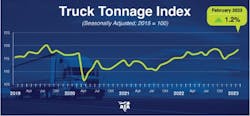

American Trucking Associations’ seasonally adjusted (SA) For-Hire Truck Tonnage Index has increased sequentially for the last three months, an indicator that contract freight continues to hold up at high levels, according to ATA Chief Economist Bob Costello.

Tonnage rose 1.2% in February after increasing 0.6% in January. In February, the index equaled 118.4 (2015=100) compared with 117 in January.

“Tonnage has increased sequentially for the last three months totaling 2.9%,” Costello said. “As a result, the index is just 0.3% below the recent high in September.”

“Looking ahead, we continue to see evidence the inventory cycle is improving, which means bloated stocks will stop being a headwind and eventually help truck freight volumes,” Costello added. “Increased infrastructure spending will also boost volumes heading into the summer months. However, we expect to see continued freight softness related to lower home construction and slowing factory output.”Compared with February 2022, the SA index increased 2.3%, which was the 18th straight year-over-year gain, but the largest since October. In January, the index was up 1.4% from a year earlier. In 2022, compared with the average in 2021, tonnage was up 3.5%.

See also: Freight volumes, spot rates fall in February

The not-seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 107.6 in February, 4.5% below the January level (112.6), according to ATA. In calculating the index, 100 represents 2015. ATA’s For-Hire Truck Tonnage Index is dominated by contract freight as opposed to spot market freight.

Trucking serves as a barometer of the U.S. economy, representing 72.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.93 billion tons of freight in 2021. Motor carriers collected $875.5 billion, or 80.8% of total revenue earned by all transport modes.