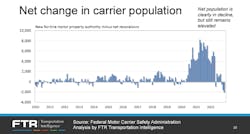

As freight truck utilization continues to fall from pandemic-era capacity, more small carriers are giving up for-hire authority as equipment and other carrier costs remain higher at the start of 2023. This could be a slow, messy year for freight.

The trucking industry lost more carriers in December than any month since Hurricane Katrina disrupted much of the over-the-road freight industry, according to data from FTR Transportation Intelligence. This followed months upon months of more new motor carriers trying to get in on the raging freight market.

The booming freight market born out of the pandemic that began nearly three years ago created a market for new for-hire carriers within a thriving spot market. During most of 2020 and 2021, hundreds to thousands of companies established for-hire authority each month. While there were fits and starts through much of 2022, Vise said the industry started losing “a pretty substantial number” of carriers in October.

“Preliminary data for December would indicate that we have lost more carriers in December than we lost in any month on record—with the exception of December ’05, which was in the wake of Hurricane Katrina and all the disruptions that led to,” Vise said. “This is likely to continue for a period of time.”

Smaller carriers turn to driving jobs

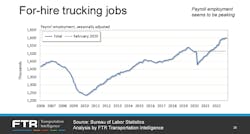

Most of these new and departing carriers are independent, one-truck operations, Vise noted. While smaller carriers are leaving the industry, for-hire payroll employment is leveling out its steady climb since it was knocked down by COVID-19 in March 2020.

“We lost a lot of carriers in the springtime, but when you see the amount of growth we’ve had in the second quarter in payroll employment, clearly what happened here is that a lot of those workers—mostly drivers—were absorbed into larger carriers,” Vise explained. “And we really just saw a shift of activity and capacity from the spot market into the contract market.”

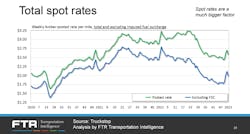

Dean Croke, DAT Freight & Analytics principal analyst, told FleetOwner last week that the spot and contract markets are both declining with the excess capacity in the market to start 2023.

“Even though demand is relatively flat, we’ve got more trucks than loads, and that’s why rates will continue to go down through the first quarter,” Croke said. “This quiet season will be quieter than normal because of the economic conditions we are working with and mostly because there is an excess of capacity in the market against the backdrop of cooling demand. And that just puts more downward pressure on rates. That’s why you’re seeing spot rates continue to decline longer term.”

See also: Spot market returning to ‘seasonal’ and ‘normal’ after 2021 surge, 2022 slump

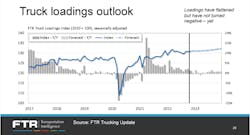

“We have, at this point, essentially flattened out our current forecast, which likely will be revised downward at the end of this month,” Vise said of FTR prognostications. “We're essentially just running flat—just a little bit above flat for this year in the total number of truck loadings. And we’ll likely be looking at a small negative number when we update our information.”

Vise predicted that as smaller carriers fail, there will be less capacity for those drivers to find work with larger carriers.

Freight factors to watch in 2023

Vise said that FTR sees fuel prices and spot rates as two leading factors that could dictate the 2023 freight market.

The smaller carriers remaining in 2023 are still grappling with diesel prices, which nationally remain about 90 cents more per gallon than last year.

“Diesel prices are probably one of the two biggest issues that most of these carriers deal with,” Vise noted. “We're talking primarily one- to two-truck operations that operate primarily the spot market and live on rates. Of course, that rate minus the cost of diesel—as well as all their other operating costs, such as truck payments, maintenance, insurance, and so on—are a key factor.”See also: 'Recession' shouldn't be a scary word in 2023

Based on the current crude oil prices, FTR analysis suggests that diesel prices are 40 to 50 cents higher “than we normally would see,” Vise added. “So there is still some potential there, arguably, for diesel prices to come down further.”

Spot rates steadily declined in the first half of 2022 before somewhat leveling off in the fall. “We did have a big jump at the end of last year,” Vise added. “But that is something we always see as we lose a lot of spot capacity during the holidays. So that big jump tends not to stay—it certainly didn’t last year. So in all likelihood, we will see a sort of flattening out here.”

Available truck utilization in 2023

Available truck utilization stayed high through 2021 and into 2022 before sharp declines that put it below the 10-year average of 91% by year’s end, according to FTR’s Active Truck Utilization Index.

The index estimates how many trucks are needed to haul all the available freight and divides that by the number of active trucks available to move that freight. Vise called it a freight “tightness barometer.”

“It looks to ease continually for the next several months, likely bottoming out around the late third quarter this year,” Vise said. “This is going to be interesting because if we do continue to see deterioration in freight, we very well could lose a lot more drivers. That would weaken the near-term utilization quite significantly. But the other side of that is that it would probably put us behind the curve as we come out with a recovery.”

But if the economy is worse in 2023 than FTR anticipates, it would create a more significant upside for freight heading into 2024.