Freight transportation is experiencing a widely recognized slowdown and truck and trailer costs to operate are higher, maintenance and repair is only costing fleets more, and even tires are much more expensive. Yet Class 8 used sales were unexpectedly up for May, even as the equipment is markedly older with higher mileage, challenging some observers of the equipment market to make sense of it all.

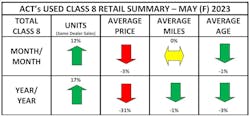

According to the new State of the Industry: U.S. Classes 3-8 Used Trucks report from ACT Research, used Class 8 retail volumes (same dealer sales) rose 12% in May over April, perplexing ACT VP Steve Tam, who in a summary of the report said: “Sales usually slow 4% to 5% in May, so the increase was not only uncharacteristic but also presents a bit of a conundrum in the context of the current economic and freight environments. As owner-operators and smaller fleets in particular exit the industry, inventory continues to increase. This is providing remaining fleets with more options than they have had in a long time.”

See also: Indicators keep pointing to bottoming freight cycle

Tam's ACT, J.D. Power Valuation Services, and the American Transportation Research Institute all have recent data on these new over-the-road equipment trends.

“Auction sales increased 32% month-over-month in May,” Tam noted. “Dealers continued their risk-averse track, selling 19% fewer wholesale units compared to April. Combined, the total market swelled 13% in May [compared to April]. Compared to May 2022, the retail market was 17% larger. The auction and wholesale segments also expanded, 43% and 79%, respectively. Their combined performance drove the total market 31% higher year-over-year.”

He concluded, “Despite the current anemic economic and soft freight conditions, the comparison highlights just how tough conditions were in 2022 with respect to scarce inventory. As the year progresses, the year-to-date scenario also continues to diverge from last year.”

ACT also found that in May, average mileage was flat compared to April, with average price down 3% and age down 1%. Longer term, average age, price, and miles were lower, according to the industry data aggregator.

J.D. Power: Trucks cheaper, older, with higher mileage

J.D. Power Valuation Services’ latest used truck findings for June emailed to FleetOwner, Commercial Vehicle Guidelines, which is based on data from May, sees 3- to 7-year-old tractors at auction from various major manufacturers—Freightliner (Daimler), Kenworth and Peterbilt (Paccar), International (Navistar), and Volvo and Mack (Volvo)—getting cheaper but trending with extremely high mileage.

For example, a model-year 2021 was about $79,800 at auction in May, $22,200 or 21.8% lower than the month before. A model-year 2019 averaged $42,492 at auction, $4,489 or 9.6% lower than April. An MY 2017 tractor in the same age range was $21,844 at auction in May, $3,080 or 12.4% lower than April.

See also: Truckload volumes rebound while spot prices hold

“One side effect of the 2020-2022 new truck shortage is trucks that were obtained accumulated extremely high mileage due to very little downtime,” the new J.D. Power report states. “In addition to the aforementioned average of 170,000 miles per year for 2021s, the 2022s sold in May averaged 180,000 miles per year, and 2020s (technically not part of the shortage, but still affected by it since they were only a year old when it began) averaged a whopping 185,000 miles per year. This dynamic represents a headwind to selling prices going forward.”

The pricing and mileage dynamics hold for trucks sold by retailers, according to the J.D. Power update.

The average sleeper tractor retailed in May 2023 was 72 months old, had 471,232 miles and brought $72,064, the report says. Compared with April, this average sleeper was four months older, had 29,828 (6.8%) more miles and brought $2,503 (3.4%) less money. Compared with May 2022, this average sleeper was one month older, had 26,971 (6.1%) more miles and sold for $47,166 (40.0%) less.

According to J.D. Power, average retail for 2- to 6-year-old trucks in May by model year was:

- 2022: $142,621, or $29,900 (26.5%) higher than April

- 2021: $112,304, $1,863 (1.6%) lower than April

- 2020: $83,334, $1,414 (1.7%) lower than April

- 2019: $68,245, $1,091 (1.6%) lower than April

- 2018: $53,890, $1,161 (2.1%) lower than April

“Don’t read too much into the monthly swings in our average for the 2022 model year,” the report cautions. “Low volume of sales combined with a shifting mix of trucks sold means a multi-month trend is a more reliable indicator of market performance for the newest used trucks.”

It continues: “Otherwise, 3- to 5-year-old trucks brought an average of 1.6% less money than April, and 35.1% less than May 2022. The first five months of 2023 averaged 29.4% less money than the same period of 2022. Monthly depreciation in 2023 is currently averaging 3.8%. Late-model sleepers are still bringing about 20% more money than the last strong pre-pandemic period of 2018 in nominal dollars, or roughly the same money when adjusted for inflation.”

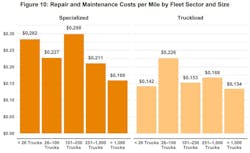

ATRI: Used trucks may be cheaper, but they cost more to operate

The leases or payments on all those trucks, their repair and maintenance, and even their tires accounted for a larger slice in 2022 of the total per-mile cost of operating a truck, according to the new American Transportation Research Institute update on fleet operating costs, which revealed in June that carrier costs rose 21.3% last year over 2021 to a new per-mile high of $2.251. The top cost for fleets in 2022 was fuel, rising almost 54% over the previous year, but in other notable findings from the report, payments on leased or financed trucks and trailers, repairs and maintenance on that equipment, and new tread rose significantly.

Truck and trailer lease or purchase payments accounted for 33.1 cents (up from 27.9 cents in 2021) of that $2.251 per mile in 2022, according to ATRI's research.

Rising global oil prices last year led to higher tire prices. According to ATRI, trucking spent 4.5 cents per mile of the $2.251 on tires, up from 4.1 cents in 2021.