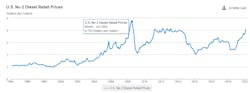

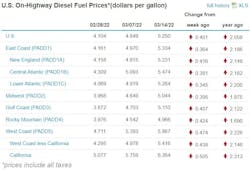

The average price of diesel continued its climb across the U.S., according to government figures released on March 14 that put the nationwide average at $5.25 per gallon, the highest cost on record.

Over the past week, the price of on-highway diesel jumped 40.1 cents, which means trucking's main fuel has risen more than $1 per gallon in the past two weeks. The trucking industry might see prices stay higher as market volatility tracks with unease over the Russian invasion of Ukraine and a squeeze in diesel supplies that started late last year before the invasion.

In the last two weeks, the per-gallon U.S. average price of diesel has risen almost $1.15, following this week’s 40.1-cent increase reported by the U.S. Energy Information Administration (EIA) plus the historic spike of 74.5 cents on March 7 that set a never-before-seen high for diesel.

See also: Diesel price surge sets U.S. record

By comparison, the week before on Feb. 28, diesel rose 5 cents nationwide, averaging $4.104 per gallon in the U.S., when the effects of the Ukraine invasion seemed to be starting to impact the marketplace.

U.S. coasts pounded by fuel-price spikes

On March 14, the West Coast also led the nation in diesel prices. They rose another 47.4 cents out west to $5.867 per gallon. In California alone, diesel rose 50.5 cents to $6.264 per gallon.

The next priciest region of the U.S. for diesel was the East Coast, where trucking’s main fuel rose 36.4 cents to $5.334 per gallon. Diesel was priciest in the Mid-Atlantic, where it rose 38.1 cents to $5.474, followed by the Lower Atlantic, where the fuel was up 34.5 cents to $5.264 per gallon. Along the East Coast, New England had the largest spike, 41.6 cents, but the lowest per-gallon price of $5.231.

Elsewhere, diesel along the Gulf Coast rose 40.7 cents to $5.11 per gallon, followed by the Midwest—up 39.5 cents to $5.044—and the Rocky Mountain region, where diesel rose 42.4 cents on March 14 to $4.966 per gallon, according to the latest data from EIA.

Prices for two vital oil variants, WTI and Brent, showed signs of easing back on March 14 to below $100 per barrel. They were hovering around $130 during the prior week, though the price of crude was much lower in the weeks and months before the threat to Ukraine and the sanctions against Russia and its oil imports were put in place. And in 2021, the average price of crude was about $70, even as oil companies sought to cut production. Last May, Brent crude dropped as low as $63 per barrel, according to EIA.

“Growth concerns from the Ukraine-Russia stagflation wave, and FOMC hike this week, and hopes that progress will be made in Ukraine-Russia negotiations” are weighing on prices, Jeffrey Halley, senior market analyst at Oanda, told CNBC. “It seems like the old adage that the best cure for high prices, is high prices, is as strong as ever,” he added, noting that he believes the top is in for oil prices.

Diesel spike will harm conditions for trucking, index predicts

Meanwhile, FTR’s Trucking Conditions Index (TCI) fell to 11.46 from 14.45 between December 2021 and January amid rising diesel prices, the transportation intelligence firm reported on March 14.

While higher freight rates were able to limit diesel’s effect on trucking operations to start the year, the problem has grown worse since Russia invaded Ukraine and could affect smaller fleets more, FTR’s analysts warned.

See also: Fuel prices rise as early sign of Ukraine war's impact on U.S. trucking

Although the more robust freight rates at the start of 2022 more than offset the effects of higher fuel costs, freight volume was a significantly weaker factor than it had been in December, according to the TCI, which was published in FTR’s March Trucking Update.

Since the year began, fuel costs have surged in the wake of Russia’s war in Ukraine. Those rising costs—diesel’s price per gallon set a U.S. record in March—will hurt trucking conditions in the near term, according to FTR analysis. But the longer-term effects of geopolitical tensions in Eastern Europe are not yet clear, according to Avery Vise, FTR's VP of trucking.

For now, the latest TCI outlook remains positive, but the downside risks have increased greatly.

“The war in Ukraine has introduced a high level of uncertainty into the dynamics of truck freight,” Vise said. “Sharply higher fuel costs for carriers are a given, but we do not yet know whether sharply higher gasoline prices on top of strong pre-existing consumer inflation and big swings in the stock market will lead to a drop in consumer spending.”