Diesel followed a slight 1-penny decline last week with a 4.2-cent drop this week in the U.S. national average, which was down to $5.571 per gallon for the week of May 23, according to newly released government data.

However, the fuel remains historically expensive in the U.S.—and a new index by FTR Transportation Intelligence, also released May 23, showed the impact that months of elevated prices for trucking's main fuel are having on shipping conditions.

See also: U.S. diesel flattens, breaking two-week trend of record prices

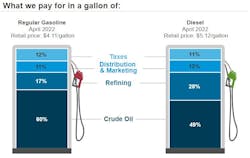

According to the U.S. Energy Information Administration (EIA), prices have jumped $2 to around $5.60 a gallon just since January, and the U.S. average is $2.318 higher than it was a year ago after a depressed period during the COVID-19 pandemic when demand was much lower and diesel followed along.

Diesel was down the week of May 23 in three of the five regions that EIA tracks with its weekly data. On the East Coast, which has seen precipitous increases the last few weeks, the fuel was down 3.9 cents to $5.905 per gallon. In the Midwest, the distillate was down 5.3 cents to $5.293. Diesel also was down along the Gulf Coast—7.9 cents to $5.216—in the third region. In the other two EIA regions of the U.S., diesel was up 3 cents to $5.498 in the Rocky Mountain region and rose less than a penny on the West Coast to $6.081.

Gas up everywhere ahead of Memorial Day

The upward trajectory of the U.S. average for gasoline meant there was no good news May 23 for consumers about to head out on Memorial Day weekend travel, which also is traditionally the start of the busier summer travel season when gas always moves higher. The fuel nationwide was up 10.2 cents to $4.593 per gallon, or $1.573 higher than a year ago, according to EIA. Unlike diesel, gasoline was up in every one of EIA’s regions. The East Coast, Midwest, and Gulf Coast all had increases of about 10 cents while the West Coast saw almost a 13-cent climb over last week.

AAA’s daily U.S. average price for gas has been trending up all week and now sits at $4.596 per gallon—11.3 cents higher than a week ago, up 47.6 cents over a month ago, and $1.55 higher than a year ago.

This week, President Biden is considering tapping a rarely used emergency diesel reserve to address what is emerging as a major diesel supply crunch and to help alleviate high prices. This is among number steps Biden's administration has taken—including the largest ever use of the Strategic Petroleum Reserve earlier this spring—to try to bring down the cost of diesel fuel and gasoline.

Shippers index collapses amid high diesel costs

Shipping conditions continue to deteriorate, largely because of the record diesel price increases, combined with tighter capacity utilization, according to research firm FTR.

FTR’s Shippers Conditions Index fell to a record low of minus 23.1 for March, the most negative reading ever for the index, according to a May 23 release from the researchers. This followed what had been a record low in February of minus 17.9. The near-term outlook is highly negative even before factoring in a new surge in diesel prices that occurred in early May, according to an FTR release.

See also: Survey points to exodus of small operators—and fuel costs as the culprit

“Fuel costs, labor costs, and ongoing congestion across the supply chain are going to keep the pressure high on shippers as we move into the summer months,” said Todd Tranausky, vice president of rail and intermodal for FTR.

FTR’s Shippers Conditions Index tracks the changes representing four major conditions in the U.S. full-load freight market: freight demand, freight rates, fleet capacity, and fuel prices. The individual metrics are combined into a single index that tracks market conditions that influence freight transportation, according to FTR's release. Positive scores represent good conditions while negative ones point to pessimistic conditions. The index, FTR said, reflects the industry’s health at a glance.