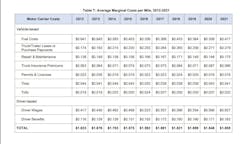

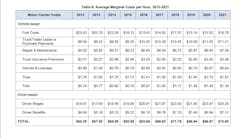

The total marginal cost of trucking grew by 12.7% in 2021 to $1.855 per mile, the highest on record, according to the American Transportation Research Institute’s (ATRI) 2022 Operational Costs of Trucking analysis.

Leading contributors to this increase were fuel (35.4% higher than in 2020), repair and maintenance (18.2% higher than in 2020), and driver wages (10.8% higher than in 2020). On a cost-per-hour basis, costs increased to $74.65.ATRI’s report focuses on for-hire carriers, which hold 52.6% of the total trucking market share, compared to private carriers’ 43% market share. Although private fleets utilize different business models than for-hire fleets, private carriers are impacted by many of the same external factors as for-hire carriers, and there is some market overlap, with 55% of private fleets acquiring for-hire authority in 2021, the report notes.

The trucking industry experienced many new, atypical market conditions in 2021 and their effects are seen in ATRI’s latest data. Overall, fleets with 100 or fewer trucks spent 4.9 cents more per mile than fleets with more than 100 trucks—closing the 2020 gap with larger fleets by 70%. While larger fleets spent less than smaller fleets on insurance premiums per mile, the advantage was offset by higher out-of-pocket incident costs per mile for large fleets.The report, however, is optimistic. Contract rates remain stable despite declining spot rates; many carriers posted earnings growth in the first two quarters of 2022; and truck tonnage rose over most of the first half of 2022, with a June year-over-year increase of 7.9%, as did the number of shipments and freight spending. In addition, ATRI noted that the financial health of trucking remained strong throughout 2021 despite spiking costs, with an average operating margin in most sectors at 10%.

See also: Trucking index falls mostly on diesel price gains

Furthermore, faced with challenges throughout the supply chain, carriers emphasized greater efficiency. Empty or “deadhead” mileage decreased to 14.8%, and average truck fuel economy increased to 6.65 mpg. This year’s report includes several new efficiency metrics, such as annualized driver turnover, average dwell time at shipper facilities, and revenue per truck.

“The last couple years have created great uncertainties in trucking, but ATRI’s newest Operational Costs report provides critical data and insights into the trends and anomalies that emerged in 2021. As the report hints, the coming year holds opportunity for continued growth in our industry,” said Ozark Motor Lines Chief Financial Officer Jason Higginbotham.

A copy of the full report is available to download.