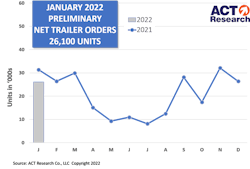

Trailer orders for January held firm at 26,300 units, up 1% month-over-month and down 13% year-over-year, according to FTR Intel. While trailer orders for the past 12 months totaled 242,000 units, ACT Research reported that the first month of the year was also 17% below last January’s activity.

“The commercial trailer industry is remarkably steady right now,” Don Ake, FTR VP of commercial vehicles, said. “Production has basically flatlined for nine months and now January orders are equal to December. The supply chain failures have created one of the most stable environments in the history of the industry. OEMs are not confident about getting more parts and components in the future, so they are not yet booking all the fleet commitments into the backlog.”

The industry is in a tight holding pattern, as supply chain shortages continue to prevent build rates from rising. OEMs have decided to maintain healthy backlogs, but not raise those levels much until there is a much clearer picture of future build rates. Preliminary net orders are expected to be moderately higher than production totals for the month.

“The longer the supply chain stays clogged, the more pent-up demand there is,” Ake said. “Fleets are desperate for all types of trailers. As freight demand grows, the lack of available trailers puts stress on carriers and shippers alike. Once they get more parts and components, OEMs will be pressed well into next year as they try to catch up with demand.”

According to Frank Maly, director of CV transportation analysis and research at ACT Research, the industry backlog stretched through August, on average, at the start of the year. January reports point to a closing backlog that could extend into September, with dry van and reefer commitments likely reaching early into the fourth quarter.

“This production environment means that fleets will continue to struggle to acquire equipment as we move through the year,” Maly concluded. “While we expect OEMs to ramp volume throughout 2022, the pace will be slower than both OEMs and fleets would prefer. Component, material, and staffing headwinds will continue to challenge any meaningful increase in production volume.”