An excess of carriers helped push rates down during the freight recession—well below average operating costs. Fleet executives were told that, over time, the problem of excess capacity would resolve itself. Trucking’s capacity problem might finally be reaching that equilibrium in 2025.

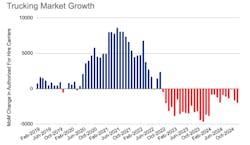

After a significant number of carrier exits in 2023, low rates in 2024 did not purge fleets quite so rapidly. Meanwhile, the number of new carrier registrations increased slightly. Both trends suggest a slightly more hospitable market for fleets. Some industry analysts predict trucking capacity will grow in 2025.

“Capacity, at a minimum, has not grown. Depending on what metric you want to rely on, it has either held flat or has actually come down,” Avery Vise, VP of trucking for FTR Transportation Intelligence, told FleetOwner.

Paired with rising freight demand, “We have brought utilization in the for-hire segment up. Overall utilization [both for-hire and contract] is finally higher than the 10-year average, though not by very much—and it is headed higher still.”

Excess capacity, spurred partly by the pandemic’s rate boom, was a major contributor to trucking’s post-COVID low freight rates.

How will trucking’s supply and demand shake out for 2025? Here are the predictions from analysts with FTR, DAT Freight & Analytics, ACT Research, and Motive on the trucking industry’s capacity.

How capacity changed last year

Research firms found that, overall, the trucking sector’s capacity fell in 2024.

The Federal Motor Carrier Safety Administration’s count of overall carriers continued to decrease in 2024, though less harshly than the year prior. The challenging freight environment shuttered many carriers, and the Bureau of Labor Statistics reflected this as overall sector employment fell.

Carrier count fell, but more slowly

According to FMCSA, the number of motor carriers with operating authority dropped in 2024 to 339,220—about 13,000 or 3.7% less than in 2023.

The industry saw more newly registered carriers than the previous year, however. FMCSA's count of newly registered U.S. carriers rose in 2024 to 148,485—over 25,000 or 13% more than newly registered carriers in 2023.

“The number of smaller carriers exiting the market has actually started to trail off,” Vise said. “It does appear that it is stabilizing. As the market continues to improve, we would only expect that to continue.”

Motive’s latest economic outlook report looked at 2024’s capacity trends and other information to predict the Q1 freight environment. The report found that last year’s carrier exits were significantly fewer than in 2023. About 19,000 carriers exited the market in 2024 compared to 40,000 in 2023—a 50% drop in exits.

“These exit levels signal a significantly more stable market than a year ago and a steady positive trajectory,” author Hamish Woodrow, wrote in the report.

Major disruptions this year, like tariff conflicts between the U.S. and its top trade partners Canada/Mexico, could upend that stability. However, Woodrow expects the trade issue to not interrupt long-term cross-border trade.

“There’s a lot of rhetoric right now; there’s a lot of discussions on tariffs,” Woodrow said. “It’s important to listen to what’s happening out there, but we’re not expecting it to destroy trade between the U.S. and Mexico.

"Like all negotiaitons, we’re probably going to end up in a new framework that will still incentivize trade across the border and allow for growth to happen. What you could find is, short-term, something gets imposed—and then, long-term, a more happy ground is achieved.”

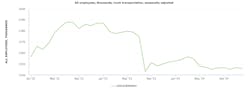

Sector employment declined

Similar to the drop in authorized carriers, employment in the trucking sector declined.

Seasonally adjusted employment in the truck transportation sector inched upward for the first half of 2024 before declining through the rest of the year, according to the Bureau of Labor Statistics. From January 2023 through December 2024, seasonally adjusted employment in truck transportation fell by almost 3%.

Several major trucking companies filed for bankruptcy in 2024 alone, including KAL Freight, No. 186 on the FleetOwner 500: For Hire.

“Trucking capacity has been decimated over the last 24 months,” Woodrow told FleetOwner. “We’ve seen upwards of 50,000 businesses go under during this freight recession.”

Vise said that some of the capacity drop came from larger carriers making cuts to their operations.

“For the longest time, I think the larger carriers were taking the point of view that ‘all we need to do is maintain, and those small carriers will go out of business and our margins will improve,'” Vise said. “And that just kept not happening. Eventually, the larger carriers finally said ‘OK, we’re going to have to start cutting back.’”

ACT Research’s For-Hire Trucking Index reported that carriers’ capacity contracted for almost all of 2024.

“Approaching three years of weak profitability, for-hire carriers aren’t in the position to add significant new capacity,” ACT’s December report said. “Given the current volume and rate environment, we would anticipate for-hire capacity additions to remain at replacement levels.”

See also: New entrants are not (completely) crazy

How capacity could change this year

Slowing exit levels suggest that carriers are entering a much more stable market this year. Firms expect capacity to now continue to grow in 2025.

Motive’s economic outlook said that new carrier registrations in January would likely increase by 30%.

“We’ve needed the market to reduce in size to meet the demand where it is,” Woodrow said.

Vise said that the number of smaller carriers tapered down in 2024 and might begin to increase in 2025.

“It’s starting to look like we might be heading in the other direction and actually starting to increase the number of small operations,” Vise said. “We’re not getting back to the same kind of carrier profile that we had before the pandemic. We still have this large degree of very small operations that are providing a buffer for what is going on with the larger carriers.”

Slow growth

Growing capacity won’t be the bogeyman it was during the freight recession. The rate in carrier growth will be more natural and controlled.

“We’re not looking at 2021; we’re not looking at 2018,” Vise said.

FTR sees the incremental change in capacity as a sign of only modest rate increases.

“The best you can say from the carrier perspective is we wouldn’t expect a surge in capacity,” Vise said. “If we do see a greater number of carriers, my guess is that’s primarily going to be coming from people who have left the larger carriers."