LAS VEGAS — Omnitracs is using the latest in artificial intelligence from its Omnitracs One platform to power what the trucking technology company says is an easier and more user-friendly tax management experience.

Omnitracs Tax Manager uses mileage from a telematics device and fuel data then automatically files for all states and jurisdictions, streamlining the tax reporting process for fleets. To be efficient and competitive in the past, fleets had to move processes to the digital realm and introduce automation to complete tasks faster and with fewer errors. While these improvements were significant for their time, they created an influx of data to sift through and manage.

“Another piece of this that's really exciting was that it is built to be platform agnostic,” Hannah Archuleta, an Omnitracs product manager, said. “So moving forward, all the calculations are completely software-based. So it doesn't matter which telematics device it may come from, we just get that raw data and we're able to do all the calculations available at the actual software level so that anyone could be able to use this information.

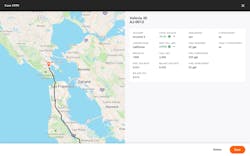

Archuleta gave a demonstration to the media during Outlook 2020, Omintracs’ annual user conference.

“Collecting and normalizing data from a variety of sources was the first big hurdle, but the bigger challenge was to figure out how to make it easier to find and sort missing or miss-matched data,” said Paul Nagy, chief product officer at Omnitracs. “Even for fleets already using IFTA software, office teams were still spending large amounts of time reconciling the data which provided an opportunity for improvement.”

The International Fuel Tax Agreement (IFTA), which is nearly 40 years old, has undergone some recent changes in different regions of the U.S. and Canada, causing a split rate during filing quarters. And more changes are on the horizon. “A lot of the other solutions out there that do the automated taxes have not been updated,” Archuleta said. “It's a very commoditized solution and a lot of money's being left on the table right now.”

Other tax jurisdictions are moving toward a milage tax as trucks have become more fuel-efficient along with the push to alternative-powered vehicles. “They're not getting all the money that they need to be able to recoup taxes for infrastructure development and everything included within that,” Archuleta said. “So we see that as a huge opportunity to try to get really ahead of it... And this is the solution to actually combat those (changes) and make sure we're staying right up there with the customers and being able to adapt with them once these new tax laws do come into place.”

AI-enabled machine learning technology cross-references driving history and fuel purchases so Omnitracs Tax Manager can automate and reduce manual processing. This will create more efficiencies over time, Omnitracs CEO Ray Greer said. To simplify the process even further, the software also features a new “guided” experience that walks customers step-by-step through their filing preparation.

The contiguous 48 U.S. states and Canadian provinces use IFTA to ensure that fuel taxes go to the state or province where the proportional amount of driving occurred. Mileage taxes consist of an array of tax statutes that vary by state affecting any trucks traveling on public roads. The substantial number of tax laws and jurisdictions directly impacts all truck fleets of any size regardless if they cross state lines.

Omnitracs Tax Manager will be available to fleets in March.