Truckers should expect six to nine more months of downward pressure on rates, a leading transportation analyst suggests, but shippers should be cautious about aggressively pursuing cost reductions as a regulatory squeeze on capacity could outweigh a stagnant economy by mid-2017.

“Can you find freight growth in a sluggish economy? It’s not a very easy answer,” FTR CEO Eric Starks said in this quarter’s State of Freight webinar on Thursday. “This is a completely different environment than we’re used to. The shipper doesn’t really have the upper hand but, going forward to the end of this year, we do anticipate the shipper will have some favorable conditions.”

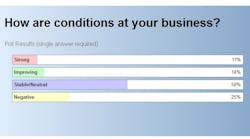

Indeed, a quick poll of webinar participants precisely reflected this market uncertainty, with half reporting business conditions were stable or neutral, 25% percent reporting strong or improving conditions, and the other 25% reporting negative conditions.

The good news is that while industrial production—a key freight driver—has been unusually stagnant, manufacturing output hasn’t fallen as it would ahead of a recession, Starks noted. But freight growth from core capital goods orders (or business activity) has slipped for more than a year—and that follows three years of being basically flat following the recovery, according to FTR’s analysis. Still, the retail market continues to trend higher, showing noticeable growth over the last several months—a “very positive sign.”

“So the disconnect between what’s happening within the business environment and what’s happening on the consumer side is very noticeable,” Starks said. “The million dollar question is, can this continue for an extended period of time? I don’t think it can. We need to start seeing these come back into line.”

Inventory-to-sales ratios are also freight indicators, and again the signals are mixed. Retail inventories are “not awful, but still higher than we would like,” tied largely to some carryover from last year’s West Coast port strikes, Starks explained; manufacturing inventories have picked up, “but not a huge change;” while wholesale inventories are high, and that creates “ripple effects.”

“The higher the ratio, the less pressure there is on transportation. You need to generate more freight to continue to produce or move goods,” Starks said. “Until we start seeing the wholesale inventory numbers start going back down, it’s going to be difficult to see how there’s significant pressure within the transportation environment. We’ve seen a fundamental change where things have deteriorated, and it has a noticeable, negative impact. This is at least a six- to nine-month period to be able to work those inventories down.”

As for truck capacity, utilization has been holding at about 95%, according to FTR’s figures.

“There’s not a whole of pressure up or down,” Starks said. “As we start moving through the year and into 2017, we expect that it will tighten, and as it gets close to 100% that starts to put additional pressure on rates.”

Speaking of rates, while truck pricing has fallen off “relatively dramatically” into early this year, the market seems to be stabilizing—albeit at a low level.

“Shippers are pushing back heavily right now,” he said. “But you have to be careful, because what goes around comes around. As things start to turn, the carrier pushes back—and I don’t think that’s desirable for anybody.”

Indeed, coming truck regulatory changes—including the electronic logging device (ELD) mandate, speed limiters, and the implementation of national database of driver drug test results—pose a substantial risk to demand/capacity balance.

FTR anticipates about 50% of the market is currently using electronic logs—but that means the other half still has to convert ahead of the December 2017 deadline. Productivity losses from ELDs have ranged from 2% to 10%, and carriers need as much as two years to recover.

“What we’re really talking about is the smaller to medium carriers who will find it a little more difficult [to become compliant],” Starks said. “We do know there will be a productivity hit, the question is when?”

While some carriers, under pressure from shippers, will convert in the first half of next year, the real push will begin in the summer, Starks adds.

“If history is anything, we do know there are some people in the industry that will wait until the last second,” he said. “So there could be a crunch on capacity as we move into the holiday season in 2017.”