Less than a month after an internal audit concluded a pilot program lacked enough participants to be statistically conclusive, the Dept. of Transportation said Friday that Mexican motor carriers will soon be able to apply for authority to conduct long-haul, cross-border trucking services in the United States.

Fully opening the border to approved carriers is “a significant milestone” in the implementation of the North American Free Trade Agreement, according to the DOT statement. The policy change ends a 20-year political dispute over the NAFTA trucking provision, and is expected to result in the permanent termination of more than $2 billion in annual retaliatory tariffs on U.S. goods.

And the certainty over that economic impact outweighed the statistical uncertainty from the Federal Motor Carrier Safety Administration’s three-year test program to evaluate the safety impact of granting long-haul authority to Mexico-based trucking companies.

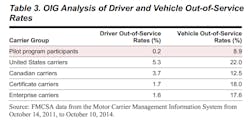

While the recently published audit by the DOT Office of Inspector General did not make any recommendations, it did determine that FMCSA “established sufficient monitoring and enforcement activities” to meet a lengthy list of requirements mandated by Congress. The audit also confirmed FMCSA’s analysis: Pilot program participant carriers, as well as Mexico-domiciled and Mexican-owned carriers with existing authority to operate in the U.S., performed no worse than U.S. and Canadian motor carriers.

However, only 15 carriers participated in the pilot, well short of the 46 Mexican trucking companies FMCSA estimated would be needed to achieve its inspection target. Additionally, 90 percent of the border crossings and 80 percent of the inspections were attributed to only two carriers, according to the OIG report. And the most active carrier in the pilot rarely traveled beyond the border zone.

FMCSA explained the lack of interest in the pilot to be the result of a number of factors: the termination by Congress of the previous demonstration project, the temporary status of the pilot program, increased interest in existing types of operating authorities and lack of established business relationships in the United States.

Still, DOT chose to accentuate the positive in its announcement. Transportation Secretary Anthony Foxx said the data proved that Mexican carriers “demonstrate a level of safety at least as high as their American and Canadian counterparts.”

“Opening the door to a safe cross-border trucking system with Mexico is a major step forward in strengthening our relationship with the nation’s third largest trading partner, and in meeting our obligations under NAFTA,” Foxx said.

Trucking reacts

Reaction from U.S. trucking interests ranged from tepid to ‘outraged.’

American Trucking Assns. (ATA) supports policy that allows foreign motor carriers to operate in the U.S., “provided they comply with all regulatory and financial requirements applicable to U.S. motor carriers,” said ATA president & CEO Bill Graves. “Nothing less is acceptable to ATA.”

Trucks transport more than 65% of the value of all U.S.-Mexico surface trade, Graves noted, and he added that ATA is committed to working with the DOT “to improve cross-border operational efficiencies … while respecting and complying with national operational requirements.”

The Owner-Operator Independent Drivers Assn.(OOIDA) contends the new policy is “all about geo-political economics.”

“FMCSA’s persistence to move this program forward is mind-boggling, especially when the agency tells us ad nauseam that their highest priority is safety,” said Todd Spencer, OOIDA executive vice president. “The FMCSA is clearly doing an end-around and playing with numbers to try and justify opening the border to long-haul trucks from Mexico. It’s clear from the lack of participation that Mexico-based motor carriers are not interested hauling beyond the commercial zone, if it means complying with the same regulations that U.S. truckers do.”The International Brotherhood of Teamsters (IBT), which has challenged with OOIDA previous attempts to open the border to Mexican trucks in court, argues that the OIG audit “made clear” that the pilot program was “a failure.”

“I am outraged. This policy change by the DOT flies in the face of common sense and ignores the statutory and regulatory requirements of a pilot program,” said Teamsters general president Jim Hoffa. “Allowing untested, Mexican trucks to travel our highways is a mistake of the highest order and it’s the driving public that will be put at risk by the DOT’s rash decision.”

Still, the DOT has submitted the FMCSA report to Congress, and published in the Federal Register a notice of the FMCSA plan to accept applications from Mexico-domiciled motor carriers interested in conducting long-haul operations.

The basics

Companies from Mexico that apply for long-haul operating authority will be required to pass a Pre-Authorization Safety Audit to confirm they have adequate safety management programs in place, including systems for monitoring hours of service and to conduct drug testing using an HHS-certified lab. Additionally, all drivers must possess a valid U.S. CDL or a Mexican Licencia Federal de Conductor, and must meet the agency’s English language proficiency requirements.

As with Canadian companies that are granted U.S. operating authority, carriers and drivers from Mexico are required to comply with all laws and regulations, including regular border and random roadside inspections. Once the motor carrier is approved, their vehicles will be required to undergo a 37-point North American Standard Level 1 inspection every 90 days for at least four years.

American trucking companies have been able to apply and operate long-haul in Mexico through NAFTA since 2007. Currently, five U.S. companies use this authority to transport international goods into Mexico, according to DOT.