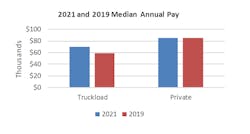

Truck driving wages rose across the industry over the past year, according to an American Trucking Associations study. The driver compensation data, released Aug. 10, shows the average truck driver saw wages increase 18% between 2019 and 2021.

The data shows how the ongoing driver shortage across the U.S. has benefited those who are behind the wheels of commercial vehicles, which transport more than 70% of all goods in the country. ATA Chief Economist Bob Costello noted that for-hire carrier turnover drove some of the wage increases as drivers chased bonuses by hopping fleets.

See also: How to reduce the symptoms of driver turnover

“The vast majority of turnover is churn in the industry,” he said during a virtual press conference about the study. “I call it the free agency of trucking. If you’re a driver and you have a good driving record, and you can pass a drug screening, you can change jobs for any reason you want. They’re in such high demand.”

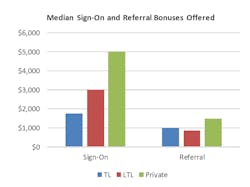

The wage increases include sign-on bonuses, which can range between $1,500 and $10,000. More than half of truckload carriers surveyed by ATA are offering sign-on bonuses. The median truckload driver earned more than $69,000 (including salary and bonuses, but not benefits) in 2021—an 18% increase from the previous survey in 2019. Costello said truckload drivers averaged a 10.9% wage increase last year.

The 185 fleets in the 2022 ATA Driver Compensation Study together employ more than 135,000 employee drivers and nearly 20,000 independent contractors. They were asked about compensation, including pay rates, bonuses, and benefits.

Costello said the findings showed how intense—and complex—the driver shortage is. “There’s no one reason for the driver shortage, which means there’s no one solution right now,” he explained. “Any time you have a situation where demand far outstrips supply, what happens to price? It goes up. The driver market acts exactly the same way. That is one of the reasons why we’re seeing pay go up so much.”

Wages for American truckers rose significantly in 2021 as demand for drivers amid the ongoing driver shortage increased competition for talent, according to the survey.

“I think what happened was the driver market was so tight in 2021 that fleets were pretty desperate to get drivers—good, safe, responsible drivers—so we tended to see that sign-on bonus come up,” Costello said. “But I hear anecdotally from fleets all the time that they much prefer the referral bonus.”

Average referral bonuses rose for company drivers in all three major segments measured by the study: truckload (up $150 to $1,150), less-than-truckload (up $80 to $875), and private (up $250 to $1,150).

Wage data from ATA survey

Here is a look at some other data points from the ATA survey of U.S. fleets:

- More than 90% of truckload fleets raised pay in 2021, with the average increase hitting 10.9%.

- On the truckload side, 96% of fleets offered referral bonuses for new drivers, and 54% offered sign-on bonuses.

- The median truckload carrier referral bonus was $1,150—up $150 from 2019.

- The median truckload sign-on bonus increased $750.

- The median salary for private fleet drivers was $85,000, which was the same level as the 2019 study.

- There was a $4,000 jump in private fleets' median sign-on bonuses in 2021.

- All less-than-truckload fleets surveyed raised pay in 2021, with the median wage reaching $73,000.

- The average LTL pay increase was 2.6%

- LTL drivers who hauled freight over-the-road were paid a median wage of $73,000 in 2021. While LTL employee drivers on local routes made $55,000 on average.

- Owner-operators performing non-drayage activities for truckload carriers made median annual gross revenues of $235,000 in 2021, according to the study.