For-hire trucking is off to a strong start in 2025. Rates have steadily improved across the first quarter of the year. The spot market saw heightened freight demand in the first week of April.

However, analysts warn, these happy conditions are likely a temporary reaction to get shipments ahead of President Donald Trump’s import tax threats. As the year progresses, for-hire freight demand could suffer the effects of Trump’s unpredictable trade war.

“People might be bringing in additional stuff to beat tariffs, but, for the most part, they’re on the sidelines trying to decide whether to make investments,” Avery Vise, VP of trucking at FTR Transportation Intelligence, told FleetOwner. “That is a broader concern because we think that holds back not only 2025 but probably holds back 2026 as well."

See also: The cost of tariffs for carriers

Early April enjoys strong spot market

Both FTR and DAT Freight & Analytics reported that the spot market saw a sizable boost to rates and load postings across all three major trucking segments in the first week of April.

However, the firms speculated that tariff preparations comprised much of that spot market strength.

Rates up for major segments

Linehaul spot rates grew across all three segments week over week, both firms reported.

FTR found that the average broker-posted rates in Truckstop rose for all equipment types. Across all segments, the average rate rose to just about $2.50—a year-over-year increase of about 4.7%, including a calculated fuel surcharge. The increase is one FTR’s strongest year-over-year rate comparisons since May 2022.

Dry van and refrigerated saw their largest week-over-week rate increase of the year so far. Broker-posted dry van rates rose more than 5 cents from the prior week, up 1.2% year over year. Refrigerated rates rose 8.5 cents, which was still 2.5% below the same 2024 week. Flatbed rates increased more than 3 cents, up 4% year over year.

DAT’s measure of linehaul spot rates found similar growth: Rates across all three segments rose both week over week and year over year. Flatbed rates received the biggest increase.

DAT’s average dry van rates, excluding a fuel surcharge, reached $1.66 per mile, an increase of 2 cents from the previous week and up 8 cents year over year. Refrigerated rates were $1.90, up by 1 cent from the previous week and up 2 cents year over year. Flatbed rates averaged $2.19, up 4 cents week over week and up 18 cents year over year.

Load board postings rise

Load posting increased across all three major segments, according to both DAT and FTR. However, both firms suspected that much of the increase in demand is temporary, as companies pushed to import goods ahead of anticipated tariffs.

FTR’s measure of load activity through Truckstop found continued growth in spot market freight demand. Total load activity reached its strongest level since July 2022, rising 4.6% week over week and 34% year over year.

FTR found a significant increase in volumes across all three major segments. Truckstop’s dry van loads rose 7.7% month over month and 7% year over year, refrigerated loads rose 12.7% month over month and 12% year over year, and flatbed loads rose 3.8% month over month and an impressive 48% year over year.

The firm was uncertain what caused the recent strength across trucking segments but suspected that much of the surge is tied to preparation for impending tariffs.

DAT also found a bump in load post volumes for dry van and refrigerated but not for flatbed. Compared to the previous week, the firm reported that dry van load post volumes rose 8%, refrigerated load posts grew 22%, and flatbed posts dropped by 2%.

Dean Croke, principal analyst at DAT, said that the significant boost to refrigerated freight demand is due in part to tariff concerns. Companies in Mexico moved extra produce into the U.S. in case duties target imports of produce.

“Sources south of the border tell DAT they were moving as much produce as possible, expecting that exports to the U.S. could be subject to additional tariffs,” Croke said in the DAT blog, noting that the tariffs ultimately spared Mexican produce.

2025 started strong, but stormclouds loom

For-hire trucking’s health improved for the first months of the year. Reflecting on the first quarter, industry research firms agreed that truckload rates improved slightly.

On a pessimistic note, however, the firms predicted that macroeconomic trends including the trade war are likely to weaken carriers’ rates.

The Bureau of Labor Statistics’ Producer Price Index for general long-distance truckload freight ticked up slightly in Q1, indicating carriers are receiving slightly greater pay for their goods. According to the index, June 1992 represents a score of 100, and in March the score was 182.196, its highest since April 2023.

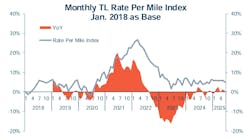

The TD Cowen/AFS Freight Index found that overall truckload pricing ticked up in Q1 but remained relatively depressed. The report’s truckload rate per mile index, measured as a comparison over January 2018, rose to 5.9% but has trended mostly flat for several months. The index has remained between 4.3% and 5.9% for nine straight quarters. The authors predict the index will decline marginally in Q2 to 5.5%, weighed down by uncertain macroeconomic conditions.

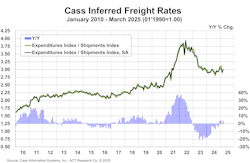

Cass Information Systems reported that, in March, freight demand weakened, while rates ticked up. The Cass Freight Index score for shipments was 1.054—down 2.1% seasonally adjusted from February and down 5.3% year over year. Cass’s measure of freight rates increased to 3.001, up 3.7% seasonally adjusted from February and up 3.5% year over year.

Authors of the Cass index report suggested that total shipments will continue to decline in 2025. The index’s shipments component fell 5.5% in 2023 and 4.1% in 2024.

The report noted that pre-tariff shipping might lead to more freight movement in Q2. While goods shipments might temporarily bump up, the authors said, “the trade war is likely to extend the for-hire freight recession as higher prices reduce goods affordability and consumers’ real incomes.”