Rush Truck Centers, the nation's largest commercial vehicle dealership chain, is projecting Class 8 truck sales for 2018 of 14,000 units across its network. That would be a rise of about 7% from 2017.

Medium-duty trucks make up a bit less of Rush's total, and the dealer network is expecting sales of some 12,500 units this year. But compared with 2017 numbers, that would be a more than 14% increase—twice the company's bump up in anticipated Class 8 sales.

Total truck sales from light-heavy duty and including used trucks are on track to climb by more than 3,700 across the Rush dealerships, which is a gain of 11.4% overall. And medium duty is driving a large part of those increases, this year accounting for 34% of total sales while Class 8 trucks make up 38%.

In a year of bigger sales numbers all around, MD trucks saw enough activity to move the needle at Rush respectively for the medium-duty and Class 8 segments from about 33% and 39% in 2017.

W.M. "Rusty" Rush, president, CEO, and chairman of Rush Enterprises, attributes the gains in medium duty to things like growing regional distribution and the e-commerce helping drive it. Fleets' and trucking companies' difficulties hiring CDL-holding drivers to operate the biggest trucks could be a factor, too.

"With the changes in last-mile and the different dynamics that are coming into distribution—the way distribution is evolving and changing—it tends to lead to more medium-duty truck sales," he said. "I expect medium duty will remain strong."

Another influence in medium duty he pointed to is new product offerings in the segment like the CV Series and Silverado 4500HD/ 5500HD/ 6500HD conventional cab trucks that'll be built through a Navistar-General Motors partnership.

Further, Rusty Rush predicts that when truck sales drop again in market cycles, medium-duty trucks could be more resilient. "I think when you do see a dip—which is typical historically—you'll see a much larger dip on the Class 8 side than in medium duty," he said.

Given its reach across 22 states; sales in light-, medium-, and heavy-duty trucks; and a large presence not only in long-haul/ over-the-road but other trucking segments like refuse and construction, Rush Truck Centers' sales are a good bellwether of larger industry trends. Rush has Peterbilt and Navistar/ International divisions as well as Ford, Hino, Isuzu, and Mitsubishi Fuso medium-duty sales within those.

But the greater part—now about two-thirds—of Rush's network revenues comes from parts and service. The company services all truck makes and models and has maintenance bays across its facilities dedicated to alt fuels like CNG (although when they're not servicing such trucks, those bays can of course bring in diesels if there's that demand). Rush shops see all manner of trucks come their way, so their technicians get a sampling of what's really out there.

And though electric trucks and cleaner/ alternative fuels to diesel get a lot of media attention, that's just not where the industry is. Like others in the business, Rusty Rush believes diesel will be the mainstay and lion's share of trucking for decades to come, and that's certainly the case in equipment that's getting serviced.

"Electric trucks have the same impediments that natural gas trucks do," noted Michael McRoberts, COO of Rush Enterprises. "For example, with natural gas, you have the weight, cost, efficiency of the engine, and the infrastructure."

"Those are the same problems that you have with electric trucks, only the electric technology isn't fully evolved yet," he added. "They're heavier, they're more expensive, and there's no infrastructure [to support them]. A lot of things have got to happen, and absent a government mandate or grant funds, you won't have electric for the sake of electric.

"It's got to be economically advantageous."

Another problem with electric trucks in the U.S. is how electricity is produced, McRoberts noted. "What's often missed with electric trucks," he said, "is that a lot of that [promoting them] is done under the umbrella of sustainability and clean air."

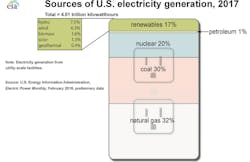

According to the U.S. Energy Information Administration, fossil fuels are the largest sources of energy used to generate electricity here. As of 2017, EIA reported the nation is using mostly natural gas (32%), coal (30%), and nuclear fission (20%) as well as small amounts of biomass (2%) and residual petroleum fuels (<1%) to churn out power across the states.

Only about 17% of electricity in the U.S. is produced by renewable sources like water (7%) and wind (6%) energy used to turn generators. And solar power produced only about 1% of U.S. electricity in 2017.

So you can wow people with electric trucks producing no emissions—but if the juice needed to power big electric vehicles comes from polluting energy sources, you may be better off shooting for cleaner-burning diesels or alternative fuels like CNG in trucks if the end goal is cleaner air.

"There's a lot of information out there people need to get educated on," McRoberts contended. "I think there's a space for electric trucks and they'll have a role in medium duty more than anything else, but for long-term sustainability, they've got to be economically viable" and ultimately sustain themselves rather than requiring subsidies.

Still, regarding government activity, there's been movement on that front that could help support electric truck advancement just in the past week.

On one side of the country, California is looking to require 100% zero-emission buses in public transit by 2040. And on Tuesday, nine Mid-Atlantic and Northeast states and the District of Columbia signed an agreement aiming "to achieve substantial reductions in transportation sector emissions and provide net economic and social benefits for participating states," and electric trucks could be a part of that initiative.

But whether they're diesels or ultimately something else, medium-duty trucks seem to be gaining in transportation, and it's due to several independent trends. Look for MD trucks to continue offering increasing capabilities and potentially account for a larger chunk of fleet assets going forward.