The U.S. transportation economy fared much better than the rest of the economy in the third quarter of 2020, which was the second full quarter of the COVID-19 pandemic. As 2021 gets off to a rocky start with the pandemic still limiting much of the economy, the trucking industry has the opportunity to lead the U.S. recovery as goods demands continue to rise, along with truckload rates that have surged since late summer.

While the overall U.S. economy has not fully rebounded to pre-pandemic levels, the goods transportation sector is close, according to Avery Vise, the FTR Intel vice president of trucking, during a Jan. 14 FTR State of Freight webinar. “In general, we’re expecting to see the goods economy outpace the overall economy for a few more quarters — that’s going to be due in large part to the pandemic itself,” he said.

With COVID-19 cases still surging around the U.S., some regions are facing winter economic shutdowns. So, how well federal and local governments are at getting the COVID-19 vaccinations in Americans’ arms over the coming months will play a significant role in the economic recovery, according to Clay Slaughter, FTR’s chief strategy officer and general counsel.

“As more and more people have had the opportunity to be vaccinated, some of those reasons for another shutdown will dissipate,” Slaughter said. “When you get to the point that you vaccinated enough people — or gave them the opportunity to be vaccinated — then you're going to have a much different equation about the decision to open businesses, to keep the community open. If folks have had the opportunity to be vaccinated, and they simply said, ‘I don't wish to be vaccinated,’ you don't have the compelling social mandate to say we're going to shut things down, it becomes an assumption of personal risk at that point.”

Services down, goods up

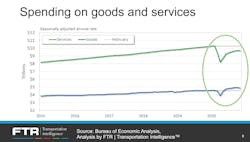

Since February 2020 — the last full month before the coronavirus led to economic shutdowns across much of the U.S. and the world — spending through December on services is down 6%, while spending on goods is up 6.7%, Vise said. “It’s a diversion we expect to continue for a while,” he added.

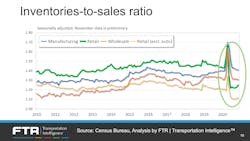

With goods sales doing better than most sectors, retail inventories remain close to an all-time low since June, Vise notes. “This — on top of the overall gross demand — has added further to the need for goods movements and it is going to continue to do so for some time,” he said.

The low retail inventory data, which is based on dollar value, is a bit misleading, Vise noted. Automobile inventory is driving the retail figures lower because cars are “by far the most expensive retail items and very lean automotive inventories are somewhat exaggerating the inventory issues with retails,” he said.

While excluding automobile inventories does lessen the appearance of the shortage of retail goods, it does not change that stocks across most goods sectors remain “historically lean or very close to an all-time low,” Vise said. “But it is important to note that the delta there between the norm and where we are is tighter than it is if you look at the total retail. What that means is that the inventory situation is more susceptible to a swing to an oversupply at some point if we see a decline in sales and the supply chain perhaps overestimating what that demand is going to be."

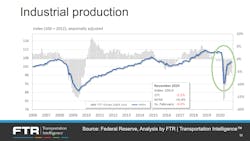

While the 2020 government stimulus and consumer demands have helped prop up the goods economy, the industrial sector has not fared as well, Vise said. “As of November, industrial production was still down about 5% from February; manufacturing is still down close to 4%. Inventories are still a bit higher in manufacturing relative to sales than they were before the pandemic. So even though we've started to see the demand environment improve — to some extent — we're still working from inventories that were in place before the pandemic.”

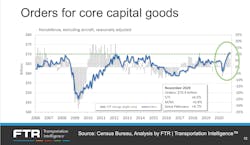

Demand, however, continued to rise as 2020 ended. Capital goods — excluding defense and aircraft sectors — are “at an all-time high on a nominal dollar basis,” according to Vise, who adds that this is a good indicator of business investment. “It’s a very positive sign for the economy as we enter 2021.”

2021 off to a hot start

The new year began with record volume on the spot market, according to Truckstop.com. Some of this demand reflects delayed shipments leftover from the December holidays, Vise said. “So we’ll really need to wait another week or two to confirm that the spot market remains basically as hot as it was… And with the recent government stimulus, there’s certainly every reason to think that’s going to continue for a period.”

Vise, however, stressed that spot market numbers should not be heavily relied upon when looking at the overall freight economy. “It tends to exaggerate absolute volume when we're in a disruptive environment, as we certainly have been for months,” he said.

So FTR has freight forecasts designed to reflect the entire market for truck freight — including contract, spot, short-haul, long-haul, private, and for-hire. “And if we look at the market from that perspective, we certainly have recovered most of the volume we’ve lost,” Vise said. “But we’re not back to the February levels (seasonally adjusted).”

For 2020, FTR estimates total freight loadings were down about 4%. Vise said that FTR expects total freight volume to rebound back to pre-pandemic levels by the middle of 2021.

Capacity tightens

The industry, however, is facing another problem as demand ticks back up: “While freight demand has not fully recovered, driver capacity is much tighter than it was,” Vise said. “Payroll employment in trucking is still down 3% relative to February. And we have some extraordinary pressures on the supply of drivers, many of which are related to the pandemic.”

One of those pressures is that fewer commercial driver’s licenses were issued to new drivers as social distancing limited training and testing in 2020. Another is the pandemic pushed some drivers out of the industry. And trucking has found more labor competition in construction, manufacturing and last-mile delivery, which all have fewer regulations on workers.

Another big chunk of the truck driving pool was sidelined by the federal Drug & Alcohol Clearinghouse. In 2020, 52,000 CDL holders tested positive (or refused a test) for a banned substance; more than 45,000 of those are still in “prohibited status,” Vise said. “That more than 1% of CDL drivers that we estimate.”

He said that only about a third of the violators had begun the process to return to duty. “So we are going to be challenged for months to come due to the clearinghouse and the pandemic constraints,” Vise said. “And we don’t expect much change in the situation with capacity utilization.

With truck utilization down, rates “have seen an extraordinary recovery,” Vise said, citing the most recent data that shows truckload rates up 15% year-over-year in November — the largest year-over-year jump mid-2018. FTR estimates that despite lower rates for most of 2020, the rise in rates since August will end 2020 with a 3% increase in rates over 2019. “For 2021, we expect contract rates to take the lead in growth,” Vise said. “And we expect rates to be up another 10% or so.”

Unclear future

Of course, there are still more unknowns about how 2021 will fair for freight and the rest of the economy. “As people start to get vaccinated and we move into the second half of the year, people might feel like they can go out and do things,” Erik Starks, FTR chairman and CEO, said. “There is a possibility that they say, ‘You know what, I’ve spent all this money on goods, I’m ready to spend on services. I’m ready to go out to eat, I’m ready to go on vacation, I’m ready to do all these different things.’

“So it’s very possible that you have a shift from one area to another," Starks continued. "If that’s the case, that has a different implication for transportation. But I think the ultimate takeaway is that people want to get out of the house. They want to do things."

Starks added that he anticipates that as more of a Q4 2021 issue than something that will immediately impact the freight industry.