Newly released data from a Truckstop.com survey shows that the post-lockdown surge of small carriers who entered the trucking industry in 2020-21 are finding recent “challenges”—the exploding cost of fuel chief among them—too much for them to stay in business on their own.

The new data shows that half—51%—of carriers that Truckstop.com defines as small fleets and owner-operators are considering job changes in the next six to 12 months, even though 32% of respondents said they have plenty of business and are making 50% to 74% more money. The culprit is surging fuel prices, the survey also shows. The nationwide average price for a gallon of diesel fuel is hovering around $5.60—or about $2.36 more than just one year ago.

See also: How to maximize fuel economy

The precipitous climb in fuel costs in recent months is a dominant theme of the survey, with 80% of truck drivers citing diesel costs as a challenge they face daily, Truckstop.com officials said in an email exchange with FleetOwner. Among the survey respondents, more than a third—39%—said "they can't afford to move loads any significant distance" due to increased idle time and exploding fuel expenses.

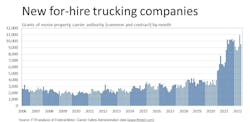

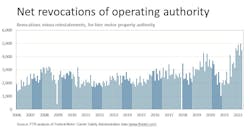

FTR Transportation Intelligence also sees the trend toward declining operating authorities and the rise in revocations—terms used by the Federal Motor Carrier Safety Administration (FMCSA), which gathers data on the comings and goings of carriers. Fuel prices are the prime driver, along with less favorable rates on the spot market, Avery Vise, FTR’s VP of trucking, told FleetOwner.

“We are seeing more carriers going out of business. That has been happening for aboutsix months,” he said. “It’s really been happening, if you want to dig a lot deeper, for about a year. This does correlate with diesel prices, which started increasing at the end of August, early September.”

Vise added: “Cost escalation in isolation would probably not be deadly to a lot of these carriers if spot rates were holding—a lot would still be doing okay. It’s the combination of [less favorable] spot rates and higher fuel costs."

As for the exodus of small carriers that the survey and FTR see, such a shift may significantly impact U.S. freight-hauling capacity, even if only a portion of that 51% exited in that short of a timespan and didn't stick around to drive for other companies.

This development also might aggravate the nationwide shortage of drivers—though some truckers may only fold up their own small businesses in favor of staying in the industry by taking their CDLs and working behind the wheel for larger haulers and private fleets. In recent conference calls, executives with larger fleets agreed, saying they are starting to notice this driver demographic trend and more broadly the impact of historically high fuel prices.

"On the supply side, seating tractors has become somewhat easier across the larger carriers in our industry. While early, this may be a consequence of the rotation out of the spot-market business than back into company fleets for some professional drivers,” U.S. Xpress CEO Eric Fuller said during a May 5 call.

“We are seeing increased inflationary pressures throughout the business," Fuller added. "Wages, both office and driver, are increasing [and] new equipment prices, insurance, maintenance, and fuel expenses are all up. Taken together, the cost of doing business is increasing across our industry.”

See also: What do drivers really want? Ask them.

During a May 3 call, Werner Enterprises Chairman Derek Leathers weighed in: “Over the last couple of years, we've seen an absolute explosion of single-vehicle [FMCSA] registrants … as they chase the spot-market opportunities, especially when it was inflated as high as it was.”

Leathers continued: “They're bearing the brunt of overexposure to a spot market that has seen deflationary pressures over the last 90 days. And in many cases, [the spot market rates are] all-in rates with fuel included, while fuel was increasing dramatically. So, I think the washout will be severe.”

In April 20 comments, Knight-Swift President and CEO David Jackson echoed both Fuller and Leathers. Jackson added: “The cost of everything is on the rise, especially for those that don't have economies of scale, speaking particularly to small carriers that we might compete with. Cost per mile has been irreversibly increased in many ways, in many areas.”

Vise added to the fleet executives’ view: “Most [small operators] are not going to leave trucking altogether. They’re likely to go back to driving elsewhere.”

The survey itself did not reveal whether small operators would lean toward looking at careers with other fleets or leave the trucking industry entirely.

'Significant challenges and opportunities'

Results of the survey of 504 U.S. truck drivers, conducted Feb. 24-28 by consultants Censuswide on behalf of Truckstop.com, were released on May 17.

To honor National Transportation Week May 15-21, the freight marketplace “took a pulse” of its enrolled carriers and what they are experiencing. The check-in revealed “significant challenges and opportunities in the transportation industry,” according to a Truckstop.com release.

In the email to FleetOwner, the Truckstop.com reps dug deeper into the results, which showed:

- Among truck drivers looking to change jobs, 64% said better pay was the biggest factor in switching.

- Better working hours were cited by 59% of the operators, while 58% said better benefits are important as well.

- The pandemic and supply chain congestion have taken a toll on the truckers surveyed. More than two-thirds in the survey reported feeling pressure to work longer hours while 64% said they worry about consumers getting goods on time.

- 34% of respondents said the driver shortage was having the most impact on drivers.

- Supply chain issues concerned 23%.

In other survey results, almost all of the respondents—96%—said they believe improvements made possible by the Infrastructure Investment and Jobs Act, signed into law by President Joe Biden in November, will positively impact freight transportation, the most impactful being:

- Improved conditions on interstates, highways, and roads: 35% of those surveyed.

- Better traffic flow that reduces congestion and improves delivery times: 32%.

- Increase in new drivers with the under-21 apprentice program: 28%.

Kendra Tucker, CEO of Truckstop.com, said: “The freight transportation industry is cyclical, which means innovating ahead of the impending ups and downs is paramount to ensuring our customers have the tools they need to navigate the industry’s cycles and ensure steady cash flow.”

Tucker goes on in the company's release to tout the advantages of the “neutral” online freight marketplace for carriers, brokers, and shippers, which advertises the access it gives independent operators to fair rates and faster pay (with 69% of the survey respondents saying factoring is an efficient way to pay them).

The Truckstop Go mobile app and Rate Insights keep carriers informed through end-to-end functionality and artificial intelligence, according to the company release. With industry ebbs and flows, including a fluctuating spot market and industry improvements brought on by the 2021 infrastructure bill, intuitive functionality and innovative technology are crucial elements to keep carriers competitive and profitable, the release also states.

Senior editor Geert De Lombaerde contributed portions of this story.