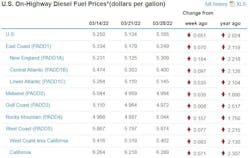

One week after diesel prices dropped for the first time in March, trucking's main fuel is on the rise again. Government data showed a slight increase in the U.S. average to $5.185 per gallon, up 5.1 cents from the previous week.

Data from the U.S. Energy Information Administration had begun a slow reversal the week of March 21, when EIA reported the nationwide average for a gallon of diesel easing 11.6 cents to $5.134. But EIA’s just released week of March 28 data shows an uptick in every region, with New England (up 18.4 cents to $5.309 per gallon) and the Rocky Mountains (up 15.7 cents to $5.044) pacing the country.

See also: Rising fuel prices keep TL rates elevated

Consumers, meanwhile, are seeing prices for gasoline level off after major surges this month—the March 28 nationwide average for a gallon of gas was down less than a penny to $4.231 from $4.239 the week before. But with WTI and Brent crude oil prices staying above $100 per barrel, that trend may also reverse course when new numbers for gasoline and diesel are reported by EIA on April 4.

Elsewhere, diesel in New England wasn’t even the most expensive on the East Coast. The Central Atlantic, where the distillate for trucking was up 9.7 cents to $5.40, set that mark. The Lower Atlantic average was up as well (to $5.145, a 3.5-cent increase). The Midwest also saw a 3.5-cent increase to $4.994, and diesel prices along the Gulf Coast rose less than a penny to $4.972 per gallon.

Demand a market driver as well as Russian invasion

The Russian invasion of neighboring Ukraine last month shocked the oil and distillate markets—diesel rose 74.5 cents in one week and has since stayed above that week's record high of $4.849—but the invasion and Russia’s bloody ongoing attempts to seize Ukraine aren’t the only drivers of the market. U.S. demand, as reported by FleetOwner’s sister publication Oil & Gas Journal, also is surging.

In fact, U.S. oil demand in February, as measured by domestic petroleum deliveries, was the strongest it has ever been as the economy surges past the COVID-19 pandemic.

Also placing pressure on the markets is total crude inventory, which excluding the Strategic Petroleum Reserve was down 2.5 million bbl on March 18, according to EIA and also as reported by O&GJ.

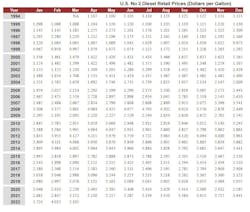

So demand is surging while supply is sagging—not a good mix for consumers or anyone in the trucking industry hoping that fuel might drop in price. As it is, the U.S. average price for a gallon of diesel as March ends is at its highest level since 1994, according to EIA, so trucking might be in for sustained record fuel costs.