Last year COVID-19 ripped apart the fabric of society, but many economic signs, from GDP to heavy-duty tractor volumes, indicate it’s slowly being stitched back together, according to data provided during NTEA’s work truck industry mid-year update.

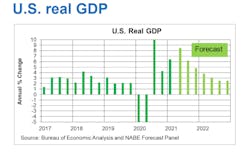

“The forecast here for GDP is very good,” said Steve Latin-Kasper, senior director of market data and research for NTEA, citing Bureau of Economic Analysis and National Association of Business Economics (NABE) Forecast Panel data. “For the rest of this year, we're expecting GDP to grow another 8.5% which would have been a record if it wasn't for the breakout growth from the pandemic back in the third quarter of 2020 reaching upwards of 30%.”

NABE’s outlook showed GDP going from 3.8% to 6.7% from December 2020 to June 2021.

He continued that a “return to normal,” or GDP growth rate levels of about 2.5%—similar to 2017 to 2019—will come by the second half of 2022. “A fair amount of volatility” will remain until then, Latin-Kasper said. While much of the manufacturing sector has already returned to form or improved on -pre-pandemic levels, the entertainment and tourism industries have yet to find their footing.

Despite more than half of the U.S. population over the age of 12 having been vaccinated, according to the Centers for Disease Control and Prevention, the emergence of an allegedly more transmissible “Delta variant” of the coronavirus, and re-imposed mask mandates in Los Angeles County, show the specter of COVID-19 continues to haunt the country, spooking would-be consumers from typical summer spending.

Labor should also rebound by Q1 of 2022, Latin-Kasper noted. Initial claims peaked to 21 million initial unemployment claims in April 2020 and are now at about 500,000 per month, falling to 250,000/month by the end of the year. Unemployment as of June was 5.6%.

“The recession is over, but the impact of the recession isn't over,” Latin-Kasper noted.

In the work truck industry specifically, total shipment revenue, which includes tractors, trailers, buses, bodies, and related equipment, dropped from $156 billion in 2019 to $126 billion in 2020, a 20% decline, and ramped back up to an estimated $141 billion in 2021. This, too, should rise sometime in the first half of 2022.

“We were headed towards recession on an annual percentage change basis as of the end of 2020,” Latin-Kasper said. “The pandemic just sped it all up in made it fall faster and further than it would have otherwise.”

Classes 2 through 7 box-off chassis shipments had started to decline in year-over-year growth even before COVID-19 started to spread in the U.S., plummeting 23% in Q2 2020 before a sharp ascent. The most recent NTEA estimate shows a 10% YOY increase, roughly the same as this time of year in 2017 and 2019.

The shift to last-mile delivery spurred by the ecommerce explosion pushed the lighter duty trucks and vans to the head of the pack.

“Class 2 and 3 sales are going faster than all other weight classes in the industry right now and have been for the first half year of 2021,” Latin-Kasper said, noting Class 6 is keeping pace.

NTEA forecasted Classes 2 through 5 sales, which are up 5% YOY and could jump to 15% by the end of the year.

Supply chain challenges have limited the growth potential, though.

“Shipments are struggling to keep up at the moment,” the economist said. “Supply chain issues are going to make it difficult for shipments to catch up for a while longer.

Class 6-8 sales and shipments took a more precipitous dive in 2020 and are inching back to growth.

On commercial van sales, Latin-Kasper said: “Sales bounced back strongly from a low of roughly 13,000 units to a current peak of roughly 27,000.”

Inventory and supply issues will make things “choppy” through the end of the year as OEMs navigate supply challenges, Latin-Kasper added.

Some good news for the transportation comes by way of OPEC increasing oil production, which is expected to knock $10 of the current $75/barrel price by the end of the year, according to a NABE forecast.

“We may see the price of diesel come back down in the very near term," Latin-Kapser said, though it won’t be immediate as consumer demand will keep fuel prices up as previously remote workers begin commuting again. “Expect to see fuel prices falling probably some point in the third quarter, certainly by the fourth quarter, unless something very strange happens and OPEC decides to cut supply again.”

If a federal infrastructure spending is ever passed, that would also be a boon to the commercial truck industry, Latin-Kasper noted.

The biggest issue that could let the air out of these projections is inflation

“Some economists are expecting greater than 3% inflation—this could end up being one of the defining issues of what has an impact on our potential for growth going forward,” Latin-Kasper said. “Inflation is a con right now, but most economists think it's temporary.”