A relative calm in January’s trailer orders comes amid an ongoing production storm, based on market analysis by ACT Research.

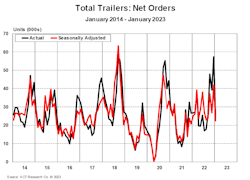

Preliminary net trailer orders dipped in January, with 24,200 units (22,000 on a seasonally adjusted basis) projected to have been booked during the month, according to ACT Research’s State of the Industry: U.S. Trailers report.

“We expected net orders to slow in January after the explosion of orders in 2022’s final quarter. Despite the anticipated sequential decline, preliminary net orders were only 9% lower compared to the same month last year,” said Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research.

See also: Class 8 orders slow to start in 2023

McNealy noted that the month’s data are "simply a return to more normal levels” following the year-end surge.

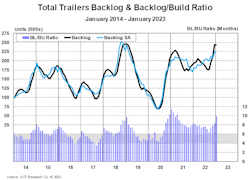

“Nearly as soon as a build slot is available, there is a fleet ready to fill it with an order," she said. "Demand remains strong, and with the backlog-to-build ratio near the 10-month mark, on average, fleets needing trailers continue to stay the course.”

Lower order totals for both dry and refrigerated van types, as well as flatbeds, were offset somewhat by increased placement for lowbeds and tanks, with orders for dumps virtually unchanged, McNealy added.

“We are hearing that some orders are being made to replenish dealer stock rather than going directly to fleet customers,” she said.

Either way one looks at it, the industry is essentially committed into the beginning of the fourth quarter, according to ACT Research.

“With four more build days in January relative to December, build was 4% higher month-over-month. That said, build per day decreased from the previous month’s unit-per-day rate,” McNealy said. “OEM conversations continue to suggest supply-chain constraints, including labor, are likely to remain a limiting factor to production in 2023.”

Outlook explained

In discussing the recent year-end earnings report from publicly traded trailer manufacturer Wabash, President and CEO Brent Yeagy confirmed the analysis.

“Between cyclical and structural influences, we agree with third-party forecasters that equipment demand is likely to remain strong,” he said. “With under-buys in prior years and the supply chain remaining as a constraint into 2023, implied demand for this year is still very likely to outstrip supply just on those specific factors alone.”

Indeed, in detailing the Wabash backlog figure, reported at a record $3.4 billion to end Q4 2022, Yeagy suggested that recent multiyear orders mean the company already has booked roughly $600 million in orders beyond this year.

See also: A look at commercial truck, trailer trends for 2023

Yeagy will speak at ACT Research’s OUTLOOK Seminar 68 on Feb 22 in Columbus, Ind.

In a presentation titled “Understanding the Dynamic Changes within Logistics that Are Altering the Future of the Trailer and Truck Body Markets,” Yeagy will discuss how changing supply chain dynamics, the rise of e-commerce, and a growing desire for sustainable business models are impacting the outlook for transportation equipment.

“We can no longer look at the past to predict the future of the trailer and truck body markets,” Yeagy explained. “We are looking ahead to better understand the demands of the customer and the overall markets we serve. At Wabash, we’re focused on pragmatic solutions with our business partners that get to the heart of the real problem we’re trying to solve. Spoiler alert: the engine is becoming considerably less relevant.”

ACT Research’s seminars are held twice each year for clients and the larger transportation, logistics and distribution industry. Attendees are industry leaders and decision-makers representing C-suite and upper management of OEMs, Tier 1 & 2 suppliers, autonomous and electric new entrants, fleets, dealers and financial institutions. OUTLOOK Seminar 68 will center on the theme of “Driving Decarbonization: The Future of Commercial Vehicles.”