Experts say indicators continue to show the trucking industry is becoming mired in a significant slowdown, as orders for Class 8 trucks dropped in March, the risk of a recession remains for later this year, another Fed rate hike looms that could depress consumer sentiment and tractor production and purchasing, pressure on profits is increasing, and the spot market for freight continues to be “soft” and “seasonal” and, as one analyst put it recently, a “cudgel” on capacity.

Several recent reports point to the economic danger to trucking and to capacity, but almost all continue to mention a spot market for freight that continues to slump—with one expert, Tim Denoyer, VP and senior analyst at ACT Research, saying “the pendulum of pricing power has been firmly with shippers for some time, and the cudgel of lower rates is starting to impact capacity.”

See also: Owner-operators express their most common pain points

Denoyer’s comments are contained in an April 18 email from ACT with a subject line: “The Rebalancing of Capacity Begins,” where he goes on to point out that “spot rates are now about 17% below truckload fleet operating costs in Q2, worse than the 15% operating loss in Q1, by our estimates.” He also had other observations, specifically about fleet failures, in the April 18 report, a synopsis of ACT’s monthly 58-page Freight Forecast, that point to trouble for trucking.

“Failures started to pick up when the loss reached 10% in [the fourth quarter of 2022],” Denoyer said in the report. “This was a record at the time, and we see Newton’s third law of motion at work as the rebalancing requires a string of record losses following record pandemic profits. Q2 [of 2023] is the fourth straight quarter of significant losses, and both the time and magnitude of the losses should send a strong enough signal to tighten capacity.”

And, he continued, “though new equipment production remains elevated, hiring and fleet exit trends tell us capacity is slowing at the margin. With marginal fleets scrambling for miles with busted budgets, spot rates have gone far below costs, but this can only go on so long.”

Another spot-market report sings the same refrain

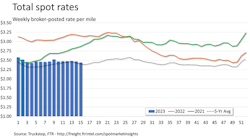

Prolonged weakness, according to data from FTR Transportation Intelligence and Truckstop, also continues to be evident. For the week ended April 14, both dry van and refrigerated (reefer), two dominant sectors in trucking, saw their largest drop in broker-posted rates on the spot market since January, according to the Spot Market Insights weekly report.

See also: J.B. Hunt executives grow more cautious on market turn

“The moves in all three segments were directionally in keeping with seasonal expectations, but van rates are running significantly below their five-year averages while flatbed rates are still running slightly above average,” the FTR/Truckstop report noted.

Avery Vise, VP of trucking at FTR, sounded a note of caution about ringing too many alarm bells over the spot market, though he conceded that spot, the top freight market for owner-operators, is going through a prolonged period of weakness, and he also noted that spot is running below FTR's five-year averages.

"The main thing to understand is we are still coming off an extended period of extraordinarily strong conditions," Vise told FleetOwner. "The period between mid-March and mid-May is typically seasonally weak. The best way to look at [the spot market] is there's no sign of strength; the big question is will the weakness continue or are we very close to bottom."

Vise predicted some strength in the spot market after the Commercial Vehicle Safety Alliance's International Roadcheck 72-hour safety inspection blitz, which is May 16-18. Some capacity usually is removed from the roads as trucks are placed out of service for various violations from the event, he noted. Anti-lock braking systems and cargo securement are the focus this year. About 12,000 vehicles were placed out of service during last year's Roadcheck.

"We're going to get that strength, we always do," Vise said. "We're going to be watching that very carefully. If [the spot-market weakness] continues, it will indicate that it's more than seasonal."

See also: Tips to safely survive Roadcheck 2023

Freight generally is shifting more into the contract market, Vise observed, because of an overall capacity migration. He did note that a "fairly high" number of carriers still are going out of business, though because the cost of diesel fuel has eased considerably from the historic highs of 2022, carriers are coming back to trucking in roughly equal measure.

"The weakness in spot isn't necessarily indicating a weakness in freight overall," he added. "There's been a lot of talk about a freight recession; from our point of view, that already has started."

Overall freight-industry pessimism keeps showing

Two more ACT reports, from Feb. 13 and April 11, based off the research group’s North American commercial vehicle forecast, expect a mild recession to materialize in the second half of 2023 and that the Fed will produce at least one more interest-rate increase in its ongoing effort to tame inflation. How does this impact trucking, particularly orders of new trucks?

According to the April 11 release of ACT’s forecast, “the critical factor in forecasting 2023 is when do lower freight volumes, lower freight rates, and higher borrowing costs compress carrier profits sufficiently to kill the cycle? Our current thinking is that the negatives begin to weigh on orders soon, and more meaningfully by the year’s second half. However, with a healthy backlog, early 2023 carrier profitability strength, and the potential for a [California Air Resources Board]-induced prebuy [of compliant trucks] in California, there is a compelling case to be made for production volumes to be sustained at end-of-2022 levels through all of 2023.”

See also: Freight volumes, spot rates fall in February

“The wildcard in any forecast presently is the debt ceiling,” added Kenny Vieth, ACT’s president and senior analyst. “While the Fed plays a major role in determining consumer and business borrowing costs, the all-too-familiar dysfunction in Washington about another debt ceiling battle may serve to pause business investment, unnerve investors, and spike interest rates even higher, which could induce a deeper recession sooner.”

In a March report, ACT's For-Hire Trucking Index showed a sharp slowdown in capacity growth, falling into contraction territory in February for the eighth of the prior 11 months. “The soft freight market persists as inflation continues to impact consumers’ purchasing power, and recent bank failures and job cuts make recession more likely,” ACT's Denoyer said in a March 27 email summarizing the health of the trucking index.

Orders meeting expectations, but …

April data from both ACT and FTR Transportation Intelligence didn’t provide much encouragement, though both said March truck orders met expectations.

In an April 4 report, ACT had preliminary March Class 8 orders at 18,600 units, or down 19% from February and 10% lower year-over-year. FTR, in its own release of preliminary North American order data, said March orders fell for the fifth time in the last six months, coming in at 19,000 units, or 18% below February and down 11% year-over-year. However, FTR noted that “while recent orders have softened, order activity is in line with market expectations and running at a robust annualized rate of 340,000 units over the last six months.”

See also: ‘Soft’ spot rates another signal of freight-economy trouble?

He continued: “Overall, the numbers were solid and will have little impact on production levels over the next two quarters. Given the uncertainty in the economy, this is a welcome sign that demand has not collapsed and that fleets still have access to capital.”

Eric Crawford, ACT VP and senior analyst, said: “Given how robust Class 8 orders were into year-end and ensuing backlog support, coupled with increasingly cautious readings from the ACT Class 8 Dashboard … we have expected [seasonally adjusted] orders in a range of 15,000 to 20,000 units per month into [mid-Q3 2023]. After coming in stronger than expected last month, Class 8 orders fell back within the 15,000 to 20,000 range, and have averaged 19,500 units year to date."

The news also was middle of the road for medium-duty truck orders in March, according to ACT, which reported that MD demand declined year-over-year by double digits for the second straight month, meaning orders for Classes 5-7 were down for March and February this year compared to the same months in 2022. March Classes 5-7 orders fell 15% year-over-year (but actually were up 9% over February) to 18,600 trucks, according to ACT.

Trucking industry demand for new trucks was "quite healthy" in March, ACT noted on April 19, despite the turmoil experienced in the banking sector and yet another interest-rate increase. Pent-up demand remains resilient, the report said, and cancellations continue at miniscule levels for both HD and MD classes.

Downtrodden tonnage report

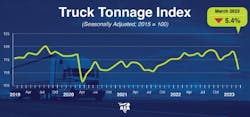

Meanwhile, in another sign of a slower trucking industry economy, American Trucking Associations reported April 18 that the sequential decline in March of ATA’s For-Hire Truck Tonnage Index was the largest monthly drop since April 2020, during the start of the COVID-19 pandemic. The index fell 5.4% in March after increasing 0.9% in February, according to ATA.

Compared with March 2022, the seasonally adjusted ATA tonnage index fell 5%, the first year-over-year decrease since August 2021. In February this year, the index was up 1.9% from a year earlier. During the first quarter, tonnage was 0.6% below the same three-month period in 2022, according to ATA.

In all this, ATA Chief Economist Bob Costello added: “Falling home construction, decreasing factory output and soft retail sales all hurt contract freight tonnage—which dominates ATA’s tonnage index—during the month. Despite the largest year-over-year drop since October 2020, contract freight remains more robust than the spot market, which continues to see prolonged weakness.”