Price pressure on commercial fleets large and small continued this week as the nationwide average for diesel fuel rose again 5.9 cents to $5.16 per gallon, according to the U.S. Energy Information Administration.

Diesel has eased a bit in recent weeks since Russia’s invasion of Ukraine, but never has fallen below $5 per gallon. Meanwhile, the nationwide average for the week of April 25 sits closer to the highest mark the fuel has ever reached, $5.25 per gallon, which EIA reported the week of March 14.

Nationwide, trucking’s main fuel is now more than $2 above—$2.036—its price of a year ago.

See also: Diesel prices turn back north

The fuel trended up in every single region of the country on April 25 and threatens to reach the $5-per-gallon mark in even the least expensive part of the U.S. for the distillate, which has been the Gulf Coast. Diesel rose in that region 6.1 cents to $4.916 per gallon. The fuel now sits below $5 in only one other region, the Midwest, where it was still up 6.6 cents the week of April 25 to $4.987.

Consumers, who saw prices for gasoline ease for five consecutive weeks, weren’t so lucky the week of April 25, according to EIA. The nationwide average price for a gallon of gas rose 4.1 cents to $4.107. And that distillate was up everywhere but the West Coast, where it was down 1.2 cents per gallon but still the highest in the nation. The rest of the country saw gas price increases, from a high of 5.9 cents on the Gulf Coast to a low of 4 cents in the Rocky Mountain region.

Oil prices ease slightly while demand stays high

Meanwhile, new data from the American Petroleum Institute, as reported by FleetOwner’s sister publication Oil & Gas Journal, shows that demand as measured by total March 2022 domestic petroleum deliveries dropped 5.9% since February—but demand for oil is still highest since before the pandemic, March 2018. Deliveries were 20.4 million barrels per day in March.

See also: Risks of Ukraine invasion to U.S. trucking, transportation

Also, crude inventories, excluding the Strategic Petroleum Reserve, decreased by 8 million barrels from the previous week, according to the EIA.

Besides demand, the price of WTI and Brent crude also remained at or near $100 per barrel, as much as $30 more per barrel than they were a year ago.

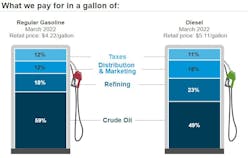

So nationwide prices for all distillates are still caught between brisk demand for fuel in a surging economy and supply chain and high oil prices.