How Trump tariffs are impacting trucking

October 17: Trump formalizes truck duties

The White House formalized its 25% tariff on imported medium and heavy duty trucks and parts, beginning on Nov. 1.

While imported trucks will soon face a steep duty, senior U.S. officials told journalists that there will still be some favorable treatment linked to the U.S.-Mexico-Canada trade agreement (USMCA).

Under the incoming regime, trucks qualifying for favorable USMCA treatment will only see their non-U.S. content hit with the 25% tariff. Eligible truck parts will enter tariff-free until the Commerce Department establishes a process to target their non-U.S. content.

October 7: Truck tariffs delayed to November 1

U.S. President Donald Trump announced more details—and a delay—for the imminent 25% truck tariffs.

“Beginning November 1st, 2025, all Medium and Heavy Duty Trucks coming into the United States from other Countries will be Tariffed at the Rate of 25%,” Trump said through social media on October 6.

September 25: Trump levies 25% tariff on heavy-duty trucks, more tariffs on household goods

In a string of social media posts, Donald Trump announced a 25% duty on all heavy-duty trucks made outside the U.S., as well as a 50% tariff on many household goods, a 30% tariff on all upholstered furniture, and a 100% tariff on pharmaceutical products if the product’s company is not building a plant in the U.S.—all effective October 1.

The duties will likely increase equipment prices and further dampen freight demand.

August 29: Court rules many tariffs illegal

The U.S. Court of Appeals ruled that most Trump's reciprocal tariffs are illegal. The Court struck down the tariffs on China, Mexico, and Canada that were attributed to fentanyl, and also affected many of the Liberation Day tariffs that affect nearly all major trading partners. The move does not rule out steel and aluminum section 232 tariffs, however.

August 18: Surprise expansion of metals tariffs targets trailers

The White House made a surprise expansion to its tariffs on steel and aluminum derivative products, nearly doubling the value of goods affected by these tariffs. Most noteworthy for fleets: truck trailers are now affected by the tariffs, which will likely raise equipment prices for commercial carriers.

August 1: Trump orders tariffs on dozens of countries in push to reshape global trade

President Donald Trump ordered the reimposition of tariffs on dozens of trading partners Thursday.

July 8: Tariffs create turbulence in medium truck tire market

According to manufacturers of truck, bus, and radial (TBR) tires, medium truck tire demand is soft and could continue to get worse as operational costs rise. Modern Tire Dealer shares insights from several major manufacturers on the current and future state of the tire market.

July 8: Trump renews tariff threats for 14 countries

The Trump administration sent letters to 14 countries, outlining higher tariffs their products will face by August 1.

The tariffs threats were: Myanmar, 40%; Laos, 40%; Cambodia, 35%; Thailand, 36%; Bangladesh, 35%; Serbia, 35%; Indonesia, 32%; Bosnia and Herzegovina, 30%; South Africa, 30%; Japan, 25%; Kazakhstan, 25%; Malaysia, 25%; South Korea, 25%; and Tunisia, 25%;

June 4: Steel, aluminum tariffs double to 50%

The tax on importing steel and aluminum doubled on Wednesday, from 25% to 50%.

Tight capital and tariff uncertainty have so far stalled the Trump administration's hopes to enhance domestic manufacturing. The duties will significantly affect the cost of business for downstream metals users, threatening overall economic activity and freight demand.

May 30: Trump tariff pause put on hold

A federal appeals court said President Donald Trump can continue to impose sweeping tariffs under emergency powers. The Trump Administration told the U.S. Court of Appeals that it would likely seek "emergency relief" from the Supreme Court, leading the lower court to grant the White House's request to pause the U.S. Court of International Trade's ruling that paused Trump's tariffs.

May 29: Judges block Trump's sweeping tariffs

In a major blow to Trump's trade policy, a panel of three federal judges ordered an immediate end to the president's 10% baseline tariffs, retaliatory tariffs, and tariffs blamed on fentanyl trafficking.

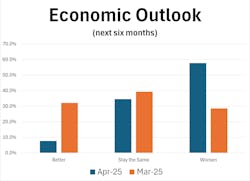

May 21: Where the industry sits with tariffs

Despite recent breakthroughs with China and the United Kingdom, the nation's global trade environment is hostile and forecasts are dim.

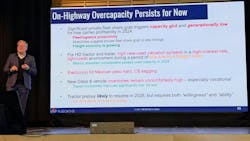

May 13: FTR analysts describe tariff distortions

FTR Transportation Intelligence shared its latest forecast during a webinar centered around how the transportation economy has shifted since President Donald Trump was elected last November.

While businesses are facing uncertainty as the middle of the year approaches, FTR analysts are certain that tariffs are going to curtail economic growth into 2026.

May 12: U.S. and China reduce reciprocal tariffs

The U.S. and China reached a temporary trade war resolution during a weekend meeting in Switzerland. Trump's baseline tax on importing goods from China lowered to 30%, while China's baseline tariff on U.S. imports lowered to 10%.

The resolution is a temporary, 90-day agreement that may change by August.

May 9: Severe tariff consequences approaching

Ripple effects of Trump's tariffs are approaching the trucking industry. Tractor sales are falling and port traffic will soon slow down due to weak import/export demand. But small fleets have reasons to be optimistic.

Class 8 tractor orders have dropped significantly. Both ACT Research and FTR Transportation Intelligence found that truck sales in April were the lowest since May 2020.

Port freight movement is likely to slow down in May. TD Cowen analysts reported a steep drop in shipping volumes during a critical import season across both the East and West coasts. The Los Angeles port said that it expects a 10% drop in all imports in the second half of the year.

May 8: Tariff Shocks and How to Cope (Commercial Vehicle Edition)

Tariffs have thrown supply chains into uncertainty and complicated strategic planning. Four consulting experts describe in IndustryWeek how game theory, the science of strategic interactions between stakeholders, can help anticipate players' actions.

Based on game theory analysis, the consultants describe several short-term and long-term outcomes that industry players will likely pursue.

May 3: Auto parts tariffs take effect

Trump's tariffs on foreign-made auto parts—specifically passenger vehicles and light trucks—officially began at 25% ad valorem.

The tariff order included a 'non-stacking' clause to prevent multiple tariff duties for a single automotive part.

April 25: Tariffs torpedoed Knight-Swift hopes for a seasonal rebound in March

Executives of Knight-Swift Transportation Holdings, No. 3 on the FleetOwner 500 list of for-hire carriers, told analysts and investors that tariffs halted the freight market's momentum.

CEO Adam Miller said the company’s contract talks with shippers started 2025 as expected, with rates rising in the low- to mid-single digits from 2024. But as President Donald Trump’s tariff plans came into focus, Miller said some customers grew more focused on getting the lowest cost possible while others hit pause on their plans. The comments from Miller and his team about hopeful trends giving way to something closer to paralysis echo those made a day earlier by leaders of Old Dominion Freight Line Inc.

Miller said the Knight-Swift team expects May to be unseasonably weak because of a drop in imports that’s already visible in supply-chain data. Because of the cloudy outlook, Knight-Swift’s leaders have stepped back from providing two quarters of guidance on volumes and profits to only forecasting the second quarter.

April 24: Old Dominion reports weak Q1

Old Dominion executives reported that their Q1 net profits fell 13% and total revenue fell 6% compared to last year.

Underpinning the drop in profits was a 6.3% decline in less-than-truckload tons per day during the quarter, with the majority of that decrease attributed to fewer shipments. CFO Adam Satterfield said he has no illusions that customers' tariff uncertainty will hurt freight volumes.

However, the executives told shareholders that they're still optimistic about a reacceleration in the market, pointing to a bump in freight demand across February, March, and April. Old Dominion's executives acknowledged that some of the increased activity was due to customers pulling inventories ahead of tariffs.

April 22: Tire manufacturers are hiking prices

Goodyear Tire & Rubber Co. and Sumitomo Rubber North America Inc. plan to increase tire prices in the United States and Canada on May 1.

Goodyear said the price hikes are due to "rising costs," and will raise some tire prices in the U.S. by as much as 4% and in Canada by up to 6%.

Sumitomo plans to raise commercial truck tire prices by up to 10%.

April 18: Volvo blames tariffs for manufacturing layoffs

Volvo is laying off at least several hundred workers at its plants over the coming months. The company is blaming the layoff on market uncertainty and tariffs.

“Heavy-duty truck orders continue to be negatively affected by market uncertainty about freight rates and demand, possible regulatory changes, and the impact of tariffs,” Kimberly Pupillo, a Mack spokesperson, told FleetOwner on April 18. “Yesterday, we informed our employees that this unfortunately means we’ll have to lay off 250 to 350 people at LVO over the next 90 days.”

Mack just launched a new highway truck and is celebrating its 125th anniversary.

April 17: Manufacturing business confidence plummets in April

Several new surveys point to massive declines in capital spending plans and a growing sense of unease in the manufacturing community.

Manufacturing pessimism spiked dramatically in April amid changing tariff plans global trade policy. Several recent surveys show a dramatic plummet in business confidence between January and April.

April 16: Peterbilt’s new leader relies on partnerships and patience amid market uncertainty

The trucking industry’s newest chief executive is taking over an iconic truck maker during uncertain economic and supply chain times. Peterbilt General Manager Jacob Montero said his brand and its Paccar parent company have been through it before, and he and his leadership team are ready for the moment.

Montero said Peterbilt has used this time to stay close to customers and educate them. With a manufacturing presence here in Texas and elsewhere in the U.S., Canada, and Mexico, Montero said that Paccar is ready to adjust to whatever the supply chain throws at the company.

April 16: J.B. Hunt whacks $200M off 2025 capex, blames uncertainty

The leaders of J.B. Hunt Transport Services Inc. have cut their 2025 capital spending plans by $200 million as part of an ongoing push to rein in costs and improve margins.

The J.B. Hunt team attributed the cuts to continued low rates and significant tariff uncertainty. An uncertain economic picture where the situation is “changing by the day or the tweet or the moment,” the president and CEO said, means the company needs to remain flexible.

April 15: U.S. tariffs on Chinese imports now 245%

The trade war heats up: President Donald Trump raised the tax on importing Chinese goods to 245% of the goods' value. China, meanwhile, halted exports of rare earth metals.

April 14: Fastenal executives detail early tariff-related moves

Fastenal (No. 302 on the 2024 FleetOwner 500: Private), one of the first industrial companies to report its Q1 outlook, shared details of its tariff response strategy.

Fastenal is hiking prices, planning to add between 3% and 8% to the company’s top line throughout the year. The company also started shipping products directly to customers in Canada and Mexico that it would have previously brought to the United States. In Q1, the company pulled ahead some purchases to build up its inventory ahead of tariffs.

April 11: The cost of tariffs for carriers

Tariffs continue to shake the broader economy—and commercial carriers can feel tremors in their own operations. Executives and analysts in the trucking industry told FleetOwner that the duties could challenge fleets’ ease of maintenance, cross-border logistics, and freight demand.

China's announcement of 125% retaliatory tariffs Friday, April 11, is poised to cause more panic.

“The bigger risk for trucking is the increased cost of pretty much all goods for the consumer and for businesses … And what that’s going to do to demand, both by consumers for goods as they face higher prices and for businesses looking to decide what they’re going to do in the near term,” Avery Vise, VP of trucking at FTR Transportation Intelligence, told FleetOwner.

April 9: Trump declares 90 day reciprocal tariff pause except for China

Trump announced a pause on his latest tariffs Wednesday. Trump said the U.S. will instead maintain the 10% import duty for imports from all countries except China, which will see extreme tariff rates.

"Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately," Trump wrote on Truth Social.

April 8: What’s your tariff temperature?

The election created immediate hope and promise of a pro-business administration coming into power as a prolonged freight recession ends. Instead, we’ve been plagued with uncertainty and this will-he-or-won’t-he-impose-tariffs drama.

Trucking and supplier executives are mixed on how the global Trump tariffs will impact U.S. transportation businesses.

In a snap poll FleetOwner ran online the weekend after Trump announced the global import duties—that he said would lead to reinvestments in U.S. manufacturing—more than half of transportation industry respondents said they expect the trade taxes to impact their business negatively; 30% said they expect positive impacts.

April 8: ‘This is nuts’: Supply chain expert on tariffs, trucking

Tariffs announced by President Trump have prompted warnings from experts about declining new orders and rising costs in the freight and automotive sectors.

Jason Miller, Eli Broad professor of supply chain management at Michigan State, outlined the current freight environment and forecasted possible outcomes in his Stifel freight forecast presentation.

"If these higher rates stay in place, you know, longer than three months, I don't see how we don't end up in a recession within six months," Miller said.

April 3: Trump tariffs will hit top tire exporters

Trump's reciprocal tariffs target many countries that export tires to the United States.

Seven out of the 10 biggest exporters of passenger tires to the U.S. in 2024—Thailand, Indonesia, Vietnam, South Korea, Japan, Cambodia and Malaysia—will be subject to reciprocal tariffs, according to information published in the Federal Register.

Modern Tire Dealer details the top tire exporters facing tariff threats.

April 2: Trump imposes sweeping Liberation Day tariffs

President Donald Trump signed an executive order implementing sweeping tariffs on nearly all imports on Wednesday afternoon.

The U.S. will impose a baseline duty tax of 10% on all imports, with some exemptions, beginning April 5. On April 9, Trump will impose varying duties on imports from 57 specific countries as much as 49%. In his speech from the White House Rose Garden, Trump said he is imposing a 25% tariff on all foreign-made automobiles (excluding heavy-duty trucks), which was announced on March 26 and took effect April 3.

April 2: Uncertainty in need of a plot twist: Tariffs, trade wars, and a disappearing prebuy

2025 was supposed to be the year trucking bounced back. However, Trump’s trade war creates marketplace ‘paralysis’ among carriers, dealers, manufacturers, and suppliers.

ACT Research President Ken Vieth reminds us why economists have hated tariffs for centuries.

March 20: Well-positioned carriers should be optimistic about freight in 2025

Tariffs are creating uncertainty for carriers that have weathered a prolonged freight recession. As capacity shrinks and demand rises, the surviving fleets will ’start to feel better,’ Bob Costello, American Trucking Associations chief economist, told for-hire carrier executives at the Truckload Carriers Association’s annual conference

“If you take away what’s going on with tariffs, in particular … I would have come out here and told everybody: It’s not going to be great. It’s not going to be the pandemic boom. But we are absolutely moving in the right direction,” Costello said.

He noted that capacity is leaving the market, and volumes are growing as U.S. consumers move past the post-pandemic desire to spend more on experiences than goods. Costello expects growth in goods spending to outpace experience spending in 2025.

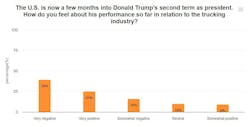

March 19: Trucking’s mixed views on Trump lean negative with tariff uncertainties

While trucking generally supported President Trump’s campaign to return to the White House, a recent FleetOwner survey found that most industry respondents viewed his first weeks back in office as very negative or somewhat negative.

Almost 300 individuals completed FleetOwner’s unscientific survey, which asked readers how they felt about Trump’s early second-term performance. Respondents were also asked to state their role in the industry and share any comments. The survey ran from March 6 to 17.

Many issues came up about how Trump is affecting the trucking industry, but the main topics were tariffs, emission regulations, and fuel costs.

March 12: Trump tariffs: 'Nobody likes this level of volatility'

President Donald Trump issued sweeping 25% tariffs on all steel and aluminum imports to the U.S.—but not before threatening and then quickly revoking an extreme 50% tariff on Canadian steel and aluminum.

On-again, off-again tariffs are dashing hopes for a 2025 freight market upturn. Trump's tariff roller coaster is concerning analysts and threatening trucking's long-awaited rebound.

March 7: Trump delays tariffs for key Mexican, Canadian imports

President Donald Trump, once again, postponed tariffs on most goods imported from Canada and Mexico.

Under the latest supply chain shakeup, several goods under the United States-Mexico-Canada Agreement—including automotive products—are exempt from Trump’s wide-ranging 25% tariffs for at least one month.

The moves are additional disruptions to a chaotic tariff rollout, which has clouded business decision-making.

March 4: Trucking braces for Trump tariff impacts

President Donald Trump went through on his threat to levy tariffs against neighbors Canada and Mexico on Tuesday, which trucking industry analysts and executives have warned could push up vehicle prices and redraw supply chains.

Beginning just after midnight on March 4, imports from Canada and Mexico will be taxed at 25%; Canadian energy imports get a 10% tax; and Chinese imports that were levied with a 10% tariff in February, now face 20% duties.

Feb. 28: Trump tariffs vs. ‘self-inflicted uncertainty’ casts cloud over business decisions

Trade war uncertainty has engulfed U.S. business decisions since President Donald Trump returned to office and threatened tariffs on neighboring and global trading partners. The trucking industry could be an economic casualty if this cold trade war heats up next week.

“Trump risk is truly self-inflicted uncertainty,” Ken Vieth, ACT Research president and senior analyst, said during his firm’s Market Vitals seminar in Columbus, Indiana.

Feb. 6: Shippers expediting freight due to tariff caution

Despite a 30-day pause, the threat of tariffs against Mexican and Canadian imports persists. Some shippers are bracing for the risk of skyrocketing expenses by moving inventories early.

“Our customers are bracing,” Jose Guerrero, director of U.S. customs operations for Uber Freight, told FleetOwner. “This month, there’s going to be a surge in volumes.”

Feb. 4: North American trade war gets 30-day tariff ceasefire

President Donald Trump’s announcement of economy-shaking tariffs changed significantly over 24 hours. Canada and Mexico reached deals to postpone the threat of tariffs, and China issued retaliatory fees against U.S. products.

Canada and Mexico reached separate deals with Trump to postpone their 25% tariffs for 30 days. The deals spare the U.S. freight industry from what could have been significant damage to freight rates and equipment prices.

China faced only an additional 10% tariff but countered the levy with its own retaliatory tariffs. The country said it would implement a 15% tariff on coal and liquefied natural gas products and a 10% tariff on crude oil, agricultural machinery, and large-engine cars, according to the Associated Press. The tariffs are set to take effect on Monday.

Feb. 3: Why Trump’s tariffs spell bad news for trucking’s recovery

President Trump is enacting major tariffs against Canada, Mexico, and China, taxing imports from those nations by 10% to 25%. Canada and Mexico have vowed to enact retaliatory tariffs. ATA warns a trade war will harm cross-border trade, equipment prices, and overall freight movement.

Jan. 31: Vehicle manufacturers keep wary eye on international trade tariffs

Automotive manufacturers are monitoring how the new president and Congress will shape international trade. Tariffs and major trade agreements have potential to disrupt the U.S. commercial vehicle market.

Possible tariff scenarios are one of the number one issues for members of the Motor & Equipment Manufacturers Association, according to Ana Meuwissen, SVP of government affairs for MEMA. Meuwissen described the new federal government’s key issues and officials for 2025 during MEMA’s Heavy-Duty Aftermarket Dialogue conference.