After a 4.6-cent uptick in the U.S. average for diesel last week, the question coming into this week for a trucking industry weary of fuel prices that soared in 2022 and took many months to come back down: What would trucking’s main fuel do Jan. 9?

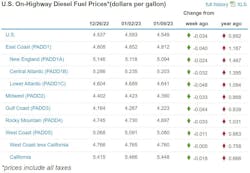

The average price of diesel declined 3.4 cents to $4.549 for the week, according to the U.S. Energy Information Administration (EIA). Motor club AAA had its U.S. average also down slightly, 4.1 cents, over the prior week and had it slowly declining daily since just after New Year’s Day. AAA reports its U.S. diesel and gasoline-by-grade averages daily as well as weekly, monthly, and for all 50 states. EIA aggregates diesel and gas weekly and breaks the prices down by averages in 10 regions and subregions of the country.

See also: Cooling demand, recession concerns kick off 2023, though trucking can expect gains

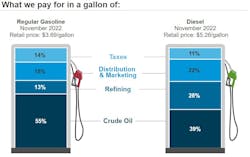

While diesel was down nationwide the week of Jan. 9 and in every region and subregion, gasoline rose in most places, according to EIA. The nationwide average for gasoline was up 3.6 cents to $3.259 per gallon, EIA's new data shows. In a curious statistical twist, however, gas also is down exactly 3.6 cents from its year-ago level. Diesel remains 89.2 cents pricier per gallon (and $1.29 more than gasoline) than it was a year ago, so week-to-week drops need to be kept in perspective.

Each region and subregion trended down for the week of Jan. 9, according to EIA. The decline on the East Coast was 4 cents to $4.812 per gallon, with important-for-trucking subregions New England (down by 2.4 cents), the Lower Atlantic (a 4.8-cent decline), and the Central Atlantic (down by 3.2 cents) all lower in price.

In the Midwest, trucking’s main fuel was down 3.3 cents to $4.390, with Gulf Coast diesel dropping 4.4 cents to $4.223, and the fuel in the Rocky Mountain region down 3.3 cents to $4.697. The historically most expensive West Coast remains the only region above $5 per gallon for diesel, but the price even dropped there a tick, 1.1 cents, for the week to $5.08 per gallon. In the main subregion out west, California itself, diesel declined 1.8 cents to $5.448.

Recession, oil prices all in on reducing fuel prices

EIA had predicted that diesel in 2023 would drop to about $4.48 per gallon nationwide, so the average is headed in that direction. But why else might trucking's main fuel cool from highs that had the average as lofty as $5.81 per gallon in mid-June 2022? A recession for one: Several sectors in trucking, including aggregators ACT Research and FTR Transportation Intelligence that track new-truck orders and production and the used-truck market, still expect a mild one this year. Recessions usually suppress demand, so prices go down on commodities such as fuel. Though demand for gas actually now is on the rise, according to one analysis.

So there are more indicators fulfilling EIA's vision that diesel will stay closer to $4.50 in 2023 than $5 per gallon or above. Trucking fleets large and small could use that stability—even though diesel looks like it might settle well above the pandemic lows of 2020 and 2021, which were $2.50 to $3.50 per gallon.