The U.S. average price for diesel fuel went up the week of April 17, according to the U.S. Energy Information Administration (EIA). That’s the news, full stop, because the primary fuel for the U.S. trucking industry had fallen for 10 straight weeks until this week.

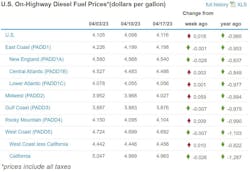

The April 17 increase was slight—1.8 cents to $4.116 per gallon, according to EIA—but the averages in two regions of the country that EIA measures also followed suit. And where diesel still dropped, the decreases were less than a penny, according to the federal fuel data reporter, meaning next week might bring higher diesel (if slightly) across the board. Before this week, diesel had dropped each week since the week of Jan. 30 and had fallen from its high of $4.622 per gallon that week.

See also: Trucker Path launches fuel discount program

Trucking's main fuel still is floating about $1 below (98.5 cents less) the highs of a year ago, according to EIA, so the outlook for the fuel is much better than it looked at this time in record-setting 2022.

Motor club AAA data showed its U.S. diesel average to be flat on April 17—up a fraction (one-tenth) of a penny to $4.196 per gallon—compared to a week ago, but AAA's average consistently has been higher than the same EIA measure.

Unlike gas, the week-of-April 17 picture for diesel in EIA’s regions was mixed.

Trucking’s main fuel was down or flat for the week in three regions important to trucking—slightly in each: The East Coast (one-tenth of a penny to $4.198), the Gulf Coast (seven-tenths of a penny to $3.876), and the West Coast (also seven-tenths of a penny to $4.692 per gallon). Trucking’s main fuel inched up in two other regions: the Midwest, where it rose 5.9 cents and broke the $4 mark at $4.027 per gallon, and the Rocky Mountains, where diesel rose almost a penny to $4.104.

What explains surging gas but diesel's lull?

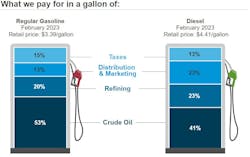

Analysts are interpreting the newly widening gap between diesel prices and gasoline as another recessionary sign because diesel is widely seen as the fuel that powers the global economy. One report shows U.S. diesel demand dropping 2% in 2023, with the West Coast hit especially hard, and trucking and container port activity both lower in China. One explanation for the rise in gasoline is seasonal—the fuel is used widely by consumers (as well as by some commercial fleets and work truckers) and the summer travel season is coming up, so demand for gas will rise significantly. Prices are headed up in part in anticipation of the season.

See also: Fleets in the 'messy middle' can chew gum and walk at the same time

Crude oil prices, seen rising incrementally last week and cheering analysts that they could be safer shelter for investment, flattened this week and even headed back down. West Texas Intermediate crude was down $1.58 per barrel (to $80.94) the morning of April 18 with Brent ($84.82) sliding about $1.50 per barrel. There are mixed signals, however, about oil, with world oil demand heading to records this year, according to the International Energy Agency, Oil & Gas Journal, a sister publication of FleetOwner’s, reported in an April 14 story. So there is some uncertainty about where oil is headed.