The spot truckload freight market returned to pre-holiday activity levels during the week ending July 15 as the number of posted loads increased 35% and truck posts added 28%, said DAT Solutions, which operates the DAT network of load boards.

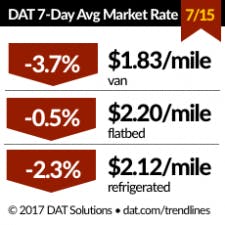

Higher demand for capacity did not lead to higher rates, however, absent the urgency to move goods ahead of the Fourth of July holiday. National average spot van, refrigerated, and flatbed rates were lower compared to the previous week.

A retreat in rates and the number of posted loads during the week after the Fourth of July holiday is typical as freight activity begins to taper off during the summer and fall.

Van Trends

The Top 100 van lanes experienced record volume and nationally van load posts increased 21%. Posted capacity jumped 30% nationally. That caused the van load-to-truck ratio to decline 7% to 5.0 loads per truck.

The national average van rate fell 7 cents to $1.83/mile after a 10-cent gain the week before. Prices were lower in the Southeast, South Central, and Northeast. Allentown, Pa., lost 11 cents to an average of $2.03/mile and Philadelphia dropped 4 cents to $1.70/mile. Other van markets to watch:

- Los Angeles: $2.21/mile, down 8 cents

- Charlotte: $2.25/mile, down 8 cents

- Atlanta: $2.20/mile, down 5 cents

- Dallas: $1.78/mile, down 6 cents

- Houston: $1.84/mile, down 5 cents

Reefer Trends

Reefer load posts increased 27% while truck posts were up 17%—again, in line with expectations following a holiday week. The national reefer load-to-truck ratio increased 9% to 9.0 loads per truck. The national average reefer rate retreated 5 cents to $2.12/mile.

Flatbed Trends

Flatbed truck posts jumped 45%, which caused the flatbed load-to-truck ratio to rise 5% to 38.0 loads per truck. Big boosts in volume led to rate increases on a couple of key lanes last week:

- Memphis-Dallas had more loads and rates were up 30 cents to $3.10/mile

- Houston-Oklahoma City volume more than doubled, and rates rose 17 cents to $3.13/mile

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.