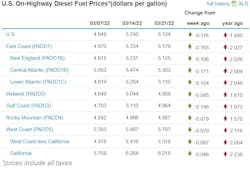

Diesel prices began a slow reversal from historic highs for the week of March 21, when the U.S. Energy Information Administration (EIA) reported the nationwide average for a gallon of trucking’s main fuel had dropped 11.6 cents to $5.134.

The U.S. diesel average had risen 40.1 cents the week prior, March 14, which followed a spike of 74.5 cents that brought the per-gallon nationwide price to a never-before-seen level.

See also: U.S. diesel prices continue to climb coast-to-coast

Nationwide, consumers still are feeling the pain at the pump as the price of gasoline dropped but only slightly. Gas was down 7.6 cents nationwide to $4.239 per gallon after an increase last week of 21.3 cents to $4.315.

West Coast diesel remains nation's highest

Diesel did drop for the week of March 21 out west—but only slightly—$7 cents to $5.797 per gallon and remains historically expensive in California, which saw a small decline of 4.6 cents from the week prior but still sits at $6.218 per gallon. The Golden State by far has the most expensive diesel of any region in the country. By comparison, the next highest region is the East Coast, where diesel eased 15.5 cents the week of March 21 to $5.179 per gallon, according to the EIA.

Along the East Coast, diesel is highest in the Central Atlantic, where prices declined 17.1 cents to $5.303 per gallon. In New England, prices also were down 10.6 cents to $5.125 per gallon. In the Lower Atlantic, diesel also dropped 15.4 cents to $5.110 per gallon, according to EIA.

Diesel was below $5 per gallon in the Gulf Coast (down 14.6 cents to $4.964), in the Midwest (down 8.5 cents to $4.959), and in the Rocky Mountain region (7.9 cents lower to $4.887).

Oil well above $100 a barrel again

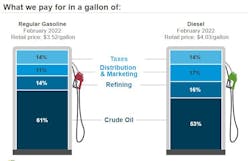

Meanwhile, volatility in the oil markets continues and may portend more price spikes in diesel and gasoline. Prices for two vital oil variants, WTI and Brent, showed signs of easing back last week, but were well above the $100-per-barrel mark again on March 22. WTI was at almost $112 per barrel and Brent was even higher, above $115 a barrel. And oil companies are raking in huge profits as a result of the fluctuations in crude.

The markets likely were responding at the start of this week to news that the European Union was considering a ban on oil from Russia in response to the Putin regime’s almost monthlong invasion of neighboring Ukraine. Europe is a far larger market for Russian petroleum than the United States, where oil imports from Russia are already banned. Oil also is higher because peace talks between Russia and Ukraine appear to be yielding no signs of progress.

High fuel prices gum up the supply chain more

In terms of how the fuel-price spike is affecting the trucking industry the most, they are only exacerbating the current problems with the supply chain, said Priyesh Ranjan, CEO of Vorto, which is an autonomous supply chain platform that tries to solve inefficiencies by using aggregated data.

“Since matching loads with truck drivers is a very complex problem, the trucking industry has always been plagued by tons of empty miles and idle time. The rapid increase in fuel price is exacerbating this inefficiency, costing the trucking fleet a lot of their earnings," Ranjan said in an email. "Smaller fleets are the most at risk, as 96% of fleets in the U.S. are 20 trucks or less and don’t have access to bulk discounted fuel.”