While Wall Street prognosticators found Navistar International Corp.’s latest earnings report “disappointing,” for truck customers there are new products to be excited about (notably the International LT tractor and A26 engine) and, most importantly, the renewed viability of a major truck and engine manufacturer means more OEM competition—and that’s good news indeed.

I’m not a stock analyst, and the finer points of Navistar’s finances don’t interest me much (I'm not a CPA for a reason). But what did get my attention during this week’s conference call with company executives were the repeated references to the immediate success of the LT Series, the Class 8 replacement for the ProStar. Company Chairman and CEO Troy Clarke reported more than 5,000 orders already, with some 2,500 shipped.

“We are back in the door with several large private carriers we haven't sold to in a number of years,” Clarke said. He also noted that the company has doubled its market penetration in the leasing and rental segment, and its share of truck orders is outpacing current market share—“a very encouraging sign.”

“I was at TMC last week and definitely there were people in and out of the truck all the time with very favorable comments. And these are the people who really make buying decisions, maintenance decisions. So we are very excited about that,” Clarke said. “We've got customers talking to us who haven't talked to us for the better part of this decade. ... Our investments in uptime, service quality, et cetera, are beginning to pay off. And one of the things we look at as a leading indicator is order share.”

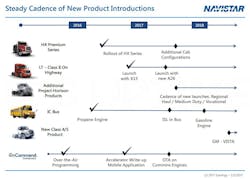

Additionally, the LT combined with the new International A26 12.4 liter engine (introduced last week at TMC, based on the proven MAN powerplant and an early benefit of the alliance with Volkswagen Truck & Bus) will drive even more sales.

“[Customers] want the truck with lighter weight and the performance of the new A26,” Clarke said. “We’ve tested and validated this product, I think as well as we’ve ever done anything; it’s really been a labor of love for the folks who look for an opportunity to show how good we can be at a product like this.”

Indeed, Clarke also noted the company is “over the hump” in terms of warranty expense, largely tied to problems with it’s previous, ill-fated engine line.

“So again the investments in quality are paying off for us and customer service,” he said. “So hopefully we are seeing better days.”

And with a somewhat unexpected turnaround in the Class 8 market, Navistar is well positioned.

“We expect continued gains in the LT with the [new Cummins] X15 over where the ProStar was, and then basically our reentry to the 13-litre segment with the new A26 with deliveries available mid-year, so we couldn't pick a better time with the markets recovering in the second half of the year to have these kind of new products,” Clarke concluded. “I said it once, I will say it again: We are very excited; it is a very exciting time to be at Navistar—why wouldn’t it be, right?”

And Wall Street seems to buying into the company’s recovery, as well. Stifel Transportation Group analyst Michael Baudendistel anticipates an increase in market share, and he upgraded the firm’s recommendation on Navistar stock.

“We believe the new LT series (a significant improvement, in our opinion, from its predecessor, the ProStar) is the most important piece in that recovery,” he wrote in a note to investors. “We also believe the just-released A26 engine may be just as important as the new tractor, as roughly 50% of the market now uses 13L engines. Even if the take rate from customers is low (which we expect it to be, especially initially), any incremental wins to customers it has not been able to sell into for the last several years will be beneficial to its share.”

Time to kick some tires.