Truckload freight markets turned a corner in September. Demand remained strong throughout the month, while the combination of tighter capacity and fuel price increases pushed spot market rates higher.

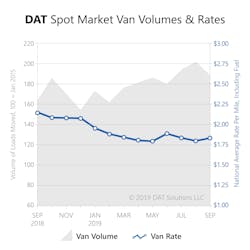

Volumes for dry van, refrigerated (“reefer”), and flatbed freight declined from their Aug. peaks but were higher than Sept. 2018 numbers, according to the DAT Truckload Freight Volume Index. The index reflects changes in the actual number of spot market loads moved each month.

“Truckload volume has been strong all year long, but pricing hasn’t always kept pace,” explained Peggy Dorf, market analyst with DAT Solutions. “That’s because truckload rates are tied more closely to capacity than volume, and last month a number of events limited truck availability in key markets for shippers and freight brokers.”

Hurricane Dorian disrupted supply chains early in the month, with the spot market kicking into action for resupply and recovery efforts along the Southeast coast. Flooding along the Gulf Coast after Tropical Storm Imelda stalled freight movements later in the month.

In the meantime, fall harvests and retail shipments spurred by Halloween kept trucks in high demand, and the close of Q3 led to a spike in activity to end the month.

Van rates averaged $1.84 per mile in Sept., up 4 cents from the prior month average. The average rate was 30 cents below the high prices of Sept. 2018. Van volume fell 6.9 percent from Aug., but compared to last year, Sept. van volume rose 15 percent.

Fall produce harvests pushed reefer load counts 10 percent higher than they were in Sept. 2018, despite the 7.6 percent decline from last month’s peak demand. Nationally, reefer rates averaged $2.16 per mile in Sept., a 2-cent increase over Aug. but a 35-cent drop from Sept. 2018.

Flatbed markets have lagged in 2019 but spot market prices began to stabilize last month. The national average stayed at $2.19 per mile, the same as Aug., but 32 cents below the high rates from Sept. 2018. Flatbed volume declined 8.2 percent compared to Aug., but load counts remained 14 percent above where they were last year.

“The spot market gained a lot of momentum heading into Q4,” said Dorf. “We expect demand to remain elevated through the rest of the year, and the holiday shipping season should push van rate higher than we saw in Q3.”