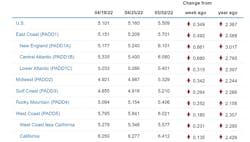

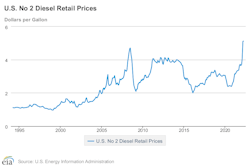

The U.S. average per-gallon price of diesel fuel set an all-time high this week, according to the U.S. Energy Information Administration. Trucking’s main fuel rose 34.9 cents to $5.509—easily shattering the previous high of $5.25 per gallon reported by EIA on March 14, shortly after Russia’s invasion of Ukraine.

Diesel is now $2.367 more expensive per gallon than it was just a year ago, according to EIA data.

The week of May 2 price spike represents the third straight weekly increase and comes in way above the surge of just 5.9 cents to $5.16 per gallon reported by the federal government agency last week.

See also: Diesel surges for second straight week

Regionally, diesel skyrocketed almost 50 cents—49.2 cents—on the East Coast to $5.701, with the distillate rising more than 86 cents to $6.101 per gallon in New England alone. Another subregion of the East Coast, the Central Atlantic, nearly matched New England above the $6 mark with a spike of 68 cents to $6.080. Diesel in the East Coast’s other subregion, the Lower Atlantic, rose 31.5 cents to $5.401.

No region was spared sharp price increases, however, but they were less pronounced. The next closest severe spike occurred in the Midwest, where trucking’s main fuel rose 34.2 cents to $5.329. Along the Gulf Coast, a gallon of diesel cost $5.210 on May 2, an increase of 29.4 cents. The Rocky Mountain price was higher than the Midwest at $5.406, but the increase there—25.2 cents—wasn’t as sharp.

Along the West Coast, including the priciest subregion of California, the increase was 18 cents to $6.021 per gallon. Diesel in the Golden State—traditionally the nation’s highest—is now $6.412. Diesel there rose a relatively modest 13.5 per gallon over the April 25 level, according to EIA data.

The May 2 fuel news wasn’t any better for consumers. The U.S. average price for gasoline also rose—7.5 cents to $4.182 per gallon. That average had trended down for five consecutive weeks, but the May 2 increase marks the second week in a row where gas was up. The U.S. gas average rose 4.1 cents last week to $4.107 per gallon.

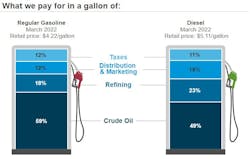

A confluence of issues likely is contributing to the record increases in distillate prices.

Oil now is well above $100 per barrel. It has recently flirted with falling below that level, but on May 2 both West Texas Intermediate and Brent crude were at $105.1 and $107.5, respectively. Petroleum demand was at the highest for the month of March since 2018, though deliveries were down from February, according to Oil & Gas Journal, a sister publication of FleetOwner.

In trucking, truckload volumes reached historic highs in March, as post-pandemic demand keeps a softening freight market moving. And the economy—especially ecommerce—continues to soar, so demand for fuel is squeezing the market and stressing an already overtaxed supply chain. Other economic indicators are mixed.

Democrats in Washington, D.C., accused oil companies of “hoarding the windfall”—keeping prices artificially high at the pump and exploiting the price explosion in a profiteering move. President Joe Biden's administration will propose legislation that would allow federal and state agencies to “go after” wholesale and retail pricing practices, according to a report last week.

'I’m hoping to survive'

Owner-operator Michael Whitaker predicted in March that high fuel costs would contribute significantly to driving many independent carriers such as himself out of business.

After weeks of steady and record diesel price increases, Whitaker, who runs Iowa-based Angel and Hannah Trucking, said in an interview from the road with FleetOwner that he feels as strongly or more about that assessment now—these days, it’s costing him about $1,040 each time he fills his tank, a significant increase from the $700 or so he was paying for fill-ups around the start of this year.

See also: Carriers optimistic about demand, survey finds

“In the end, you’re going to have more losers than winners. This is not the time to get your own [operating] authority,” said Whitaker, a heavy-hauler who delivers farming and construction machinery for companies including Caterpillar and John Deere along routes all over the U.S. He also works ports such as Baltimore, Tacoma in Washington, and Savannah in Georgia.

Freight rates aren’t keeping up with surging fuel costs and used trucks cost way too much—pre-owned prices jumped 8% month-over-month in March, according to ACT Research—all current conditions too difficult for independent operators to be getting into the business right now, he added.

“I’m hoping to survive,” said Whitaker, who also added that he believes freight brokers should be regulated and what they make more transparent. “With the highway law passing, I believe I’ll be able to survive, but the rates have to get higher. All rates should be based on the economy.”