charge in zero-emission vehicle regulations, fleets that operate in the state are busy planning their ZEV adoption while also considering their bottom line.

Other states are following in California’s footsteps. Only time will tell how far regulations will restrict fleets in their vehicle powertrain choices, and the restrictions will likely continue to vary by state until the nation “aligns with the EPA [Clean Trucks Plan] starting with model year 2027,” the report stated.

“We have a couple of really critical regulations that were adopted that's going to accelerate our move forward to lower carbon fuels, zero-emission vehicles in every sector: light, medium, heavy,” Neandross said. “These are regulations, these are policies that can be shifted, they could be rolled back ... But I go back to the trillion dollars being invested in this market right now, commitments that we are going to get to zero. That is the goal.”

A rise in diesel sales

Fleets purchased 7% more diesel vehicles in 2023 than in 2022, and the cost of diesel fuel also fell. This increased demand could signal a rush to buy diesel vehicles ahead of EPA’s Clean Trucks Plan implementation in MY 2027, which could increase the price of diesel vehicles by about 12%, according to S&P Global Commodity Insights.

The popularity of renewable diesel fuel also increased. Considered a “drop-in” fuel, meaning it can be used as a direct replacement for diesel fuel in diesel engines, the national consumption of RD increased by 68% year over year, according to the report. Yet, RD adoption is much slower outside West Coast states, suggesting that obtaining the fuel beyond the West Coast is more complex or costly.

Renewable natural gas is a popular fleet choice

More than 150 new renewable natural gas production facilities came online in 2023. This growth helped sustain CNG prices and helped them be competitive with other fuel choices. The demand for RNG among fleets also grew for the third consecutive year, while deliveries of natural gas vehicles fell by 11%. According to the report, existing users of natural gas vehicles are driving the demand for the fuel.

The natural gas market is facing “headwinds,” the report stated, as regulations mandate ZEV operation in fleets and Cummins phases out its popular CNG engine, the ISX12N, to bring to market its 15-liter X15N. S&P Global Mobility predicts a bright future for CNG, with 63% sales growth by 2030.

See also: Where natural gas fits in decarbonizing trucking

Medium-duty BEV deployments double

More than 26,000 battery-electric trucks, vans, and buses were delivered to fleets in 2023—doubled since 2022. Cargo vans and pickup trucks made up 90% of those deliveries, and of those 90%, Rivian and Ford made 95%, the report concluded. While deliveries were strong, charging infrastructure challenges persist, with long lead times, increased costs, and more.

EV popularity is growing outside of California, as well. The report notes that Texas and Florida were the first and third largest markets for electric cargo vans in 2023. Fleets running shorter, lightweight routes have been identified as the BEV sweet spot, as most vehicles travel shorter routes and return to base at the end of a shift to charge. Large fleets have also begun transitioning their fleets, as the transition requires large amounts of capital. Smaller fleets, which comprise more than 95% of fleets in the U.S., are less likely to be first adopters for EV fleets, as they have less capital to invest in the endeavor.

As some in the industry transition to an electric fleet, either wholly or partway, fleets are finding infrastructure challenges an obstacle. To combat this, the industry is seeing more partnerships between fleets, utilities, and third-party companies that help bridge the two, facilitate planning, and help fleets and utilities find grants and incentives to fund the project.

See also: Fleets Explained: How are electric vehicles different?

The hydrogen economy pushes forward

The hydrogen economy experienced growth and attention in 2023, fueled by federal investments in hydrogen production and infrastructure. While the intention behind this investment is to reduce the risk of private investment in the fuel source and make hydrogen more affordable, the cost of the fuel almost doubled from 2022 to 2023. Regardless, OEMs brought hydrogen fuel cell EVs into the field, with Nikola and Hyundai delivering Class 8 EVs to fleets.

Hydrogen can power fleet vehicles through either internal combustion or fuel cell EVs. OEMs are largely focusing on both versions of hydrogen-powered vehicles. According to the report, some believe that transitioning fleets from diesel ICE to hydrogen ICE will prove more cost-effective and help meet emissions targets quicker.

Like BEVs, hydrogen infrastructure is an obstacle to bringing this fuel option to market for the masses. Hydrogen doesn’t occur naturally and must be extracted. While these production facilities are being built, few exist in the U.S. today. Once the hydrogen is extracted, there are two ways to transport it: liquified or gaseous. The process of transporting both fuels differs, leading to less cohesion in the market.

See also: Can hydrogen actually work for trucking operations?

The next five years could see much more growth

While fleets theoretically have many propulsion and fuel choices, their true options depend on their application, the vehicles they operate, and their location. While much of the focus has been on electric vehicles—and the industry is proving this through its rapid adoption rates—other fuels and powertrains can’t yet be dismissed.

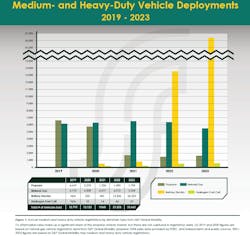

The graph below shows the deployment rates of alternative fuels over the last five years, with 2022 and 2023 showing substantial growth in EV deployment. That growth over a short time tells what this industry can do when funds, regulations, and interests align. Only time will tell how the next five years play out, and it could be much more interesting with stricter regulations on the horizon.

“I've talked about this perfect storm that I see, the three big drivers in the industry,” Neandross explained. “1. massive global investment; 2. growing commitments around sustainability and carbon reductions; and 3. the backstop of regulations. ... The tailwinds are incredible that we have right now. It's an amazing time to be in our industry. We've got this robust foundation that we have in place, and we're going to start to see increasing scaling in the years ahead."

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.