It’s a good time to be in the private fleet business.

The number, volume and value of the shipments private fleets carry continues to rise and even more growth is expected into the next decade.

But like most trucking companies these days, private fleets are facing driver shortages despite the fact that most private fleet drivers stay with their company longer than for-hire carriers.

These are among the insights gathered from the annual Benchmarking Survey Report compiled by the National Private Truck Council (NPTC), a report based on detailed interviews with private fleet managers across the U.S.

Gary Petty, NPTC’s president and CEO, recently shared some thoughts with Fleet Owner, based on the results of the 2018 survey.

“Anecdotally, private fleets are experiencing an elevated level of awareness,” Petty said. “There’s an awareness of the consequences they would face if they were exposed to market because of the cost of for-hire transportation services because the rates are so high and driver availability is scarce.”

A private fleet might meet most of a company’s transportation requirements or it might be just one part of many transportation modes for a company. The right deployment of each private fleet driver and truck is key to a company’s success—as not all lanes and loads are suited for all companies.

Because of this, Petty said, there is a “greater appreciation for what private fleet means and what leverage it gives the company in negotiating outside carrier contracts to fulfill the part of the work that doesn’t need to be done by the private fleet. And that leverage is a very important factor in being able to fill the lanes that aren’t appropriate for the private fleet.”

For some companies that operate a blended fleet, which relies on both its company drivers and for-hire carriers, having the ability to freelance some of its freight transportation can be valuable.

With the U.S. economy growing at a GDP rate of 4% and unemployment plummeting to below 4%, businesses across the country are expanding production and the freight market is booming at a nearly unprecedented pace.

“Skyrocketing for-hire carrier rates, shrinking capacity, and continuing driver scarcity will worsen through next year and beyond,” Petty said. “Freight volume will rise significantly and shipping costs are likely to grow at double-digit levels.”

Most private fleets expect to add equipment and haul more freight within the next five years while continuing to offer — against the industry trend of increasingly unstable, costly labor environment — a valuable option for corporate freight transportation.

“There has never been a better time to ‘sell’ the private fleet to company owners and senior executives who may not fully appreciate, or underestimate, the significant value which the fleet contributes to the company’s overall success,” according to Petty. “Companies with private fleets benefit from constant reminders to senior executives that outsourcing their private fleet can be a perilous option which, especially in this extreme market, could result in prohibitively expensive transportation costs, a decline in customer service, and the risk of business loss.”

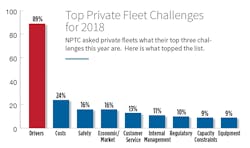

For all transportation companies, drivers are the No. 1 challenge, Petty said. “But private fleets are uniquely stable and dependable long-term compared to the rest of the industry.”

Many fleets are “aggressively trying to hire more employee drivers, full service leased drivers or even independent contractors,” Petty said. “Some are adding capacity through acquisitions of smaller for-hire trucking companies while also shifting backhaul capacity to move more in-house company freight on the private fleet. A major publicly traded retail chain is now in the process of bringing back its private fleet after outsourcing all transportation a few years ago.”

Walmart Inc., which currently has a private fleet of 6,500 trucks has taken to the national airwaves to attract more drivers to fill vacancies and improve the image of a career behind the wheel of a big rig.

Walmart built its company on the back of private fleets in the 1970s when for-hire carriers wouldn’t deliver to the company’s rural stores. Now Walmart truckers earn about $86,000 a year on average. While for years, Walmart drivers had a turnover rate below 10%, that number has been on the rise, according to Tracy Rosser, the company’s senior vice president of transportation.

“It is getting tougher and tougher to find qualified drivers,” Rosser recently told Bloomberg News. “It’s a really serious situation right now.”

Like many for-hire and private fleets, Walmart’s drivers are getting older — the average age is 55 — and the company is losing a number of drivers to retirement.

According to NPTC’s most recent Benchmarking Survey Report, private fleet drivers have a 15.4% annual turnover rate and stay with their companies for nearly 10 years on average. That’s a number that sets private fleets apart, Petty said. The yearly driver turnover at for-hire carries is up to 90%.

One reason for the disparity could be that private fleets pay drivers an average annual salary of $67,869 plus benefits, which is the highest in the trucking industry, according to NPTC. While OTR truckload driver pay is rising — as carriers try to attract more drivers with better offers — it remains lower than what most private fleets offer.

Tomorrow on FleetOwner.com: We'll take a deeper look at why private fleets retain drivers longer than for-hire carriers and the equipment private fleets are using to stay ahead of the game as they focus on the future.

What is a private fleet?

The NPTC defines a “private fleet” as a trucking operation conducted under the auspices of a corporation whose primary business purpose is not trucking, but for which trucking plays a critical role. Retail stores, for example, often operate a private fleet to facilitate efficient delivery of products to their outlets; that trucking business serves as a means of enhancing their primary business, providing goods to their customers as efficiently as possible.

NPTC said the most common reasons for operating a private fleet are the following:

- To gain direct control of transportation capacity, via an on-demand basis;

- To control costs, and;

- To provide consistent and high-quality customer service.

Private fleets typically use some mix of owned or leased equipment operated by company or leased drivers, the group explained, and may also have their own for-hire operating authority so they can provide transportation services to external customers to improve fleet efficiencies.

Although the term ‘private fleet’ is often used in a generic sense to describe dedicated fleets or third-party logistics (3PL) services, those are not private fleets. The term ‘dedicated private fleet’ is a misnomer, NPTC stressed, as the trucking services provided to a shipper by an outside carrier or 3PL are generally known as ‘dedicated fleets.’