According to the ACT Research’s For-Hire Trucking Index, a monthly survey of for-hire trucking service providers, the transportation industry experienced slower volumes, stronger pricing, and a sharp decline in the supply-demand balance in May.

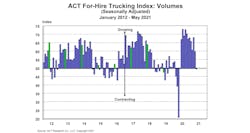

The survey converts responses into diffusion indexes, where the neutral or flat activity level is 50. In terms of seasonally adjusted volumes, May 2020 and May 2021 both landed right at that neutral mark. To show how much impact COVID-19 had, April 2020 plummeted to about 21, while April 2021 hit 60.

“Consistent with some consumer-related macro softness as well as the deceleration in DAT’s load-to-truck ratios from the beginning to the end of the month, May’s Volume Index decelerated to its lowest reading since the start of the pandemic,” said Kenny Vieth, ACT Research’s President and Senior Analyst. “Despite the drop in volume growth, we continue to witness the strongest rate environment in the survey’s history, with capacity re-engagement extraordinarily challenging as a result of driver and manufacturing constraints limiting the supply response.”

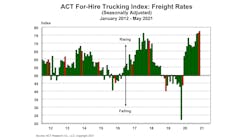

The freight rate index has increased every month of 2021 so far, hitting the highest apex last month in at least 10 years, at about 77 on the index. The previous high was January 2018. Back then, shippers faced a capacity crunch due to the electronic logging device mandate going into effect and a shortage of drivers.

In comments made in 2018 but still relevant today, John Starks, COO of Research firm FTR Transportation Intelligence, advised that shippers “will need to address freight transportation productivity, and their role in improving it, to counter the inevitable rising transportation costs associated with the current environment.”

Starks added: “The relationship between carriers and shippers tends to swing on a pendulum. And with freight demand high and capacity tight, carriers are benefiting. Numerous companies are announcing that domestic freight costs are at record levels. Since carriers currently hold such a strong position, shippers need to be hyper-focused on their relationships with carriers.”

According to DAT, van and reefer volumes declined 6% in May while flatbed dropped 9%. The national average van load-to-truck ratio was 6.1 last month, a 27% increase over April. Reefer ratio increased 31% to 13.0, and the flatbed ratio reached 97.1, the highest since April 2018.

Factors DAT cited include higher dwell time, a surge in imports and the rising cost of lumber doubled the cost of pallets, which are in high demand due to rising summer harvest activity.

“Imbalances and shortages plague supply chains across most segments of the industrial and consumer economies,” said Ken Adamo, chief of analytics at DAT Freight & Analytics. “For many businesses, ‘on-time and in-full’ shipments are essential to the efficiency and accuracy of their logistics operation. Right now shippers are having to choose one or the other.”

ACT’s supply-demand index also tumbled from 59 in April to just under 51 in May. This index is more volatile than the other two, with deterioration occurring about a third of the time since January 2012.

Regarding the supply-demand balance, Vieth noted, “The pullback in the freight gauge and a tough seasonal factor on top of that were contributing factors in the sharp decline of the Supply-Demand Balance reading, which dropped 9ppts month-over-month to a 13-month low 50.6 in May. Strong freight visibility suggests this metric will rebound from here as rebalancing continues into the medium-term.”