Class 8 truck orders sagged last month compared to March by 37% and 39%, respectively, according to two equipment reports put out on May 2 by top trucking industry data aggregators FTR Transportation Intelligence and ACT Research. ACT called the preliminary order level “weaker than expected” while FTR’s report said the low orders were “not a major surprise.”

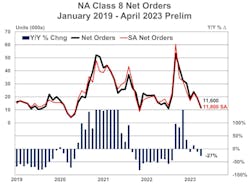

Orders were down in April for the sixth time in seven months, falling to 12,050 units, according to FTR. Not only was activity down 37% compared to March, but orders fell 20% year-over-year, that firm reported. ACT’s monthly State of the Industry: Classes 5-8 Vehicles report had orders at 11,600, down 27% year-over-year as well 39% lower compared to the previous month.

See also: Strong trailer demand, lingering supply chain challenges push backlog up

“The weak order level in April is not a major surprise, although it is happening earlier in the year than typically expected,” according to FTR’s report. “The slowdown in orders is not a direct indication of the level of demand but rather is because build slots are filled for 2023. Reduced order levels will continue through the seasonally weak summer order period.”

ACT’s VP and senior analyst Eric Crawford said, “Given robust Class 8 orders into year end, ensuing backlog support, and normal seasonal order patterns, orders were expected to moderate into Q2; we expected [seasonally adjusted] orders in a range of 15-20k units per month into mid-Q3 2023. Coupling those items with increasingly cautious readings from the ACT Class 8 Dashboard, April orders were weaker than expected on a stand-alone basis but bring the [year-to-date] monthly seasonally adjusted average to 17,500, squarely in line with our view.”

“With build strong over the last several months, backlogs will have come down during April,” Starks concluded. “The incoming order rate for March was 145,000 annualized, which is on par with the weak order levels during the summer of 2022. Despite the weakness, we do not anticipate much, if any, negative impact on production levels over the next few quarters.”

“The recent turmoil in the banking sector likely tightened credit conditions for some industry participants and may have played a factor in exacerbating April’s weakness,” ACT’s Crawford noted. “Thus, while we expect orders to remain at subdued levels into mid-Q3 2023, we are not inclined to think April’s order activity represents the likely run rate going forward.”

ACT reported that net medium-duty truck orders, Classes 5-7, were 18,000 units in April, down 6% from March and 10% year-over-year.