December U.S. trailer orders of 56,949 set a new monthly record, eclipsing the mark set in October 2020, according to FTR Transportation Intelligence. And another trucking industry source, ACT Research, had them at 57,300, the second highest since ACT began recording the data in 1996 and nearly 46% higher compared to November and 115% above December 2021, according to ACT's State of the Industry: U.S. Trailers report.

“At 57,300 net orders, December 2022 was the second highest month since we started keeping track in 1996. From this standpoint, 2022 went out like a lion,” said Jennifer McNealy, ACT’s director of commercial vehicle market research and publications. FTR had trailers orders up year-over-year an "astounding 121%" over December 2021, according to a Jan. 23 release from FTR.

See also: Keeping trailers properly utilized

ACT’s State of the Industry: U.S. Trailers report provides a monthly review of the current U.S. trailer market statistics as well as trailer OEM build plans, and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present.

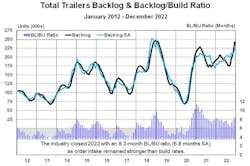

Jonathan Starks, FTR's CEO and chief intelligence officer, commented, “The surge in [trailer] orders is unlikely to be sustained going forward, and we have already seen strong moderation in Class 8 orders. However, we have now seen more than 347,000 orders placed over the last 12 months, and backlogs are at their highest level in nearly two years. 2023 is starting on solid footing even as the macro uncertainty remains extremely elevated.”

ACT's McNealy concluded: “The year closed with 361,500 net orders placed, exceeding the previous year’s 249,400 level. Approximately [306,000] trailers were built in 2022, and our projections point to a continuation of that upward trend into 2023.”