With emissions regulations set to increase the costs of tractors, fleets face a complex procurement environment leading up to 2027. Regulations will raise the average cost of model year 2027 units, which may lead to the largest truck prebuy ever.

In a webinar hosted by Fleet Advantage and the North American Council for Freight Efficiency (NACFE), experts from both organizations broke down the prebuy environment and their recommendations for fleets to build the right procurement strategy.

“This is not negative. As an industry, we’ve been through these challenges before, and we’re going to navigate this one,” Brian Antonellis, SVP of fleet operations at Fleet Advantage, said in the webinar. “It’s all about making sure that we plan correctly ... If we have a four-year strategic plan that brings us well through, we’re going to be in great shape.”

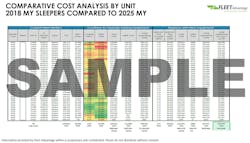

Antonellis stressed the importance of a well-planned and data-driven procurement strategy to minimize costs.

Why prebuy?

Buying equipment before new emissions regulations helps a carrier secure lower truck prices. Fixed truck production, equipment lifecycle management, and fleet operational priorities, meanwhile, limit the amount of equipment that can be prepurchased by a fleet.

Avoid new, costly technology

EPA and CARB emissions regulations, for model year 2027 and beyond, will raise the price of heavy-duty tractors. As a result, fleet profitability is challenged.

Antonellis said that the projected unit cost in 2027 could be $25,000 to $30,000 more costly. Fleets that have many trucks with a lifecycle ending in or after 2027 have an incentive to avoid that cost by purchasing early.

While GHG3 may not be an EV mandate, it pressures OEMs to sell more EVs. Fleets buying early may be in a better position to avoid EV technology growing pains.

“Phase 3 ... really isn’t a mandate of any particular solution, like ZEVs,” Mike Roeth, executive director of NACFE, said in the webinar. “But it’s very hard to comply without selling some battery electric trucks or fuel cell electric trucks in this timeframe because the numbers just don’t add up.”

Electric truck technology is still immature compared to diesel. It underperforms in range, charging availability, and overall freight efficiency. However, heavy-duty EVs are improving rapidly, as Roeth pointed out in a conference in September.

“Given the work that we’ve done and the massive amount of investment, engineering, and work that’s going on in these technologies, we’re in the very early stages of these zero-emission trucks, and they’re going to get better over time,” Roeth said. “But we need to be realistic about what an early adopter looks like versus a longer one.”

Not every carrier wants to be an early adopter. While it is up to OEMs and dealers to sell EVs, the immaturity of electric trucks marks another big incentive to limit equipment purchases after regulations take effect.

“Everybody’s a little bit nervous about going 100% in on the new technology, so you want to have a strategic number of trucks you want to place in ’26,” Antonellis said.

See also: 2027 Prebuy strategies: How fleets can prepare before regs kick in

Carriers can’t prebuy everything

Could a fleet simply avoid the extra costs of model year 2027 trucks by prebuying all their trucks due for replacement that year? Not quite.

“Knowing that we’re capped on the number, and we sell almost as many trucks as we produce every year, you can’t do that,” Antonellis said. “A lot of large fleets are planning to prebuy some of the equipment in ‘26 so that they don’t have that cap cost in ‘27 and the new technology.”

Not only is truck production limited, but OEMs are already making allocation plans. Fleets may need to start placing orders now to meet OEM allocation plans for future years.

“Allocation is just a dealer’s way of saying ‘you’re going to get next year what you bought this year,” Antonellis said. “If we want to find balance between ‘25 and ‘26, and we don’t want allocation to be an impediment to getting the number of trucks before ‘27, then we need to be placing the orders in ‘25.”

Facing limited equipment availability, some carriers might think they should extend their equipment lifecycles to put off the increased unit cost. Lifecycles faced another disruption very recently: The pandemic and its ensuing supply chain disruptions brought truck and trailer shortages, which pushed some fleets to extend their trucks’ lifecycles. However, extending a truck’s lifecycle can impact a fleet’s profits and losses to the tune of millions of dollars.

“If you’re running a fleet that had traditionally run a five- or six-year lifecycle and you shift to a seven-year lifecycle—because you weren’t able to get equipment or you weren’t able to plan far enough out—you can see a dramatic effect to your P&L,” Antonellis said. “For a fleet that has thousands of trucks running millions of miles, it’s going to be millions of dollars every year.”

Few solutions in the trucking industry are simple or obvious. Prebuy strategies need nuance and balance to be effective.

“Sure, you get to avoid a little bit of the cost by moving them up into 2026, but it’s about finding balance between ‘25, ‘26, and ‘27,” Antonellis said. “It’s certainly not about moving 100% out of ‘27.”

Data-driven strategies can strike the balance

The answer for fleets, according to Antonellis, is coming up with a well-thought plan to manage the cost increase and purchase vehicles at the right cadence.

“As you move backward from ‘27, you need to figure out how many trucks you’re comfortable with in ‘27 and how many trucks you want to prebuy in ‘26.”

To build that multiyear plan, the webinar speakers recommended an extensive look at market data, operational data, KPIs, and more.

“It’s about getting your data, getting it actionable, communicating internally in your organization, identifying where you want to be in ‘27 and beyond, and then setting that strategy now,” Antonellis said. “It gives you full ability to navigate where you want to end up.”

Antonellis also emphasized that time is of the essence. While OEMs feel prepared for a pre-2027 order surge, fleets need to start planning before their procurement options run thin.

“The planning has to start now to make sure we get the result we want in ’27,” Antonellis said.

Will a Republican government cancel 2027 regulations?

Republicans are positioned to take full control of both the White House and Congress in 2025. The Trump administration is planning for rapid deregulation of the EPA.

See also: 3 ways a Republican sweep could change the trucking industry

Republican control of the federal government likely means a weaker emissions regulation landscape for several years. However, the webinar speakers emphasized that 2027 standards are likely to remain. A solid procurement strategy is still key.

“I don’t see anything dramatically changing. We might see a little bit of course correction about how we get there, but we’re still heading in that direction,” Antonellis said. “Could there be curveballs that come our way? Could we see tweaks in timing? Absolutely. But when you think about what that looks like, if you have a plan, you can course correct in small increments versus trying to recreate yourself.”