The spot market for carriers continues to rebalance, but rates—at least for smaller fleets and owner-operators—still aren’t making up for higher current operating costs, according to four data-analysis firms that all recently weighed in on the volatile state of freight transportation.

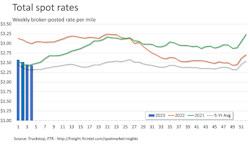

In their end-of-January survey of the spot market, Spot Market Insights, two of the firms, FTR Transportation Intelligence and Truckstop, which also runs its own heavily trafficked load marketplace, saw rates in that marketplace behaving seasonally but declining across the board.

“While rates are still tracking with the five-year average, spot-load activity this year has been weakening relative to average levels,” said the Truckstop/FTR outlook. “In the latest week, volume was nearly 21% below the five-year average. That comparison has deteriorated each week during 2023 and is the lowest since the lockdown period of the pandemic except for Thanksgiving week last year.”

Broker-posted rates in dry van and refrigerated are lower now than they were before the final two weeks of 2022, but they are still tracking very close to the five-year average, according to the Truckstop/FTR outlook.

See also: Spot market returning to ‘seasonal’ and ‘normal’

Dry van rates declined more than 34 cents in the first four weeks of 2023 after jumping about 24 cents in the final two weeks of 2022, the Truckstop/FTR report stated. Refrigerated rates have dropped nearly 75 cents after surging more than 67 cents. Flatbed rates were only about 4 cents lower than they were before the holidays.

The strength of spot rates will become clearer over the next several weeks as they typically begin to firm up in February, the two companies predicted. Flatbed saw neither the big rate surge in late December nor the sustained cooldown this year that the van segments experienced.

Higher costs = more expensive fuel

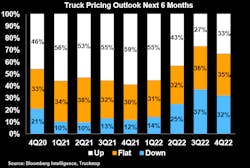

“Spot rates are not in line with the higher costs facing carriers, which is weighing on owner-operators’ profits,” Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence, said in Bloomberg’s Intelligence Survey, which also is a collaboration with Truckstop. “We expect the market to continue to rebalance with rates improving as early as 2Q.”

Translated, “higher costs” mostly means escalated prices for fuel, Dean Croke, principal analyst at another industry data miner, DAT Freight & Analytics, noted in a Feb. 7 interview with FleetOwner. Croke stressed that fleet operating costs are up 9 cents a mile over their last 100,000 miles of operation—and 90% of those costs are diesel fuel, which is 58.8 cents per gallon more expensive than it was a year ago at this time. Diesel has come a long way, though, as it was $1.50 or more per gallon higher at times last year over the year-ago level.

“Operating costs, if you include fuel, are 72 cents per mile, and the biggest change over the last 12 months has been diesel prices,” Croke added.

According to the Bloomberg Intelligence survey, which polled owner-operators and small fleets, carriers are cautious about the outlook for demand and rates over the next six months as the spot market rebalances from a surge in capacity. Owner-operators remain split about where demand is heading. About 30% of the respondents to the Bloomberg/Truckstop survey expect load growth to decline over the next six months.

Rate expectations, also according to the survey, are “split between bulls and bears: Sentiment is split among owner-operators about where rates are headed. About 33% of respondents expect the rates to rise in the next six months, while 32% expect them to fall. Sentiment is slightly better than in 3Q.”

According to the Bloomberg/Truckstop survey, spot truckload demand hit the skids in the fourth quarter of 2022: 76% of respondents noticed a drop in demand, a drop from 3Q, with about 65% saying volume growth was down from a year earlier.

Truckstop CEO Kendra Tucker said, “Owner-operators polled for this survey remain cautious, but spot rates are expected to show improvement as early as 2Q.”

Spot, contract rates show end-of-2022 narrowing

Spot rates did end 2022 in December on an upswing, according to DAT, which also runs a freight marketplace, DAT One. And DAT saw spot rates narrowing the gap with contract rates tied to longer-term contracts. December also produced the first month-over-month positive change in spot truckload van and refrigerated spot rates since January 2022, as severe weather and a late surge of holiday goods helped generate demand for capacity.

If you haul freight, however, it’s still more lucrative to haul on a contract, as some smaller operators do by leasing their services to larger carriers or when they sacrifice their own operating authorities to drive for other companies.

The gap between spot and contract rates narrowed during December to 55 cents per mile for vans, 42 cents for reefers, and 76 cents for flatbeds.

Comparing DAT’s spot rates versus contract rates as of the end of December, the U.S average spot van and reefer freight rates did rise 3 cents in December to $2.41 per mile and $2.82 per mile, respectively, according to DAT, while the average shipper-to-broker contract van rate slipped 8 cents but was $2.96 a mile and the average contract reefer rate was $3.24 per mile. The spot flatbed rate was $2.77 per mile in December, while the average contract flatbed rate did fall 13 cents but was $3.53, according to DAT.

The national average linehaul rate for van freight (with fuel surcharges excluded) jumped 12 cents to $1.83 a mile, the highest since September, according to DAT. The reefer linehaul rate increased 13 cents to $2.19 a mile, and the linehaul flatbed rate averaged $2.08 a mile. Line-haul rates remained well below December 2021, when they averaged $2.60 a mile for van freight, $3.04 a mile for reefers, and $2.60 a mile for flatbeds.

DAT’s load-to-truck ratios reflected stronger demand for truckload services. The national average van load-to-truck ratio rose from 2.7 to 3.4, meaning there were 3.4 loads for every van posted to the DAT One network in December. The reefer ratio averaged 5.7, up from 4.9 in November, and the flatbed ratio was 9.8, up from 9.3 the prior month.

'Signs of bottoming' in the freight market

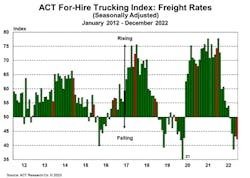

Earlier in January, ACT Research, with its own for-hire trucking index, saw a loose freight market balance with “signs of bottoming.”

“We’re now nine months into this freight volume soft patch with lower goods spending, overstocked retail inventories, and declining imports,” added Tim Denoyer, VP and senior analyst at ACT. “The good news is that from a historical perspective, that means we’re closer to the end than the start.”

“Pricing power clearly shifted to shippers in 2022, but the recent stabilization hints the bottoming process is beginning,” Denoyer added. “Capacity continues to grow, with pent-up equipment demand still red hot, and freight demand is down, leaving the market balance loose near-term.”

“December showed that seasonality is coming back to truckload freight,” said Ken Adamo, DAT’s chief of analytics. “In your 2023 playbook, expect a slow January and February for spot freight volumes, which is consistent with previous years—at least, years that don’t include a Polar Vortex or pandemic.”

Adamo added: “There was a peak season for truckload freight; it just arrived later than usual and with many of the variables you’d expect in December, from winter storms to a rush of retail sales boosted by last-minute deals for holiday shoppers. To borrow a football term, sometimes you have to let the play develop and not count out a season or freight cycle.”

DAT's Croke said cycles for the spot market have shortened and "that it's all happening within the space of 18 months." The current state of the spot market, he also said, is that it is "bottoming" but that the market should take a more favorable turn in six to eight weeks. "We're at that floor, which is a new floor but still 19 cents a mile higher" than at this time in 2019, before the beginning of the pandemic. The spot market has more volume in it now, he added, but operating costs are higher.

"The difference in this market cycle is carriers are being much more price disciplined, particularly on the large high-end contract carrier," Croke said, adding that smaller freight haulers "are trying to understand their operating costs better."