A changing workforce, distracted driving and emerging technologies are among the reasons why transportation leaders believe their world is becoming riskier.

These are among the findings presented in the 2017 Travelers Risk Index, the insurance company’s annual report on how uncertain our world is.

Transportation leaders tend to have a dimmer view of the world than other Americans.

According to Travelers, consumers and business leaders’ outlook on risk has been steadily improving since it began this annual report in 2013. But more transportation leaders see risk in their environment than other business leaders: 45% of transportation leaders believe their environment is becoming riskier compared to 37% of businesses overall, according to the Risk Index.

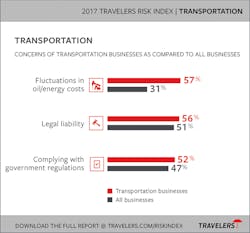

Transportation industry executives and business owners’ biggest concern is fluctuations in oil and energy costs – 57% cited it as a concern, compared to 31% of all business leaders.

More than half (52%) of the transportation industry is concerned about complying with government regulations, compared to 47% of all businesses.

Citing an aging workforce and the potential for road fatigue, more transportation leaders (43%) than other business leaders (38%) are concerned about a changing workforce over the next five years.

Attracting and retaining employees also concerns transportation companies. Specific concerns include the cost/time involved in training, the ability to keep talent in a competitive labor market, and the ability to attract and hire qualified workers.

More than half of transportation companies (57%) are concerned about driving accidents caused by employees (compared to 32% of all businesses). Distracted driving, inexperience and the general health of the workforce were the chief reasons for the accident concerns, according to the risk report.

With more than half of transportation companies (52%) reporting the use of personal vehicles for business, 56% are worried about potential business liability if an employee is in an accident while using a personal vehicle for business.

A concern that all industries appear to share is legal liability. In transportation, 56% of leaders cited it as a concern; a worry that 51% of all business leaders share.

When looking into the future, transportation companies expect the changing workforce, energy dynamics, and driverless vehicles to present the most significant emerging risks over the next three to five years, according to Travelers.

Telematics and other technological innovations have the potential to protect their business, some transportation executives said, but they must be right-sized.

The 40-page risk index report is based on two studies by Travelers and Hart Research Associates. The objective to identify “perceptions of risk” by American consumers and businesses, according to the insurance company. It then uses the data to figure out what steps could mitigate the risks.

The first study, conducted in January, surveyed 1,203 executives and business risk managers across businesses of all sizes; the second, done in April, asked 1,016 consumers (18 to 69 years old) about the risks they face in daily life.

This year, 52% of consumers think the world is getting riskier, compared with 56% in 2016 and 63% in 2013; fewer businesses (37%) perceive the business environment is getting more precarious, compared with 41% who thought so in 2016 and 44% in 2015. Despite the improvement, however, respondents indicate there is still plenty to worry about.

Consumers and businesses shared seven key concerns, according to Travelers:

Financial worries: It is the top shared fear of American consumers and business leaders.

Cyber threats: Driven by the interconnected world and the Internet of Things, both groups increasingly worry about suffering a cyber-attack on their financial accounts and personal or proprietary data.

Distracted driving: Businesses and consumers are both worried about distracted driving -- particularly about drivers using personal technology. They also see the potential for distracted driving by themselves or employees driving company vehicles to cause accidents. Businesses also worry about liability risks associated with employees driving their personal vehicles for business.

Changing workforce: Consumers, and the business leaders who employ them, are worried about the American workforce and it seems to be centered on the Baby Boomers leaving the workforce and the Millennials entering it. Businesses are concerned about managing the changing workforce while also identifying, attracting and retaining the talent they need. The workers are worried about having the skills in demand today.

Emerging technology: Consumers and businesses are both weighing the risks and opportunities of new technologies. For business owners and executives, new tech is seen as an opportunity and risk. Consumers are concerned about smart home technology, the sharing economy, and the potential risks and liabilities associated with them.

Extreme weather: Businesses continue to worry about how weather can cause business interruptions. Two in five consumers sense an increase in severe weather.

Safety: Businesses worry about safety issues with inexperienced drivers, opioid abuse, and worker injury and recovery – especially those in high-risk industries such as transportation, manufacturing, construction and health care. Personal safety is one of the top concerns after financial worries for American consumers. Rising crime and terrorism are among the specific concerns of consumers surveyed. Women are more likely to worry about most types of risks, but particularly those relating to their physical safety and transportation and travel concerns.

The 2017 Travelers Risk Index is available for free on the company’s website.