The spot market for freight is doing better than in previous weeks of 2024 but overall still worse than the same time in 2023, according to the latest data from DAT Freight & Analytics.

A higher load-to-truck ratio

DAT’s latest truck/load posting and rate data for the week of March 24-30, based on the load board DAT One, found that load posts on DAT One rose above 2 million last week while truck posts fell by 12.4%.

DAT One saw 2,034,011 load posts last week, down 2% year over year but in line with the same week in 2017. Van loads were up 5.9% week over week and up 3% year over year; flatbed loads were up 0.3% week over week and down 7% year over year; while reefer loads were down 2.2% week over week and up 1% year over year.

Meanwhile, DAT One’s total number of trucks fell to 307,690, a 12.4% decline from the previous week. These truck posts were down 30% compared to last year and down 25% compared to the same week in 2020.

Van truck posts fell 13% week over week and were down 31% year over year. Reefer posts fell 11.8% week over week and were down 30% year over year. Flatbed posts fell 9.5% week over week and 21% year over year.

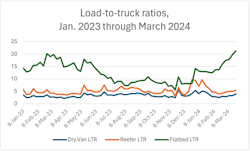

Due to the decline in truck posts and rise in load posts, DAT’s measured load-to-truck ratios rose for all three equipment types: the ratio for the van equipment type hit 3.9, up from 3.3 the previous week; the reefer ratio was 5.3, up from 5.0; and the flatbed ratio was 21.3, up from 19.7.

This higher load-to-truck ratio suggests that fleet capacity is diminishing compared to previous weeks. Excess capacity contributes to low rates for fleets and has been a challenge at the start of 2024. DAT’s earlier reports on February shared declines for rates, posts, and load-to-truck ratios.

The dry van load-to-truck ratio was the highest since the third week of January, the reefer load-to-truck ratio was the highest since the fourth week of January, and the flatbed load-to-truck ratio was the highest since July 2022.

Higher rates compared to the previous week

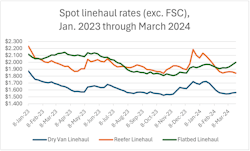

Spot linehaul rates for all three equipment types were down year over year, but higher than the previous week.

Average dry van rates were $1.562, up by $0.005 from the previous week but down 6% year over year. Average reefer rates were $1.842, up $0.012 from the previous week but down 5% year over year. Average flatbed rates were $1.999, up $0.032 from the previous week but down 7% year over year.

Overall, the reports share a more optimistic image for load-to-truck ratios and rates compared to earlier in 2024, though the measured ratios and rates were still worse than this same week last year.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.