Spot rates are lowest in three years, moderate expectations for Class 8 trucks and trailers

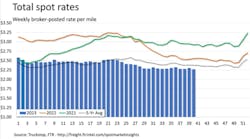

As of last week, total broker-posted spot rates declined about 3.5 cents to their lowest level since July 2020, according to data compiled by Truckstop and FTR Transportation Intelligence. As freight rates and loads have declined throughout the year, analysts see the industry responding.

Rates were down week-over-week for all equipment types, but flatbed saw the most significant drop since the summer. Not all news is negative, however. Spot rates for van equipment are still above levels from the spring, and these low spot rates, although low, are meeting seasonal expectations.

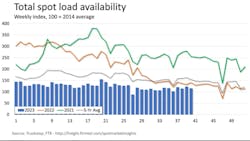

FTR and Truckstop reported a 6.3% decline in this past week’s total load activity after having risen 8% the week before. Volume was also low to nearly 18% below the same week in 2022 and almost 25% below the same week’s five-year average. Across all regions, spot volume declined, truck postings declined by 2.7%, and the ratio of loads to trucks (Market Demand Index) declined from the week before.

Total broker-posted rates declined after rising roughly 2.5 cents the week before. This resulted in rates about 11% lower than the same week in 2022 and almost 5% below the five-year average.

See also: Freight rates soft heading into Q4

The industry is responding to the volatile freight markets, as reported by ACT Research.

Moderate expectations for Class 8 trucks and trailers

As the freight market remains “elusive,” according to ACT in its North American Commercial Vehicle Outlook, expectations for Class 8 trucks and trailers are moderate.

“Within the broader Class 8 and trailer markets, U.S. Class 8 tractors and van trailers bore the brunt of the markdowns as freight metrics have failed to gain traction,” said Kenny Vieth, ACT’s president and senior analyst. “Less money in carriers’ pockets and lower industry build rates in 2024 also push down on 2025 and, to a lesser extent, 2026.”

In the past two-plus years, attracting manufacturing labor has been another industry pain point. Supply-chain integrity could be compromised if the industry is forced to materially cut production in 2024, thereby shedding labor.

“If layoffs do come to pass, it will be difficult for the industry to scale rapidly in 2025 and 2026 when U.S. and Canadian truckers and dealers will want all the equipment the industry can build,” Vieth added. “ACT’s research suggests that between prices, taxes, and other affiliated costs, medium-duty and heavy-duty vehicle costs will rise by between 12% and 14% as the EPA’s Clean Trucks regulation goes live in 2027. As such, we believe the OEMs will be at least partially successful in convincing customers to begin EPA’27 prebuying in 2024. Starting prebuying earlier should help moderate runaway demand into 2026, but risks prolonging the freight cycle downturn.”

ACT Research believes that factors such as ongoing pent-up vocational truck demand, strong tractor demand in Mexico, and labor hoarding are at work in 2024, which will help support a fundamentally weak U.S. tractor market.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.