Fleet operational costs rose 21.3% in 2022 over the previous year, says a leading trucking industry research group, and the culprit last year was an all-too-familiar one: fuel, the cost of which rose almost 54% over 2021. But a lot more besides pricey diesel and gasoline contributed to drive expenses to new highs in 2022, according to the update to an annual American Transportation Research Institute report.

The message of the ATRI update, "An Analysis of Operational Costs of Trucking," is a clear one: Between the historically high cost of fuel, pressures to improve pay (especially among drivers), surging insurance premiums, and other expenses plus losses from equipment maintenance, turnover, and excess detention time, fleets are being squeezed like never before, with many of them exiting the industry altogether.

See also: Indicators keep pointing to bottoming freight cycle

The ATRI update for 2022 pegs operational expenses overall at $2.251 per mile. By comparison, the best rates for hauling freight, under contract, are on the decline, according to another report put out June 15 by DAT Freight & Analytics. In May, according to DAT, the average national contract dry van rate was $2.62 per mile, down 6 cents, though contract rates for flatbed and hauling refrigerated cargo were better than van but declining, too. And this doesn't take into account the "bottoming" spot market for freight. The same DAT report pegs the average broker-to-carrier dry van rate on the spot market at $2.05 per mile.

A separate report just out on June 22 by FTR Transportation Intelligence showed that research group's Trucking Conditions Index predicted to stay in negative territory through mid-2024, with an emphasis on freight rates, but also showing stronger freight volume in April that pulled the index out of an even deeper hole.

"Our estimates and forecasts still show the truck freight market at close to its bottom, but the outlook remains quite weak," FTR VP of Trucking Avery Vise said with the release of FTR's report. "For example, we see almost no improvement in capacity utilization into 2024, which would keep freight rates soft."

Still, fleets are fighting through high costs and disappointing freight rates by operating more efficiently, the new ATRI assessment concludes.

"Whereas high rates in 2021 helped mitigate high marginal costs, declining rates in late 2022 made the continued rise in costs a significant challenge for the trucking industry," according to the ATRI report, available for download from the research group's website. "Despite this adverse environment, the … industry still found ways to realize average operating margins of 6% or more in each sector. Improvements in several key operational efficiencies—such as driver turnover and equipment utilization—were likely contributors to these positive results."

See also: Diesel average rises for the first time in 10 weeks

"Economic conditions for the freight market remain uncertain for the second half of 2023 and leading into 2024," it continues. "GDP growth was stagnant in the first quarter of 2023, and demand in trucking continued to soften. Freight shipments and spending fell in the final two quarters of 2022 and the first quarter of 2023, though the rate of decline has moderated with each quarter."

Why was hauling freight so much pricier in 2022?

One word: fuel, which was 53.7% higher in cost than 2021, according to the ATRI update. The U.S. average price for diesel—which is trucking's main fuel, though many smaller fleets and work truckers burn gas—reached the stratosphere, easily a record, of $5.81 per gallon the week of June 20, 2022, according U.S. Energy Information Administration (EIA) data. Gasoline, while cheaper than diesel, wasn't far behind. Both are now $1.995 and $1.385 cheaper per gallon, respectively, according to EIA, but the damage to fleets' bottom lines for 2022 was done.

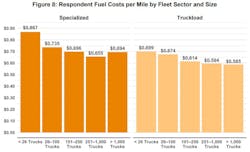

"Even though fuel costs declined in the second half of 2022, the annual increase in 2022 was higher than any other marginal cost," the ATRI study notes. "Large carriers' ability to hedge fuel markets and secure bulk pricing enables them to achieve lower marginal fuel costs. With record high fuel costs in 2022, this negotiating position was especially advantageous."

The study also goes on to note that truckload fleets with fewer than 26 trucks spent 19.5% more per mile on fuel than truckload carriers with more than 1,000 trucks. Specialized fleets with fewer than 26 trucks spent 24.9% more per mile on fuel than specialized fleets with more than 1,000 tractors.

Speed governor use remained high in 2022, according to the ATRI report, as 93% of respondents to the research group's surveys of carriers used governing, in part, because of 2022 sky-high fuel prices. The report notes a correlation between any year's average diesel price and the percentage of carriers utilizing speed governors, and this was especially true last year.

But falling fuel prices were a leading contributor to the moderation of inflation in the first half of 2023, the ATRI update adds, and continued decline or stabilization in this area could therefore contribute to stabilization in other cost centers, such as driver wages.

See also: 'Rolling recession' in U.S. economy slows trucking's recovery

Speaking of driver wages, they were 15.5% higher in 2022 than the previous year, rising to 72.4 cents per mile, an increase that fleets felt they had to absorb to attract professional drivers or retain the ones they had but also an added expense that contributed to the surge in operational costs, ATRI noted. The cost of driver benefits apart from pay, however, remained stable last year, the study adds.

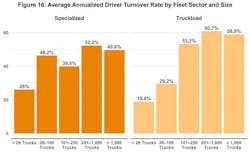

But carrier efforts to retain drivers, increasing their workforce efficiency, paid off in 2022 in lower turnover rates across almost every sector and fleet size from 2021 to 2022, according to the ATRI report, possibly partly due to driver concerns about falling freight volume. So, drivers generally stayed put more to ensure their job security, though the industry continues to experience a growing driver shortage.

Smaller fleets generally have lower turnover regardless of sector, while larger ones have churn rates that exceed 50%. Truckload carriers experienced higher turnover than all other sectors except fleets with fewer than 100 trucks. But in 2022, according to the ATRI report, truckload fleets of all sizes saw improvements in turnover, with the greatest improvement in carriers with more than 1,000 trucks. Lower turnover may be partly related to the more uncertain economic climate later in 2022.

The report also delves into equipment, noting that "atypical market conditions posed unique challenges for acquiring and maintaining equipment in 2022," and adding that truck and trailer payments rose by 18.6% to $0.331 per mile as carriers paid higher prices, mainly due to equipment impediments in the supply chains. Closely related to equipment, parts shortages, and rising technician labor rates pushed repair and maintenance costs up 12% to 19.6 cents per mile.

Efficiencies temper operational cost increases

The ATRI report also spends much of its 56 pages on how fleets balance rising costs with improved efficiencies. Driver turnover, detention times, and equipment utilization each improved across nearly every fleet size and sector in 2022, it notes.

This year's report also includes new metrics such as mileage between breakdowns and the ratio of truck drivers to nondriving employees. For example, Truckload, tanker, and refrigerated carriers had three drivers for every nondriving employee. Flatbed fleets had a slightly higher average of 3.3 drivers for every other employee. At the same time, with their much more personnel-intensive business model, LTL carriers employed just 1.4 drivers for every employee who wasn't driving.

See also: 23% more truck drivers live where recreational marijuana is legal

In its last sentences, the ATRI report concludes: "The bearish economy in 2023 will create considerable uncertainty for carriers, who will need to carefully monitor and prioritize costs to maintain financial stability. Despite an adverse economic climate, the trucking industry has made strides over the previous two years—in newer equipment, more competitive driver compensation, and improved operations—that put it in a good position to meet these challenges."