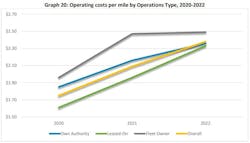

A freshly updated freight rate survey lends even more credence to the pain that small fleets and owner-operators have felt for the past year trying to do business by relying on the volatile spot market and with prices for diesel fuel at all-time highs.

The survey—distributed on Feb. 22 by the Owner-Operator Independent Drivers Association and conducted annually by the OOIDA Foundation, the small-trucking advocate’s research, safety, and education arm—contains some eye-popping testimony about what business life has been like for smaller operators in 2022 going into 2023, as the spot market continues to slump but fuel prices recover.

See also: Freight markets remain in a lull ahead of projected upturn

An owner-operator’s submission to the OOIDA survey illustrates these conditions: “At today’s spot-market rates, I won’t make it another two months. I will not drive at a loss or to break even and do nothing more than add miles to my equipment and expose myself to the inherent risks of driving.”

This O-O goes on to add in the new survey: “I own my equipment, I have no payments, and I am still struggling to survive. Owner-operator[s] with only one unit under their authority are being squeezed out by [larger carriers] that can do it cheaper because they have the cushion needed to operate at or near a loss. They get bulk [fuel] discounts, and they get all the contracts because they can underbid any single-unit operation. [2023] is owned by the megas.”

Several owner-operators with their own Federal Motor Carrier Safety Administration operating authorities also said they’d give them up and lease their trucks to other carriers or sell their equipment and change careers altogether. Others commented that they are considering changing up their equipment, operating more regionally or in different lanes, or trying to network more and establish direct contracts with shippers.

Another OOIDA member added: “I’m in paid-off equipment, but I will still need to cut costs because I expect some of my fixed costs to rise. May explore running different lanes if it looks to be more opportune. Also looking to diversify. Maybe purchase a belly dump to move rock and dirt if flatbed freight falls too far off. If things get too bad, I may just park my equipment and do something different for a bit until things get better. We will see what the future holds.”

Latest spot-market data backs up the OOIDA findings

Independent spot-market reports from three data-mining organizations—two that also run their own load boards—back up what drivers and the OOIDA Foundation found in their survey: It’s tough right now to operate off spot-market rates as most independent operators do, though many others do lease their services to larger carriers to take advantage of their bulk diesel discounts and their contract rates with built-in fuel surcharges.

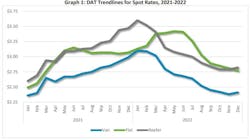

The weekly Spot Market Insights report from load board Truckstop, including analysis and commentary from trucking industry data researcher FTR Transportation Intelligence, sees spot rates in two vital freight segments, dry van and refrigerated, continuing to lag their five-year averages. They've been the weakest, in fact, since June 2020, during the lockdown period of the COVID-19 pandemic, according to the Truckstop/FTR report.

See also: Truck driver pay concerns grow amid freight slowdown

“Dry van and refrigerated in the latest week (Feb. 17) both saw broker-posted rates decline for the sixth week in the past seven weeks, and they have seen notably weaker rates than average over the past two weeks,” according to the Truckstop/FTR report, adding that flatbed load activity declined week-over-week for the first time in 2023, but spot rates were slightly stronger.

And, the insights report predicts, “continued payroll job growth in trucking coupled with the exits of large numbers of small carriers from the market could result in further activity shifting from spot to contract in the near term given a weak outlook for overall truck freight volumes.”

The Truckload Volume Index—put out by DAT Freight & Analytics, which also runs the DAT One load board as well as the DAT iQ data analytics service—hit new highs in January, indicating solid season demand for truckload services, but also showed that spot and contract market pricing remains “soft.”

The spot market dry van rate was $2.38 per mile, down 2 cents compared to December, and the average reefer rate slipped 3 cents to $2.78 per mile. The flatbed spot rate increased by 2 cents to $2.76 per mile. By comparison, the average shipper-to-broker contract van rate was $2.92 a mile, down 4 cents compared to December and 7 cents lower year-over-year. The average contract reefer rate was $3.22 a mile, down 2 cents but 7 cents higher year-over-year, while the average flatbed contract rate was unchanged at $3.53 a mile, DAT reported.

The gap between the average contract and spot rates narrowed in January, also according to DAT. But the contract rate still was 54 cents higher than the spot rate last month, compared to 56 cents in December. The contract reefer rate was 43 cents higher, while the contract flatbed rate was 78 cents higher than spot.

Other notable findings of the 2022 OOIDA Freight Rates Survey

More reporting from the OOIDA Foundation study confirmed pessimistic owner-operators heading for the shelter of larger carriers. It also showed:

- Obtaining loads from a load board and, thus, the spot market is the second-leading way owner-operators are finding freight to haul—the first being through carriers to which they are leasing their services.

- 44% of drivers stated that their carrier was better equipped to negotiate rates in 2021 compared to 2022. “These negative trends in negotiation for both owner-operators and company drivers also manifested [themselves] in the number of loads our members hauled, as those who receive freight through brokers or a third party and those who utilize carriers or shippers indicated that they received the fewer loads in 2022 compared to 2021."

- The number of OOIDA members who indicated that freight rates were dropping in comparison to the previous year increased 250%, from 20% in 2021 to 70% in 2022, coupled with a 67% drop in those who stated rates were improving.

- Members tended to hold more negative views for 2023 because of high fuel prices, increased regulations, inflation, overcapacity, and a slowing economy.

“The freight market typically alternates every few years between an up, or tight, market, and a down, or loose, market as the trucking industry is seldom in a steady equilibrium,” the OOIDA survey concludes. “Members have seen dramatic shifts in freight rates over the past several years. In 2018, the spot market reached a then-record high in June but began to slowly contract through the latter part of that year and into 2019. Following a disappointing 2019, which experienced weak manufacturing activity, freight rates once again roared back to record heights during the second half of 2020, through all of 2021, and the first half of 2022, before falling back down to earth."